Answered step by step

Verified Expert Solution

Question

1 Approved Answer

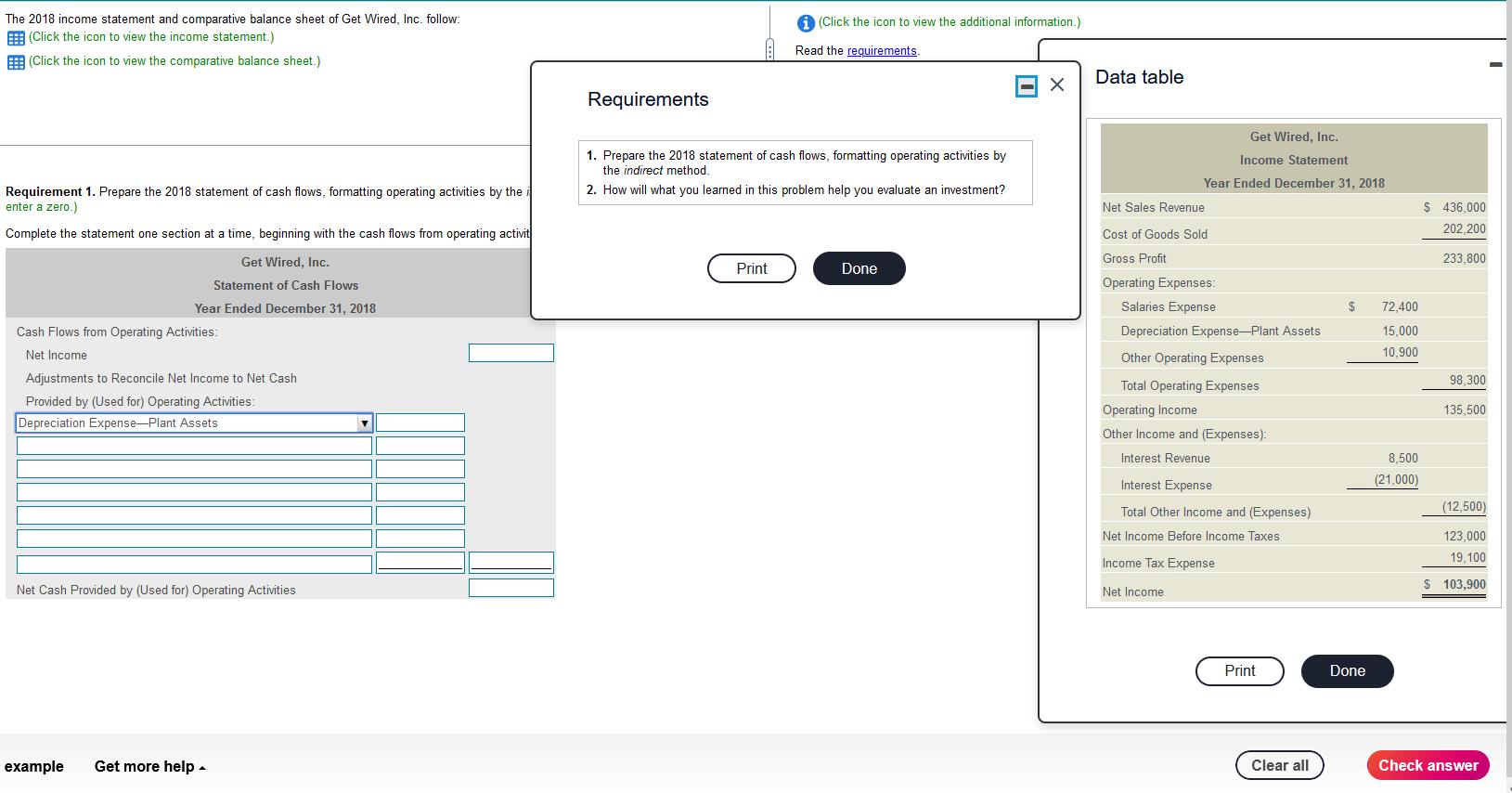

The 2018 income statement and comparative balance sheet of Get Wired, Inc. follow: (Click the icon to view the income statement.) (Click the icon

