Answered step by step

Verified Expert Solution

Question

1 Approved Answer

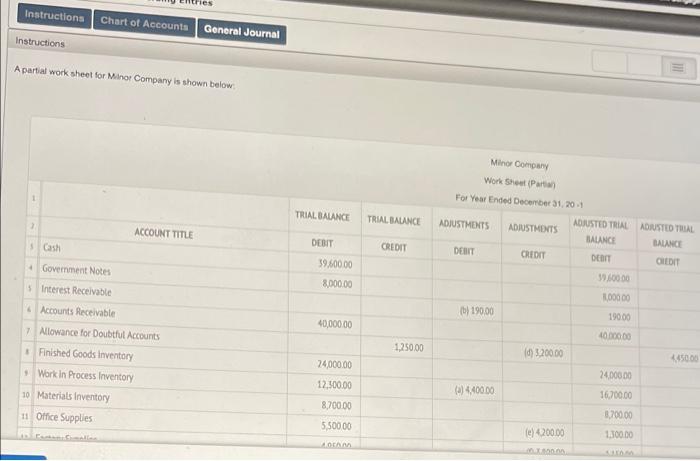

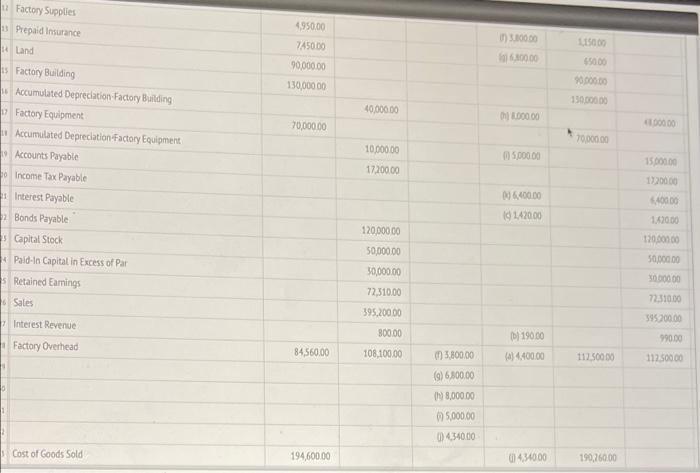

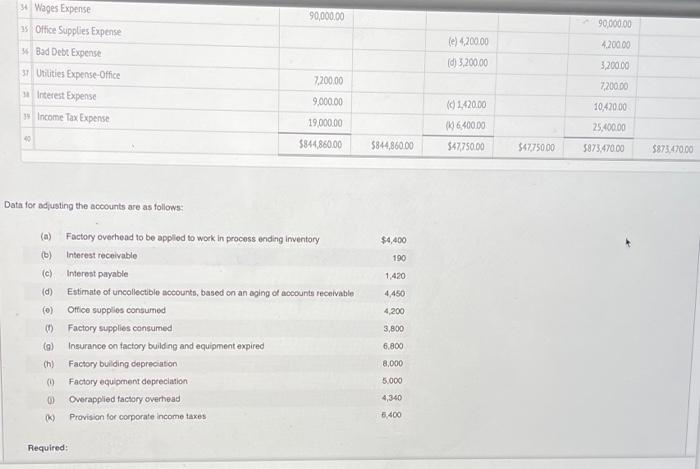

that's all the questions. if you can't do it let someone else do it Instructions Chart of Accounta General Journal Instructions A partial work sheet

