Answered step by step

Verified Expert Solution

Question

1 Approved Answer

That is the first question I need help someone. Please help me View Policies Show Attempt History Current Attempt in Progress Jeff Heun, president of

That is the first question

I need help someone. Please help me

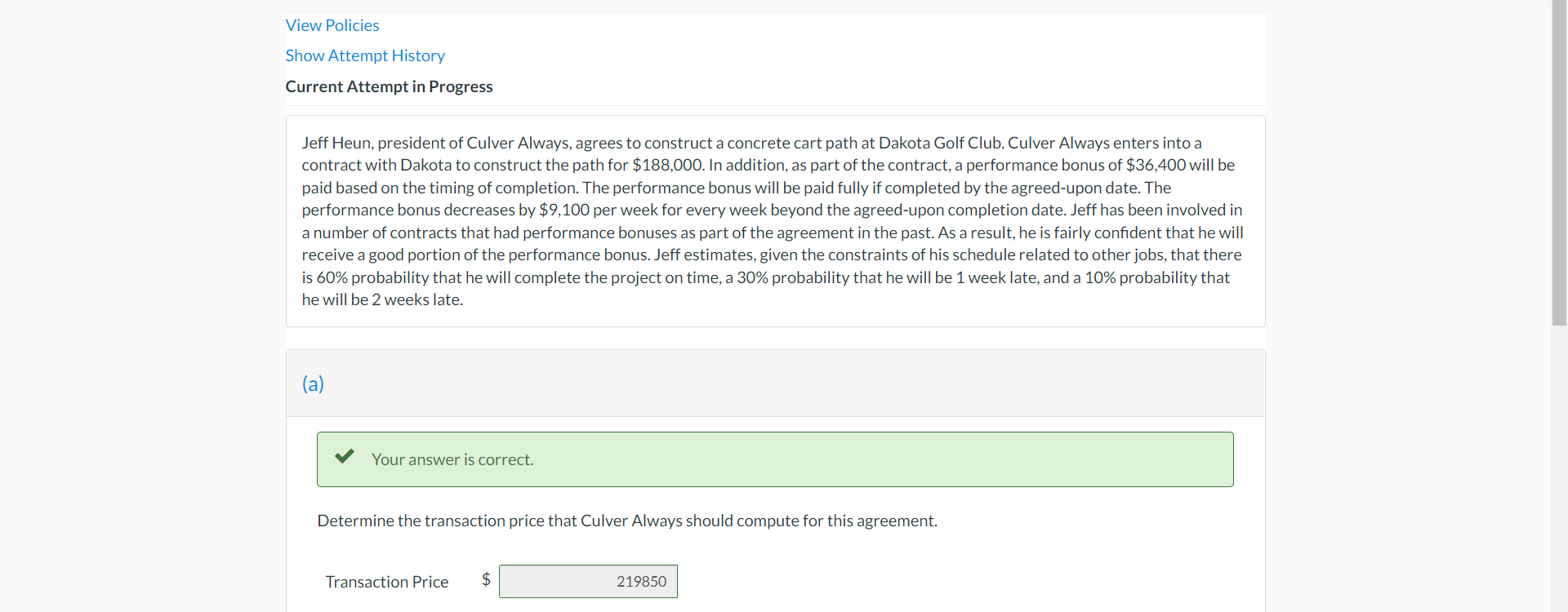

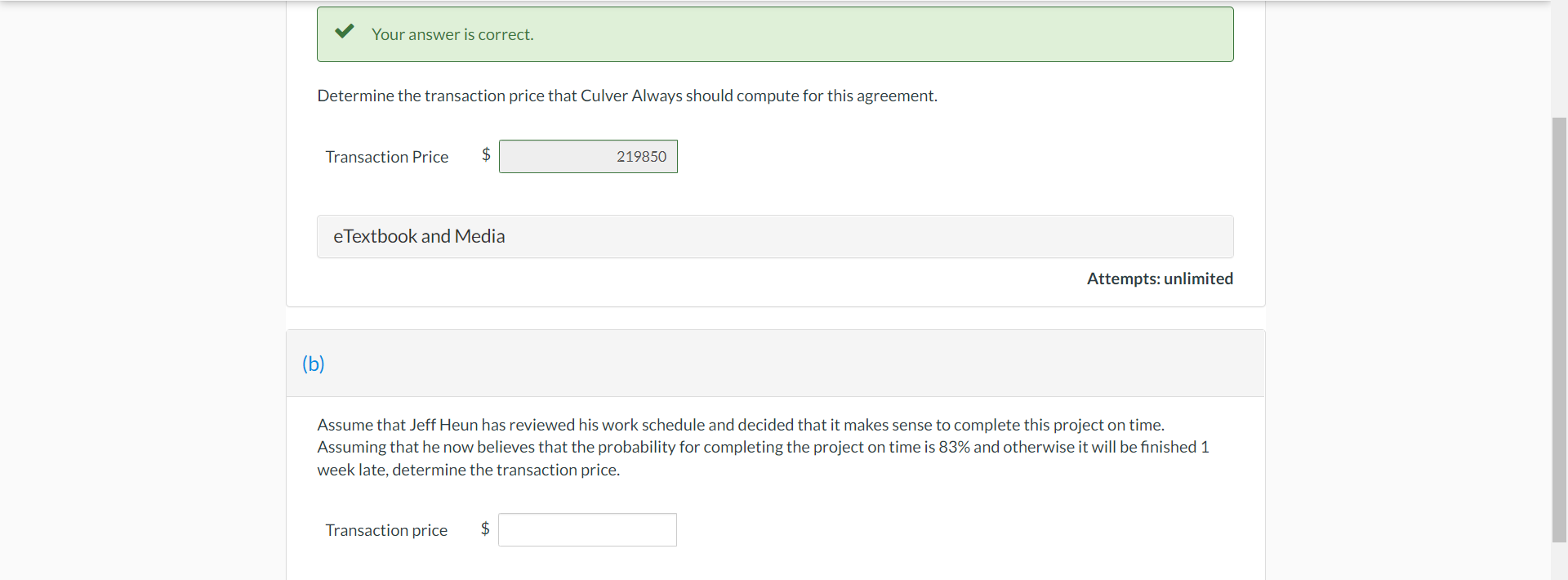

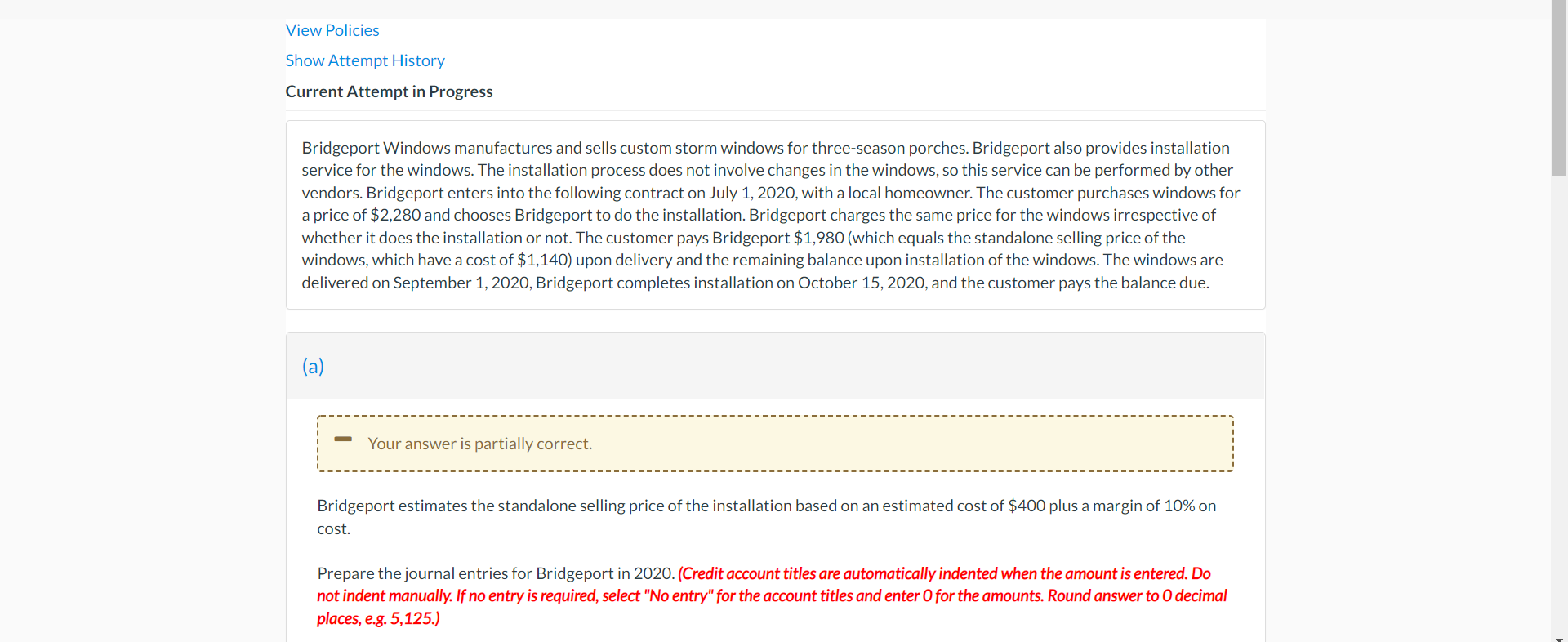

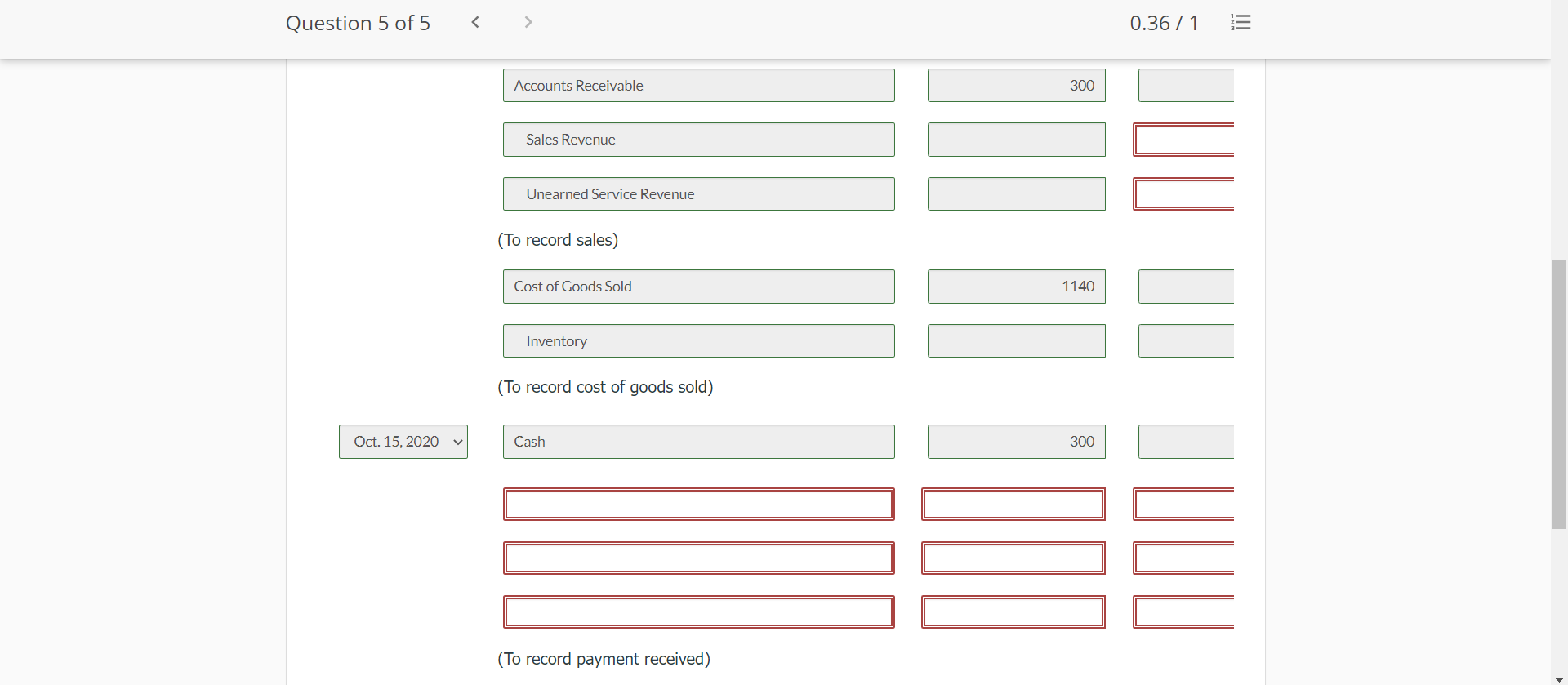

View Policies Show Attempt History Current Attempt in Progress Jeff Heun, president of Culver Always, agrees to construct a concrete cart path at Dakota Golf Club. Culver Always enters into a contract with Dakota to construct the path for $188,000. In addition, as part of the contract, a performance bonus of $36,400 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The performance bonus decreases by $9,100 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 60% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 10% probability that he will