Question

The 2016 annual report of Bank of America includes the following footnote related to its availablefor-sale debt securities: a. What amount will Bank of America

The 2016 annual report of Bank of America includes the following footnote related to its availablefor-sale debt securities:

a. What amount will Bank of America report for available-for-sale debt securities on the balance sheet? Explain.

a. What amount will Bank of America report for available-for-sale debt securities on the balance sheet? Explain.

b. How do gross unrealized gains and losses arise on these available-for-sale debt securities?

c. Calculate the net unrealized gains or losses for 2016.

d. How do these unrealized gains and losses affect Bank of America's 2016 income statement?

e. How do these unrealized gains and losses affect Bank of America's 2016 balance sheet?

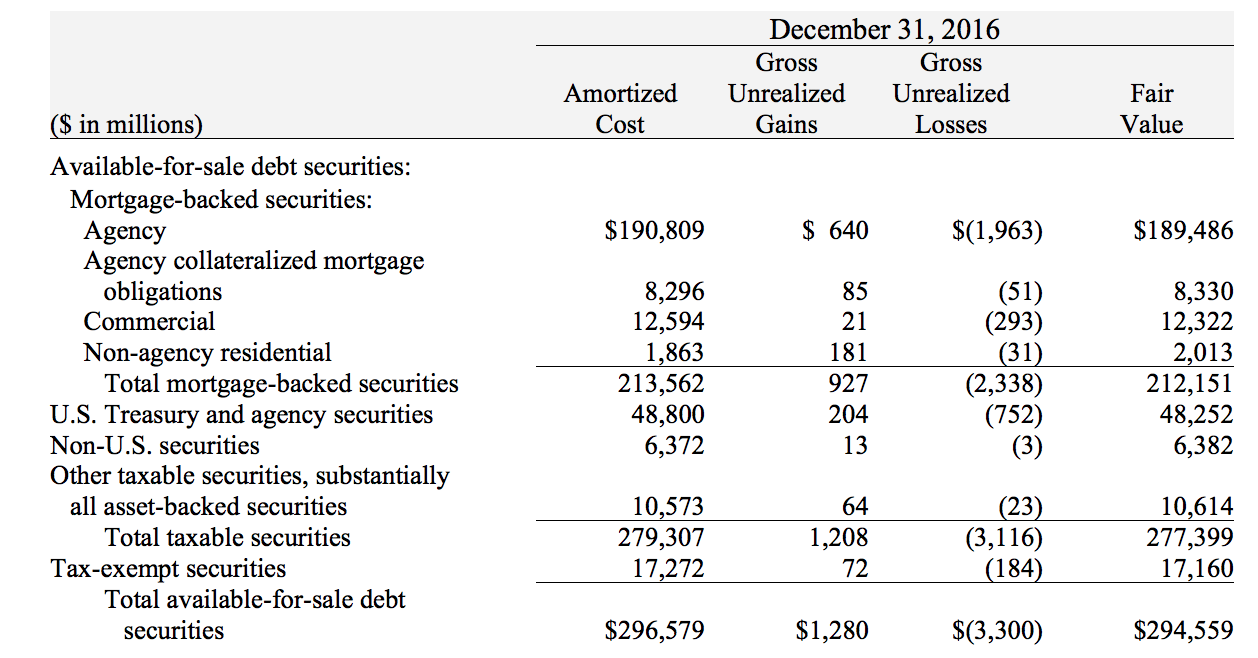

December 31, 2016 Gross Gross Unrealized Unrealized Gains Losses Amortized Cost Fair Value $190,809 $ 640 $(1,963) $189,486 ($ in millions) Available-for-sale debt securities: Mortgage-backed securities: Agency Agency collateralized mortgage obligations Commercial Non-agency residential Total mortgage-backed securities U.S. Treasury and agency securities Non-U.S. securities Other taxable securities, substantially all asset-backed securities Total taxable securities Tax-exempt securities Total available-for-sale debt securities 8,296 12,594 1,863 213,562 48,800 6,372 85 21 181 927 204 13 (51) (293) (31) (2,338) (752) (3) 8,330 12,322 2,013 212,151 48,252 6,382 10,573 279,307 17,272 64 1,208 72 (23) (3,116) (184) 10,614 277,399 17,160 $296,579 $1,280 $(3,300) $294,559Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started