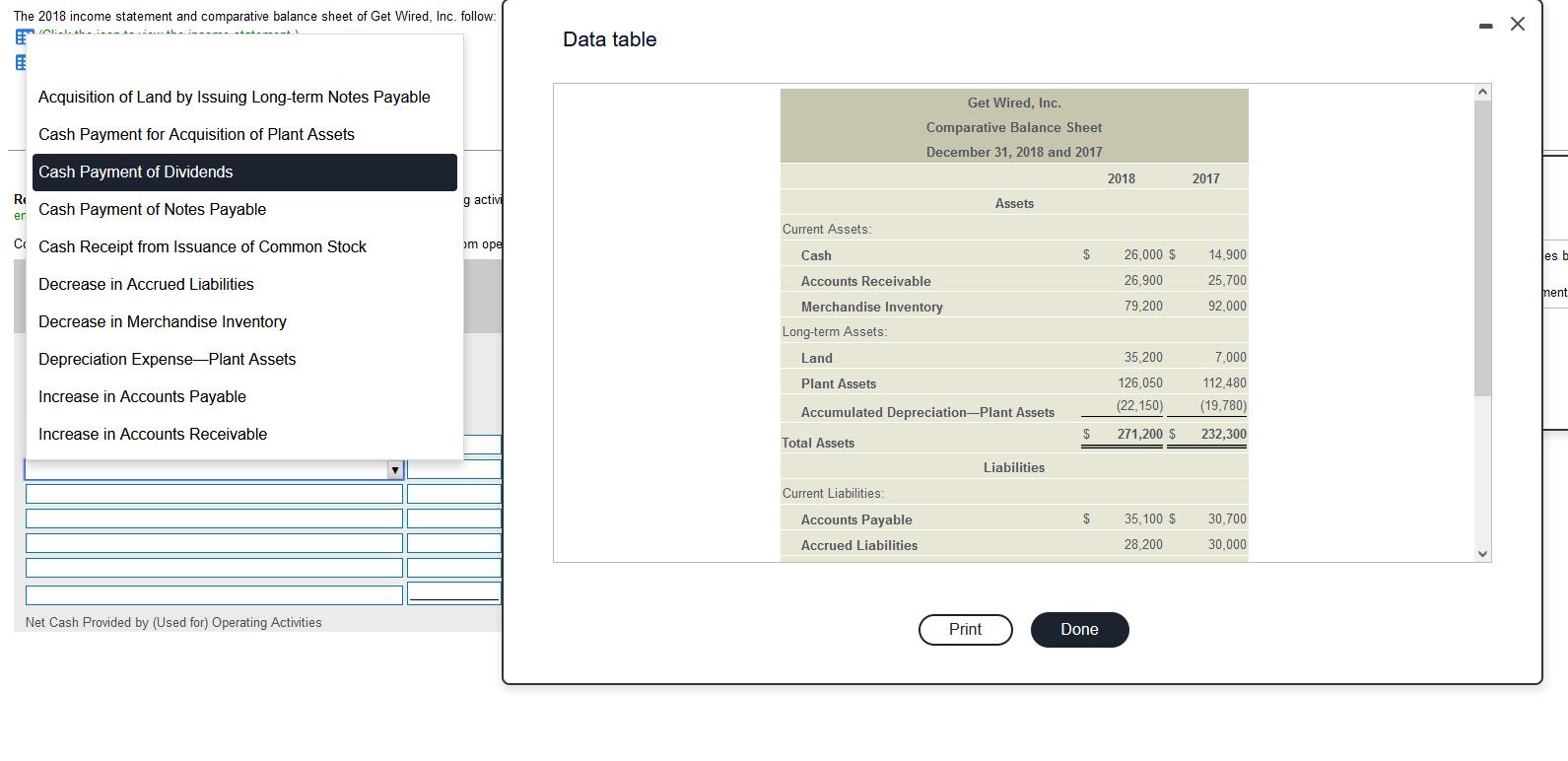

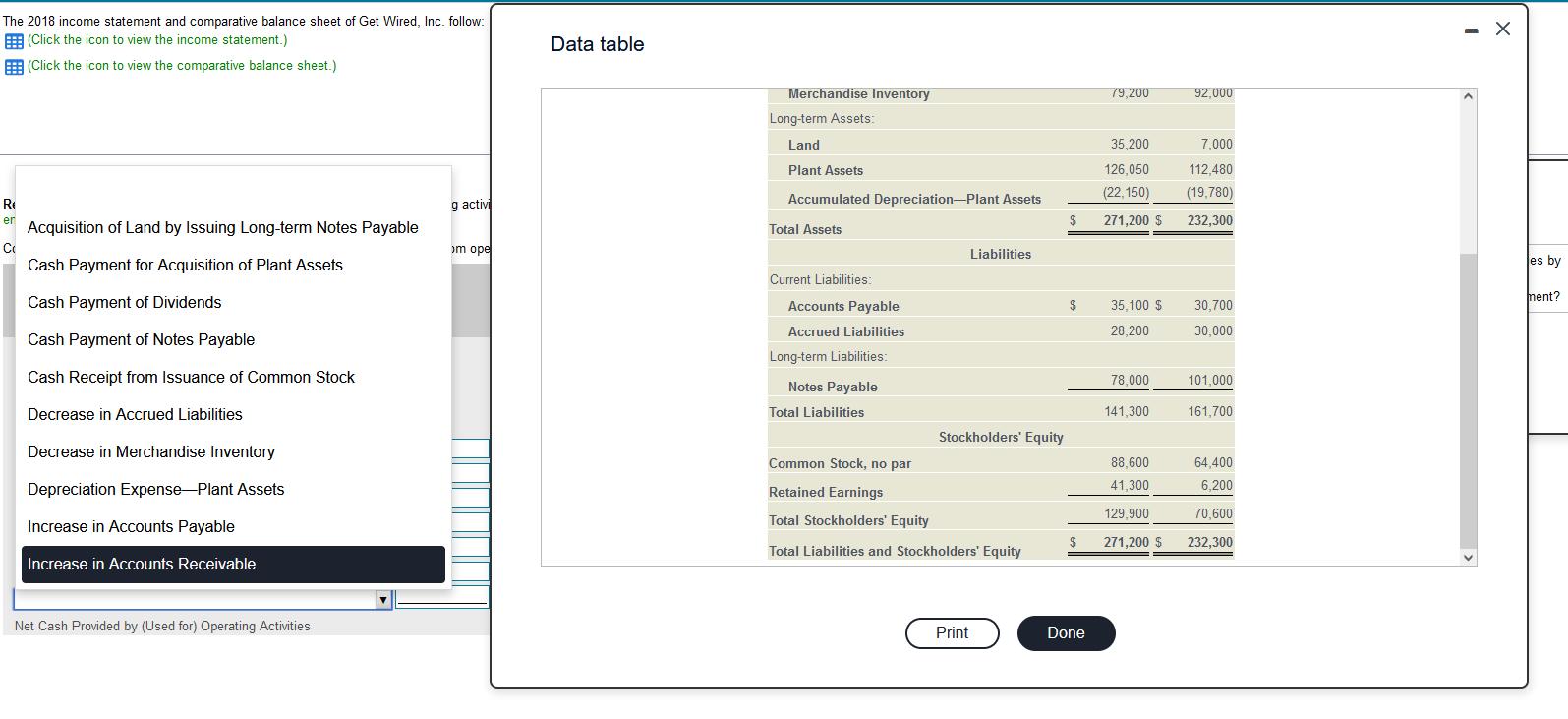

The 2018 income statement and comparative balance sheet of Get Wired, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Requirement 1. Prepare the 2018 statement of cash flows, formatting operating activities by the i enter a zero.) Complete the statement one section at a time, beginning with the cash flows from operating activit Get Wired, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Depreciation Expense-Plant Assets Net Cash Provided by (Used for) Operating Activities example Get more help. Requirements (Click the icon to view the additional information.) Read the requirements. 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? Print Done X Data table Get Wired, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense Net Income Print Clear all $ Done 72,400 15,000 10,900 8,500 (21,000) $ 436,000 202,200 233,800 98,300 135,500 !!! (12,500) 123,000 19,100 $ 103,900 Check answer The 2018 income statement and comparative balance sheet of Get Wired, Inc. follow: E E -Ak Acquisition of Land by Issuing Long-term Notes Payable Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable C Cash Receipt from Issuance of Common Stock Decrease in Accrued Liabilities Decrease in Merchandise Inventory Depreciation Expense-Plant Assets Increase in Accounts Payable Increase in Accounts Receivable Re er Net Cash Provided by (Used for) Operating Activities g activi om ope Data table Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Land Plant Assets Get Wired, Inc. Comparative Balance Sheet December 31, 2018 and 2017 Current Liabilities: Accumulated Depreciation-Plant Assets Total Assets Accounts Payable Accrued Liabilities Assets Liabilities Print $ $ $ Done 2018 26,000 $ 26,900 79,200 35,200 126,050 (22,150) 271,200 $ 35,100 $ 28,200 2017 14.900 25,700 92,000 7,000 112,480 (19,780) 232,300 30,700 30,000 - es b ment The 2018 income statement and comparative balance sheet of Get Wired, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Re er Co Acquisition of Land by Issuing Long-term Notes Payable Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Decrease in Accrued Liabilities Decrease in Merchandise Inventory Depreciation Expense Plant Assets Increase in Accounts Payable Increase in Accounts Receivable Net Cash Provided by (Used for) Operating Activities g activi om ope Data table Merchandise Inventory Long-term Assets: Land Plant Assets Accumulated Depreciation-Plant Assets Total Assets Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Print $ $ $ Done 79,200 35,200 126,050 (22,150) 271,200 $ 35,100 $ 28,200 78,000 141,300 88,600 41,300 129,900 271,200 $ 92,000 7,000 112,480 (19,780) 232,300 30,700 30,000 101,000 161,700 64,400 6,200 70,600 232,300 X es by ment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

45678 9 10 11 12 13 14 15 16 17 56700 8 Calculations 9 10 11 12 13 14 15 16 17 B Cash flows fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started