Answered step by step

Verified Expert Solution

Question

1 Approved Answer

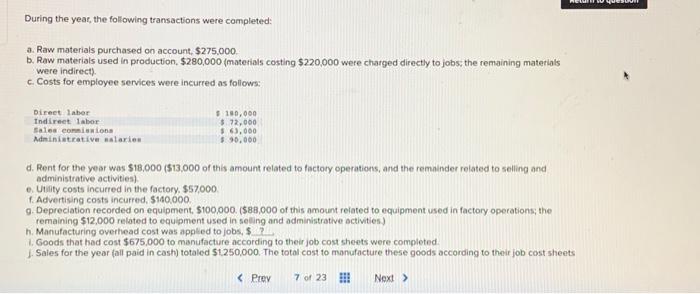

thats all the info given During the year, the following transactions were completed: a. Raw materials purchased on account, $275,000. b. Raw materials used in

thats all the info given

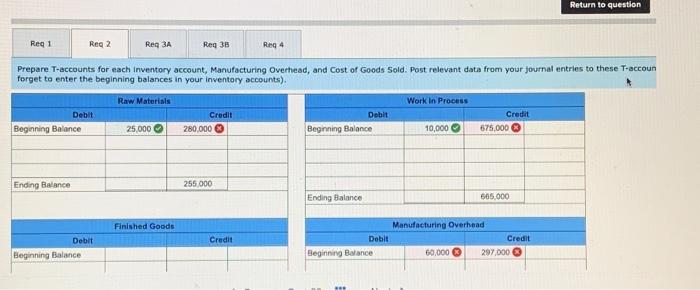

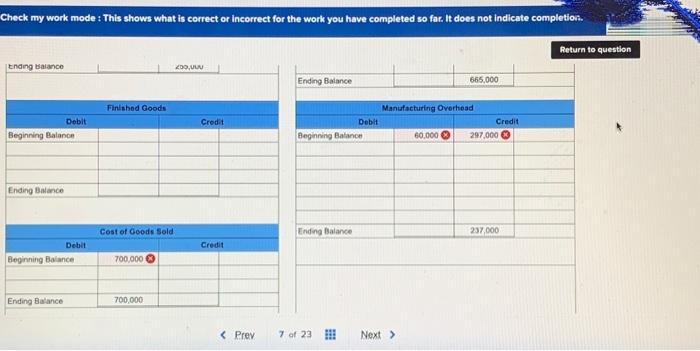

During the year, the following transactions were completed: a. Raw materials purchased on account, $275,000. b. Raw materials used in production, $280,000 (materials costing $220,000 were charged directly to jobs; the remaining materials were indirect). c. Costs for employee services were incurred as follows: d. Rent for the year was $18,000 (\$13,000 of this amount related to factocy operations, and the remainder related to selling and administrative activities) e. Utility costs incurred in the factory. $57,000 f. Advertising costs incurred. 5140.000 9. Depreciation recorded on equipment, $100,000. (\$88,000 of this amount related to equipment used in factory operations; the remaining $12,000 related to equipment used in seling and administrative octivities) h. Manufacturing overhead cost was appled to jobs, $ ? 1. Goods that had cost $675,000 to manufacture according to their job cost sheets were completed. 1. Sales for the year (all paid in cash) totaled $1250,000. The total cost to manufacture these goods according to their job cost sheet Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entrles to these T-accour forget to enter the beginning balances in your inventory accounts). Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. tnding balance Return to question \begin{tabular}{|l|l|l|} \hline Ending Balance & & \\ \hline & 665,000 \\ \hline \end{tabular} During the year, the following transactions were completed: a. Raw materials purchased on account, $275,000. b. Raw materials used in production, $280,000 (materials costing $220,000 were charged directly to jobs; the remaining materials were indirect). c. Costs for employee services were incurred as follows: d. Rent for the year was $18,000 (\$13,000 of this amount related to factocy operations, and the remainder related to selling and administrative activities) e. Utility costs incurred in the factory. $57,000 f. Advertising costs incurred. 5140.000 9. Depreciation recorded on equipment, $100,000. (\$88,000 of this amount related to equipment used in factory operations; the remaining $12,000 related to equipment used in seling and administrative octivities) h. Manufacturing overhead cost was appled to jobs, $ ? 1. Goods that had cost $675,000 to manufacture according to their job cost sheets were completed. 1. Sales for the year (all paid in cash) totaled $1250,000. The total cost to manufacture these goods according to their job cost sheet Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entrles to these T-accour forget to enter the beginning balances in your inventory accounts). Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. tnding balance Return to question \begin{tabular}{|l|l|l|} \hline Ending Balance & & \\ \hline & 665,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started