that's all the questions. if you can't do it let someone else do it

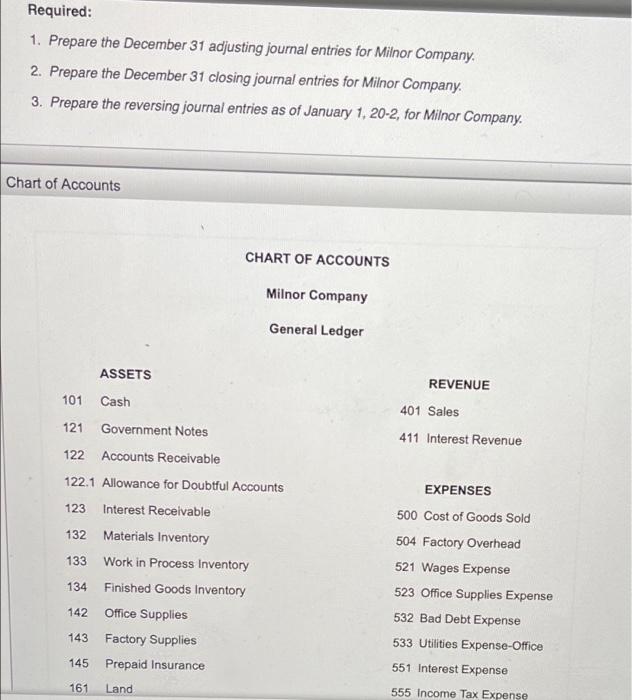

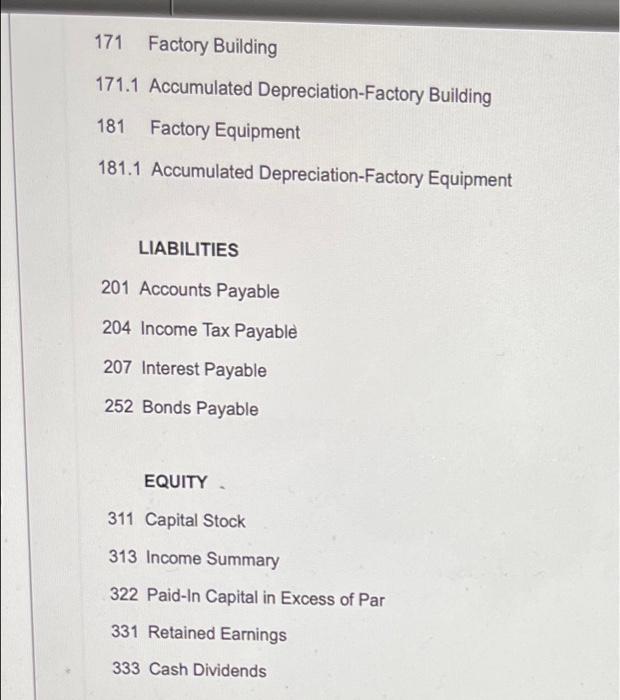

Instructions Chart of Accounta General Journal Instructions A partial work sheet for Minor Company is shown below 1 TRIAL BALANCE TRIAL BALANCE Minor Company Work Sheet Part For Year Ended December 31, 201 ADJUSTED TRIAL ADJUSTED TIL ADJUSTMENTS ADIUSTMENTS BALANCE BALANCE DEBIT CREDIT DEBIT EDIT 10000 ACCOUNT TITLE s Cash DEBIT CREDIT 39.600.00 8.000.00 Government Notes Interest Receivable Accounts Receivable 7 Allowance for Doubtful Accounts 190.00 1,000.00 19000 40,000.00 LOOD 1.250.00 3200.00 Finished Goods Inventory Work in Process Inventory 24,000.00 45000 12,900.00 (a) 4,400.00 10 Materials Inventory 11 Office Supplies 24.000.00 16.700.00 3.700.00 8,700.00 5.50000 RA 200.00 1.100.00 ON Factory Supplies Prepaid Insurance 4950.00 1.150.00 Land 10000 6.100.00 7450.00 90,000.00 130,000.00 50.00 0.000.00 130.000 40,000.00 01 000.00 70,000.00 100000 Factory Building Accumulated Depreciation Factory Building Factory Equipment Accumulated Depreciation Factory Equipment Accounts Payable Income Tax Payable Interest Payable 70.000.00 10,000.00 5.000.00 150000 17.200.00 1720000 096,400.00 19142000 1,420.00 120,000.00 120.000.00 50,000.00 Bonds Payable Capital Stock Pald-In Capital in Excess of Par Retained Earings Sales 50,000.00 50,000.00 72,310.00 000000 72.310.00 59520000 395,200.00 Interest Revenue 800.00 D) 190.00 990.00 Factory Overhead 84560.00 108,100.00 (3.800.00 (A) 4.400.00 117.500 11250000 (9) 6,800.00 IN 8,000.00 5.000.00 0434000 Cost of Goods Sold 194,600.00 0434000 190,760.00 90,000.00 90,000.00 4200.00 34 Wages Expense 35 Office Supplies Expense 56 Bad Debt Expense Utilities Expense-Office Interest Expense 13 Income Tax Expense le) 4200.00 (d) 3,200.00 3,200.00 7,200.00 7,200.00 9,000.00 (01.420.00 16,400.00 19.000.00 10,420.00 25,400.00 40 5844,860.00 5844,860.00 547,750.00 $4775000 5873470.00 $873.470.00 Data for adjusting the accounts are as follows: (a) $4,400 190 (6) (c) 1,420 d) 4,450 (0) 4,200 Factory overhead to be applied to work in process ending Inventory Interest receivable Interest payable Estimate of uncollectible nocourts, based on an aging of accounts receivable Office suppilos consumed Factory supplies consumed Insurance on tactory building and equipment expired Factory building depreciation Factory equipment depreciation Overapplied factory overhead Provision for corporate income taxes 3,800 (9) ch 6.800 8.000 5.000 4,340 5.400 Required: Required: 1. Prepare the December 31 adjusting journal entries for Milnor Company 2. Prepare the December 31 closing journal entries for Milnor Company. 3. Prepare the reversing journal entries as of January 1, 20-2, for Milnor Company. Chart of Accounts CHART OF ACCOUNTS Milnor Company General Ledger ASSETS REVENUE 101 Cash 401 Sales 411 Interest Revenue 121 Government Notes 122 Accounts Receivable 122.1 Allowance for Doubtful Accounts 123 Interest Receivable 132 Materials Inventory 133 Work in Process Inventory 134 Finished Goods Inventory 142 Office Supplies 143 Factory Supplies 145 Prepaid Insurance EXPENSES 500 Cost of Goods Sold 504 Factory Overhead 521 Wages Expense 523 Office Supplies Expense 532 Bad Debt Expense 533 Utilities Expense-Office 551 Interest Expense 555 Income Tax Expense 161 Land 171 Factory Building 171.1 Accumulated Depreciation-Factory Building 181 Factory Equipment 181.1 Accumulated Depreciation-Factory Equipment LIABILITIES 201 Accounts Payable 204 Income Tax Payable 207 Interest Payable 252 Bonds Payable EQUITY 311 Capital Stock 313 Income Summary 322 Paid-In Capital in Excess of Par 331 Retained Earnings 333 Cash Dividends General Journal 1. Prepare the December 31 adjusting journal entries for Milnor Company. General Journal Instructions PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE 1 POST. REF DEBIT CREDIT Adjusting Entries 2 3 4 5 6 7 8 9 . 10 11 12 15 14 15 16 17 18 19 20 21 22 23 2. Prepare the December 31 closing Journal entries for Minor Company. PAGES GENERAL JOURNAL DATE POST. REF 1 ACCOUNT TITLE Closing Entries DEBIT CREDIT 2 3 eBook 6 7 3 9 10 11 12 13 14 15 16 17 11 3. Prepare the reversing journal entries as of January 1, 20-2, for Milnor Company. PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE Reversing Entries POST. REF DEBIT CREDIT 2 4 5 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started