Answered step by step

Verified Expert Solution

Question

1 Approved Answer

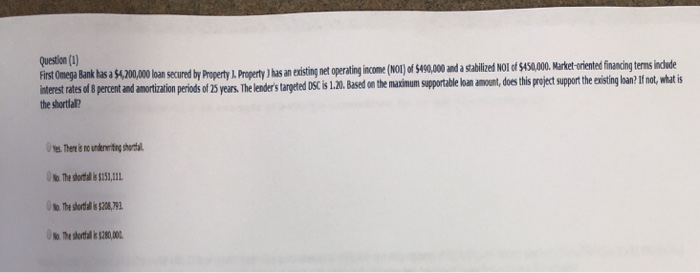

thats it the question and the lian constant table Question (1) First Omega Bank has a 54,200,000 loan secured by Property Proverty as an existing

thats it the question and the lian constant table

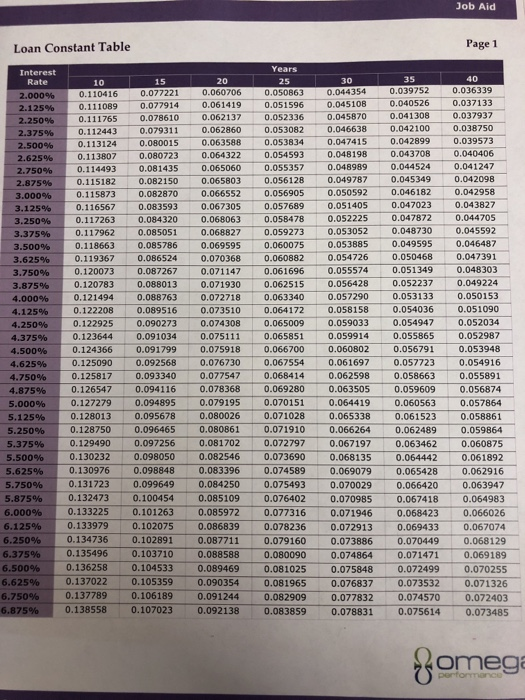

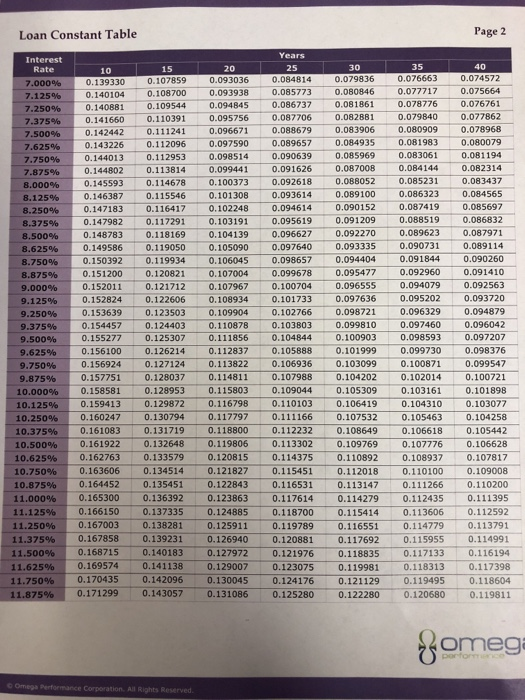

Question (1) First Omega Bank has a 54,200,000 loan secured by Property Proverty as an existing net operating income (NOT) of $190.000 and a stabilized NOT of $450,000. Market-oriented financing terms indude interest rates of 8 percent and amortization periods of 25 years. The lender's targeted DSC is 1.20. Based on the maximum supportable loan amount, does this project support the existing loan? If not, what is the shortfall Uts. There is to underenting shortal The storfil 5151,111 to the shortalis 5208,741 to the statal 5780,000 Job Aid Loan Constant Table Page 1 Interest 2.000% 2.125% 2.250% 2.375% 2.500% 2.625% 2.750% 2.875% 3.000% 3.125% 3.250% 3.375% 3.500% 3.625% 3.750% 3.875% 4.000% 4.125% 4.250% 4.375% 4.500% 4.625% 4.750% 4.875% 5.000% 5.125% 5.250% 5.375% 5.500% 5.625% 5.750% 5.875% 6.000% 6.125% 6.250% 6.375% 6.500% 6.625% 6.750% 6.875% 10 0.110416 0.111089 0.111765 0.112443 0.113124 0.113807 0.114493 0.115182 0.115873 0.116567 0.117263 0.117962 0.118663 0.119367 0.120073 0.120783 0.121494 0.122208 0.122925 0.123644 0.124366 0.125090 0.125817 0.126547 0.127279 0.128013 0.128750 0.129490 0.130232 0.130976 0.131723 0.132473 0.133225 0.133979 0.134736 0.135496 0.136258 0.137022 0.137789 0.138558 Years 15 20 25 0.077221 0 .060706 0.050863 0.077914 0.061419 0.051596 0.078610 0.062137 0.052336 0.079311 0.062860 0.053082 0.080015 0.063588 0.053834 0.080723 0.064322 0.054593 0.081435 0.065060 0.055357 0.082150 0.065803 0.056128 0.082870 0.066552 0.056905 0.083593 0.067305 0.057689 0.084320 0.068063 0.058478 0.085051 0.068827 0.059273 0.085786 0.069595 0.060075 0.086524 0.070368 0.060882 0.087267 0.071147 0.061696 0.0880130.071930 0.062515 0.088763 0.072718 0.063340 0.089516 0.073510 0.064172 0.090273 0.074308 0.065009 0.091034 0.075111 0.065851 0.091799 0 .075918 0.066700 0.092568 0.076730 0.067554 0.093340 0.077547 0.068414 0.094116 