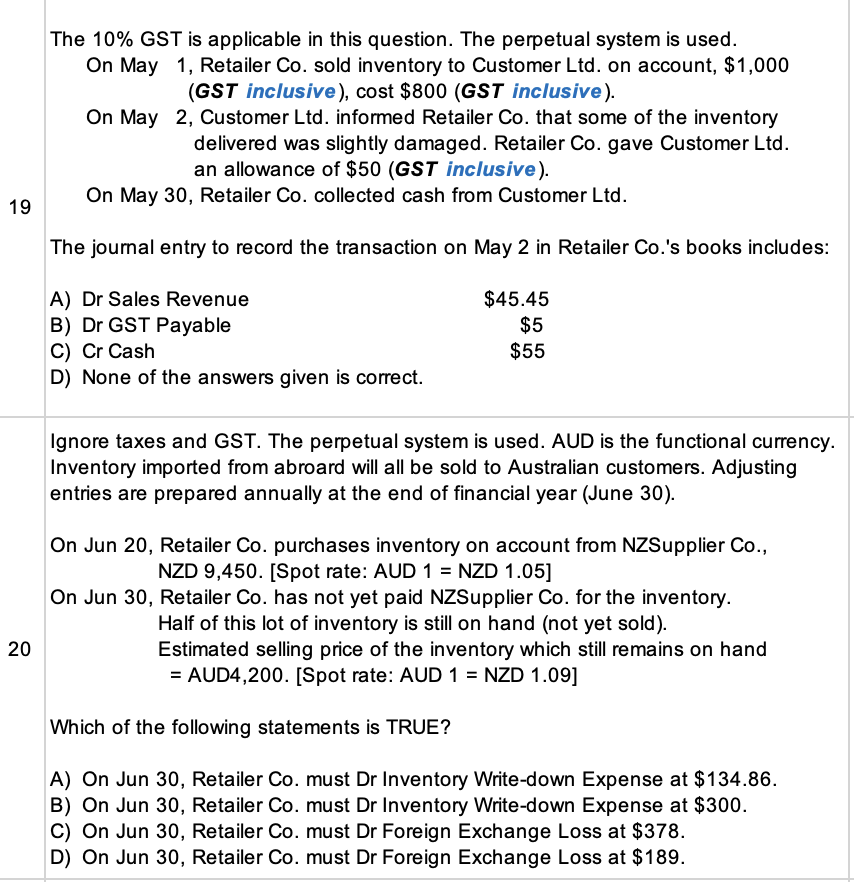

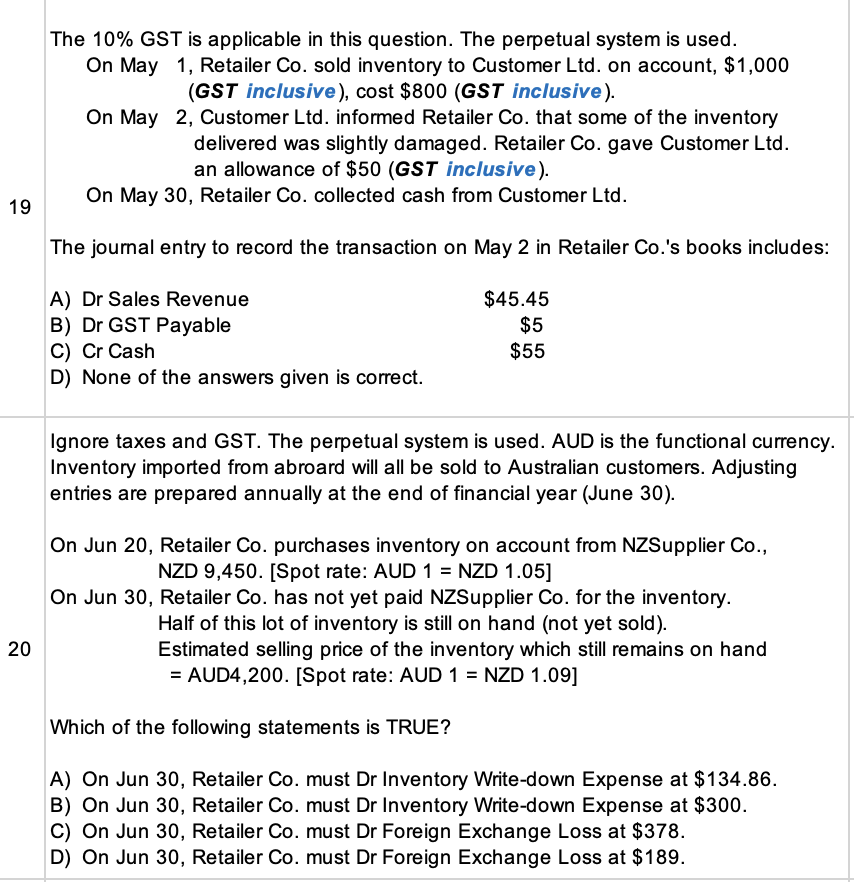

The 10% GST is applicable in this question. The perpetual system is used. On May 1, Retailer Co. sold inventory to Customer Ltd. on account, $1,000 (GST inclusive), cost $800 (GST inclusive). On May 2, Customer Ltd. informed Retailer Co. that some of the inventory delivered was slightly damaged. Retailer Co. gave Customer Ltd. an allowance of $50 (GST inclusive). On May 30, Retailer Co. collected cash from Customer Ltd. The journal entry to record the transaction on May 2 in Retailer Co.'s books includes: Ignore taxes and GST. The perpetual system is used. AUD is the functional currency. Inventory imported from abroard will all be sold to Australian customers. Adjusting entries are prepared annually at the end of financial year (June 30). On Jun 20, Retailer Co. purchases inventory on account from NZSupplier Co., NZD 9,450. [Spot rate: AUD 1 = NZD 1.05] On Jun 30, Retailer Co. has not yet paid NZSupplier Co. for the inventory. Half of this lot of inventory is still on hand (not yet sold). Estimated selling price of the inventory which still remains on hand = AUD4,200. [ Spot rate: AUD 1= NZD 1.09] Which of the following statements is TRUE? A) On Jun 30, Retailer Co. must Dr Inventory Write-down Expense at $134.86. B) On Jun 30, Retailer Co. must Dr Inventory Write-down Expense at $300. C) On Jun 30, Retailer Co. must Dr Foreign Exchange Loss at $378. D) On Jun 30 , Retailer