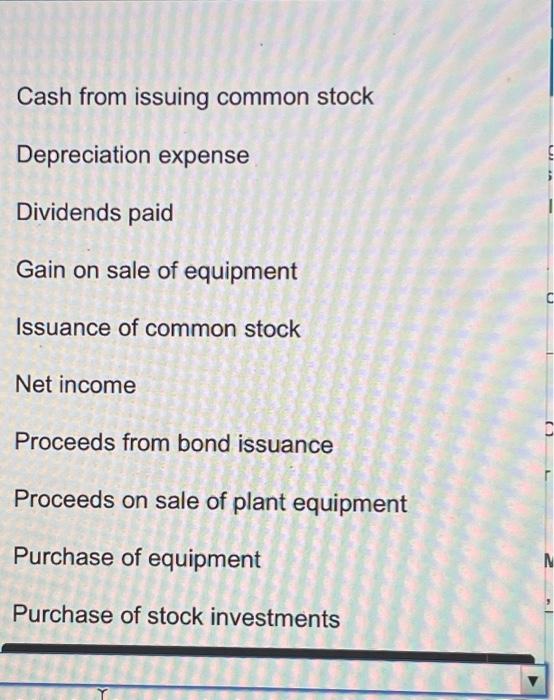

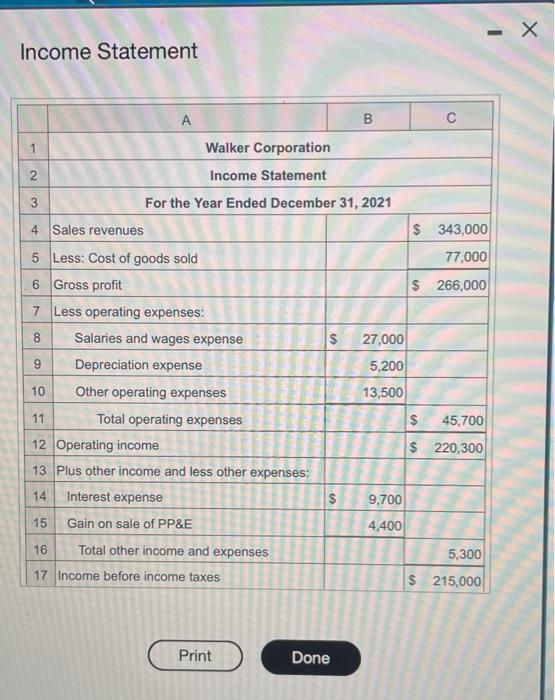

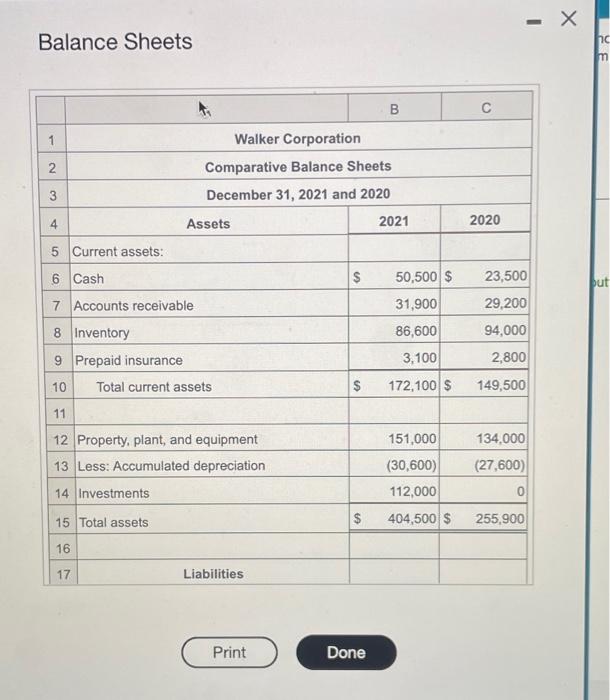

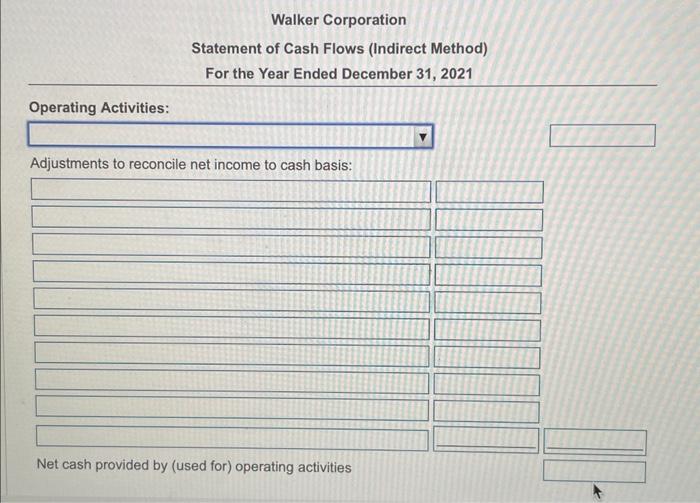

The 2021 and 2020 balance sheets of Waker Corporation follow. The 2021 income statomont is also provided. Walker had no noncash investing and finaneing transactions during 2021 . During the yoar, the company sold equipenont for $15,800, which had originally cost $13,600 and had a book value of $11,400. The company did not issue any notes payable during the year but did ssue common stock for $26,000. The company purchased plant assets and long-term investments with cash. (Cick the loon to view the income statement) (Ceck the icon to view the balance sheots) Requtrements 1. Propace the statement of cash flows for Waker Corporation for 2021 using the indirect method. 2. Evaluate the compary's cash fows for the year. Discuss each of the categories of cash flows in your response. Requirement 1. Prepare the statement of cash fows for Waker Corporation for 2021 using the indrect method Prepare the statement one section at a tme. (Use parentheses or a minus sign for numbers to be subtracted or for a net cash outtow) Cash from issuing common stock Depreciation expense Dividends paid Gain on sale of equipment Issuance of common stock Net income Proceeds from bond issuance Proceeds on sale of plant equipment Purchase of equipment Purchase of stock investments Income Statement Balance Sheets Walker Corporation Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Adjustments to reconcile net income to cash basis: Net cash provided by (used for) operating activities The 2021 and 2020 balance sheets of Waker Corporation follow. The 2021 income statomont is also provided. Walker had no noncash investing and finaneing transactions during 2021 . During the yoar, the company sold equipenont for $15,800, which had originally cost $13,600 and had a book value of $11,400. The company did not issue any notes payable during the year but did ssue common stock for $26,000. The company purchased plant assets and long-term investments with cash. (Cick the loon to view the income statement) (Ceck the icon to view the balance sheots) Requtrements 1. Propace the statement of cash flows for Waker Corporation for 2021 using the indirect method. 2. Evaluate the compary's cash fows for the year. Discuss each of the categories of cash flows in your response. Requirement 1. Prepare the statement of cash fows for Waker Corporation for 2021 using the indrect method Prepare the statement one section at a tme. (Use parentheses or a minus sign for numbers to be subtracted or for a net cash outtow) Cash from issuing common stock Depreciation expense Dividends paid Gain on sale of equipment Issuance of common stock Net income Proceeds from bond issuance Proceeds on sale of plant equipment Purchase of equipment Purchase of stock investments Income Statement Balance Sheets Walker Corporation Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Adjustments to reconcile net income to cash basis: Net cash provided by (used for) operating activities