0.078368 0.069280 0.094895 0.079195 0.070151 0.095678 0.080026 0.071028 0.096465 0.080861 0.071910 0.097256 0.081702 0.072797 0.098050 0.082546 0.073690 0.098848 0.083396 0.074589 0.099649 0.084250 0.075493 0.100454 0.085109 0.076402 0.101263 0.085972 0.077316 0.102075 0.0868390.078236 0.102891 0.0877110.079160 0.103710 0.088588 0.080090 0.104533 0.089469 0 .081025 0.105359 0.090354 0.081965 0.106189 0.091244 0.082909 0.107023 0.092138 0.083859 30 0.044354 0.045108 0.045870 0.046638 0.047415 0.048198 0.048989 0.049787 0.050592 0.051405 0.052225 0.053052 0.053885 0.054726 0.055574 0.056428 0.057290 0.058158 0.059033 0.059914 0.060802 0.061697 0.062598 0.063505 0.064419 0.065338 0.066264 0.067197 0.068135 0.069079 0.070029 0.070985 0.071946 0.072913 0.073886 0.074864 0.075848 0.076837 0.077832 0.078831 35 0.039752 0.036339 0.040526 0.037133 0.041308 0.037937 0.042100 0.038750 0.042899 0.039573 0.043708 0.040406 0.044524 0.041247 0.045349 0.042098 0.046182 0.042958 0.0470230.043827 0.047872 0.044705 0.048730 0.045592 0.049595 0.046487 0.050468 0.047391 0.051349 0.048303 0.052237 0.049224 0.053133 0.054036 0.051090 0.054947 0.052034 0.055865 0.052987 0.056791 0.053948 0.057723 0.054916 0.058663 0.055891 0.059609 0.056874 0.060563 0.057864 0.061523 0.058861 0.062489 0.059864 0.063462 0.060875 0.064442 0.061892 0 .065428 0.062916 0.066420 0.063947 0.067418 0.064983 0.068423 0.066026 0.069433 0.067074 0.070449 0.068129 0.071471 0.069189 0.072499 0.070255 0 .073532 0.071326 0.074570 0.072403 0.075614 0.073485 fomega Loan Constant Table Page 2 35 Interest Rate 7.000% 7.125% 7.250% 7.375% 7.500% 7.625% 7.750% 7.875% 8.000% 8.125% 8.250% 8.375% 8.500% 8.625% 8.750% 8.875% 9.000% 9.125% 9.250% 9.375% 9.500% 9.625% 9.750% 9.875% 10.000% 10.125% 10.250% 10.375% 10,500% 10.625% 10.750% 10.875% 11.000% 11.125% 11.250% 11.375% 11.500% 11.625% 11.750% 11.875% 10 15 20 0.139330 0.107859 0 .093036 0.140104 0.108700 0.093938 0.1408810.109544 0.094845 0.141660 0.110391 0.095756 0.142442 0.111241 0.096671 0.143226 0.112096 0.097590 0.144013 0.112953 0.098514 0.144802 0.113814 0.099441 0.145593 0.114678 0.100373 0.146387 0.115546 0.101308 0.147183 0.116417 0.102248 0.147982 0.117291 0.103191 0.148783 0.1181690 .1041390 0.149586 0.119050 0.105090 