Co. must Dr Foreign Exchange Loss at $189. The 10% GST is applicable in this question. The perpetual system is used. On May 1, Retailer Co. sold inventory to Customer Ltd. on account, $1,000 (GST inclusive), cost $800 (GST inclusive). On May 2, Customer Ltd. informed Retailer Co. that some of the inventory delivered was slightly damaged. Retailer Co. gave Customer Ltd. an allowance of $50 (GST inclusive). On May 30, Retailer Co. collected cash from Customer Ltd. The journal entry to record the transaction on May 2 in Retailer Co.'s books includes: Ignore taxes and GST. The perpetual system is used. AUD is the functional currency. Inventory imported from abroard will all be sold to Australian customers. Adjusting entries are prepared annually at the end of financial year (June 30). On Jun 20, Retailer Co. purchases inventory on account from NZSupplier Co., NZD 9,450. [Spot rate: AUD 1 = NZD 1.05] On Jun 30, Retailer Co. has not yet paid NZSupplier Co. for the inventory. Half of this lot of inventory is still on hand (not yet sold). Estimated selling price of the inventory which still remains on hand = AUD4,200. [ Spot rate: AUD 1= NZD 1.09] Which of the following statements is TRUE? A) On Jun 30, Retailer Co. must Dr Inventory Write-down Expense at $134.86. B) On Jun 30, Retailer Co. must Dr Inventory Write-down Expense at $300. C) On Jun 30, Retailer Co. must Dr Foreign Exchange Loss at $378. D) On Jun 30 , Retailer Co. must Dr Foreign Exchange Loss at $189