thats the first part of the question

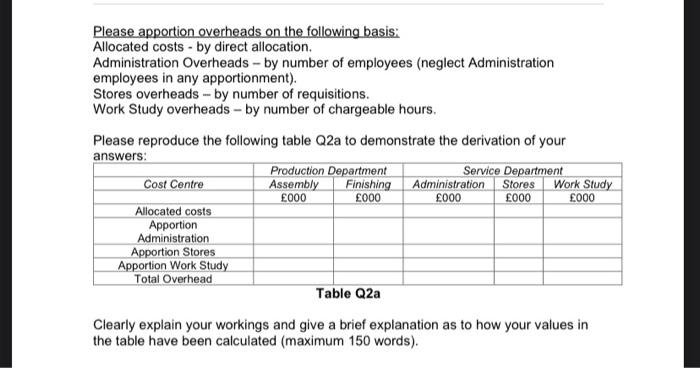

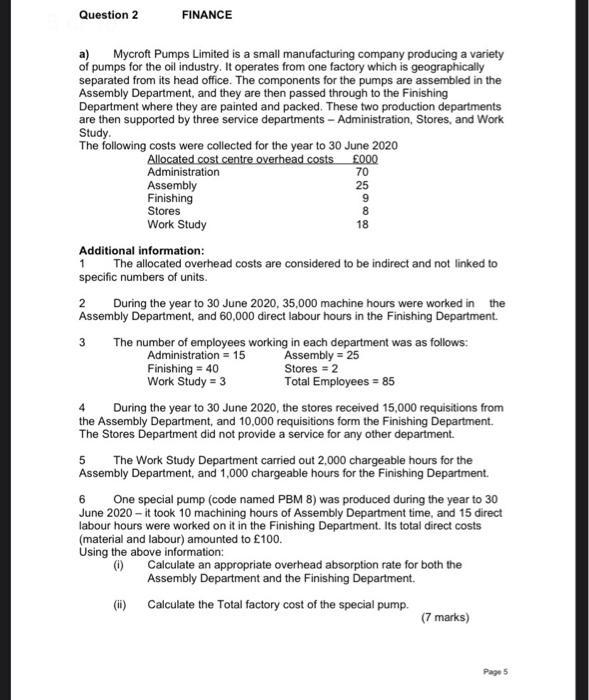

Please apportion overheads on the following basis: Allocated costs - by direct allocation. Administration Overheads - by number of employees (neglect Administration employees in any apportionment). Stores overheads - by number of requisitions. Work Study overheads - by number of chargeable hours. Please reproduce the following table Q2a to demonstrate the derivation of your answers: Production Department Service Department Cost Centre Assembly Finishing Administration Stores Work Study 000 000 000 Allocated costs Apportion Administration Apportion Stores Apportion Work Study Total Overhead Table Q2a Clearly explain your workings and give a brief explanation as to how your values in the table have been calculated (maximum 150 words). 000 000 Question 2 FINANCE 9 8 18 1 a) Mycroft Pumps Limited is a small manufacturing company producing a variety of pumps for the oil industry. It operates from one factory which is geographically separated from its head office. The components for the pumps are assembled in the Assembly Department, and they are then passed through to the Finishing Department where they are painted and packed. These two production departments are then supported by three service departments - Administration, Stores, and Work Study The following costs were collected for the year to 30 June 2020 Allocated cost centre overhead costs 000 Administration 70 Assembly 25 Finishing Stores Work Study Additional information: The allocated overhead costs are considered to be indirect and not linked to specific numbers of units. 2 During the year to 30 June 2020, 35,000 machine hours were worked in the Assembly Department, and 60,000 direct labour hours in the Finishing Department 3 The number of employees working in each department was as follows: Administration = 15 Assembly = 25 Finishing = 40 Stores = 2 Work Study = 3 Total Employees = 85 During the year to 30 June 2020, the stores received 15,000 requisitions from the Assembly Department, and 10,000 requisitions form the Finishing Department. The Stores Department did not provide a service for any other department. 5 The Work Study Department carried out 2,000 chargeable hours for the Assembly Department, and 1,000 chargeable hours for the Finishing Department. 6 One special pump (code named PBM 8) was produced during the year to 30 June 2020 - it took 10 machining hours of Assembly Department time, and 15 direct labour hours were worked on it in the Finishing Department. Its total direct costs (material and labour) amounted to 100. Using the above information: (1) Calculate an appropriate overhead absorption rate for both the Assembly Department and the Finishing Department Calculate the Total factory cost of the special pump. (7 marks) 4 Page 5