0.150392 0.119934 0.106045 0.151200 0.120821 0.107004 0.152011 0.121712 0.107967 0.152824 0.122606 0.108934 0.153639 0.123503 0.109904 0.154457 0.124403 0.110878 0.155277 0.125307 0.111856 0.156100 0.126214 0.112837 0.156924 0.127124 0.113822 0.157751 0.128037 0.114811 0.158581 0.128953 0.115803 0.159413 0.129872 0.116798 0.160247 0.130794 0.117797 0.161083 0.131719 0.118800 0.161922 0.132648 0.119806 0.162763 0.133579 0.120815 0.163606 0.134514 0.121827 0.164452 0.135451 0.122843 0.165300 0 .136392 0.123863 0.166150 0.137335 0.124885 0.167003 0.138281 0.125911 0.167858 0.139231 0.126940 0.168715 0.140183 0.127972 0.169574 0.141138 0.129007 0.170435 0.142096 0.130045 0.171299 0.143057 0.131086 Years 25 30 0.084814 0.079836 0.076663 0.074572 0.085773 0 .080846 0.077717 0.075664 0.086737 0.081861 0.078776 0.076761 0.087706 0.0828810.079840 0.077862 0.088679 0.083906 0.080909 0.078968 0.089657 0.084935 0.081983 0.080079 0.090639 0.085969 0.083061 0.081194 0.091626 0.087008 0.084144 0.082314 0.092618 0.088052 0.085231 0.083437 0.093614 0.089100 0.086323 0.084565 0.094614 0.090152 0.087419 0.085697 0.095619 0.091209 0.0885190.086832 .096627 0.092270 0.0896230 .087971 0.097640 0.093335 0.090731 0.089114 0.098657 0.094404 0.091844 0.090260 0.099678 0.095477 0.092960 0.091410 0.100704 0.096555 0 .094079 0.092563 0.101733 0.097636 0.095202 0.093720 0.102766 0.098721 0.096329 0.094879 0.103803 0.099810 0.097460 0.096042 0.104844 0.100903 0.098593 0.097207 0.105888 0.101999 0.099730 0.098376 0.106936 0.103099 0.100871 0.099547 0.107988 0.104202 0.102014 0.100721 0.109044 0.105309 0.103161 0.101898 0.110103 0 .106419 0.104310 0.103077 0.111166 0.107532 0.105463 0.104258 0.112232 0.108649 0.106618 0.105442 0.113302 0.109769 0.107776 0 .106628 0.114375 0.110892 0.108937 0.107817 0.115451 0.112018 0.110100 0.109008 0.116531 0.113147 0.111266 0.110200 0.117614 0.114279 0.112435 0.111395 0.118700 0.115414 0.113606 0.112592 0.119789 0.116551 0.114779 0.113791 0.1208810 .1176920 .115955 0.114991 0.121976 0.118835 0.117133 0.116194 0.123075 0.119981 0 .118313 0.117398 0.124176 0.121129 0.119495 0.118604 0.125280 0.122280 0.120680 0.119811 Someg Omega Performance Corporation. All Rights Reserved Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started