be 2 weeks late. (a) Your answer is correct. Determine the transaction price that Culver Always should compute for this agreement. Transaction Price $ 219850 Your answer is correct. Determine the transaction price that Culver Always should compute for this agreement. Transaction Price $ 219850 e Textbook and Media Attempts: unlimited (b) Assume that Jeff Heun has reviewed his work schedule and decided that it makes sense to complete this project on time. Assuming that he now believes that the probability for completing the project on time is 83% and otherwise it will be finished 1 week late, determine the transaction price. Transaction price $ View Policies Show Attempt History Current Attempt in Progress Bridgeport Windows manufactures and sells custom storm windows for three-season porches. Bridgeport also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Bridgeport enters into the following contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,280 and chooses Bridgeport to do the installation. Bridgeport charges the same price for the windows irrespective of whether it does the installation or not. The customer pays Bridgeport $1,980 (which equals the standalone selling price of the windows, which have a cost of $1,140) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2020, Bridgeport completes installation on October 15, 2020, and the customer pays the balance due. (a) Your answer is partially correct. Bridgeport estimates the standalone selling price of the installation based on an estimated cost of $400 plus a margin of 10% on cost. Prepare the journal entries for Bridgeport in 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter Ofor the amounts. Round answer to 0 decimal places, e.g. 5,125.) Question 5 of 5 0.36/1 III Accounts Receivable 300 Sales Revenue Unearned Service Revenue (To record sales) Cost of Goods Sold 1140 Inventory (To record cost of goods sold) Oct. 15, 2020 7 Cash 300 MON (To record payment received)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started