Answered step by step

Verified Expert Solution

Question

1 Approved Answer

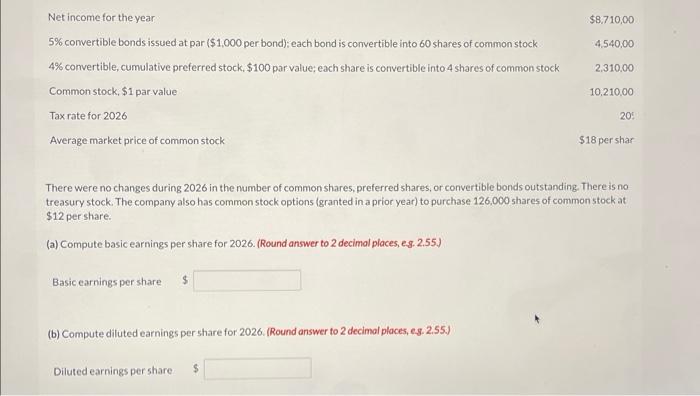

Thats all the question. There was nothing else that need to be updated Net income for the year 5% convertible bonds issued at par (

Thats all the question. There was nothing else that need to be updated

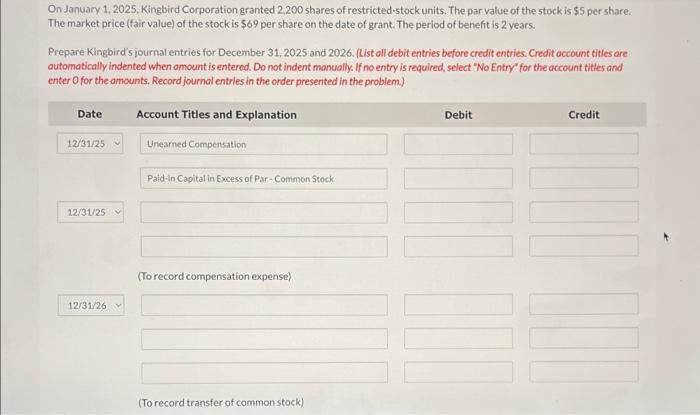

Net income for the year 5% convertible bonds issued at par ( $1,000 per bond): each bond is convertible into 60 shares of common stock 4.540,00 4% convertible, cumulative preferred stock, $100 par value; each share is convertible into 4 shares of common stock 2,310.00 Common stock, $1 par value 10,210.00 Taxrate for 2026 205 Average market price of common stock $18 pershar There were no changes during 2026 in the number of common shares, preferred shares, or convertible bonds outstanding. There is no treasury stock. The company also has common stock options (granted in a prior year) to purchase 126,000 shares of common stock at $12 pershare. (a) Compute basic earnings per share for 2026. (Round answer to 2 decimal places, es. 2.55.) Basic earnings per share $ (b) Compute diluted earnings per share for 2026. (Round answer to 2 decimol places, es. 2.55.) Diluted earnings per share On January 1, 2025, Kingbird Corporation granted 2,200 shares of restricted-stock units. The par value of the stock is $5 per share. The market price (fair value) of the stock is $69 per share on the date of grant. The period of benefit is 2 years. Prepare Kingbird's journal entries for December 31, 2025 and 2026. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titler and enter O for the amounts. Record journal entries in the order presented in the problem.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started