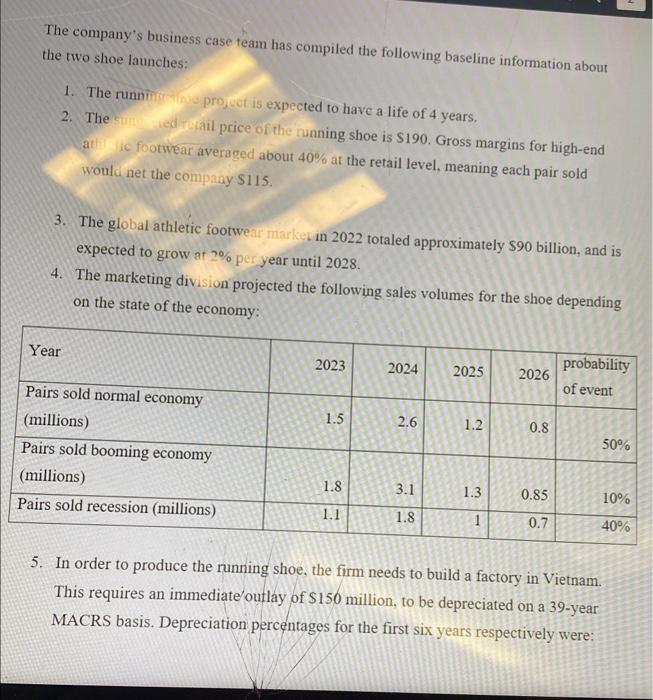

The 2023 USA Trict sielu Outdoor Championship is due to be held in Eugene this summer. The f of start-up sport spparel company, Mr. Beans, is considering taking this oppo zuty to enter the 18 to 24-year-old segment of the market, through the launch of a nesy finning shoe. The company currently dominates a niche maiket for a certain type of high-end leisure shoe, which are favored by an older age group between 35 to 48 . To appeal to a younger and broader audience, Mr. Benns is planning to bring in a group of UO track athletes as endorsers. He currently has a list of 5 potential candidates. The customer group this new launch is targeting is expected to have less buying power than Mr. Bean's usual customers. Not only does the company need to adjust the pricing of the shoe to a lower range, but the company would also need to purchase a patent from New Balance for a certain type of glue required for production. Apparently, the launch will not come cheap. Because of the economic downturn, Mr. Bean's company is currently suffering from a shortage of cash, and given the company's low credit ratings, funding for the patent will be unreasonably costly. After a discussion with their financial team, Mr. Beans discovered that the best way to afford the glue patent for the company, is to give up the purchase of a private jet the company has promised him. Mr. Beans proceeds to throw a tantrum, threatening to leave the company unless he receives an upfront $2 million payment for doing this project. Shareholders of Mr. Beans' company have long tolerated Mr. Beans' eccentricity and would not mind Mr. Beans leaving. They already bave another CEO candidate in mind: Ms. Ms. Rodriguez is on the board of various pharmaceutical firms and has no previous experience in the athleisure in try. She is likely to take a more conservative approach than Mr. Beans, and will noi that case, the shareholders worry that the research and development resources that had already been poured into the running shoe project will be wasted. To obtain an unbiased opinion, the shareholders and board of Mr. Beans' company hired your team as consultants. The company is asking for a thorough and complete analysis. It was up to your team to come up with a compelling analysis and a recommendation about how to proceed. The company's business case team has compiled the following baseline information about the two shoe launches: 1. The runninit thise project is expected to have a life of 4 years. 2. The the tunning shoe is $190. Gross margins for high-end sed about 40% at the retail level, meaning each pair sold 3. The global athletic footwear market in 2022 totaled approximately $90 billion, and is expected to grow at 2% per year until 2028 . 4. The marketing division projected the following sales volumes for the shoe depending on the state of the economy: 5. In order to produce the running shoe, the firm needs to build a factory in Vietnam. This requires an immediate outlay of $150 million, to be depreciated on a 39-year MACRS basis. Depreciation percentages for the first six years respectively were: would be sold for $102 million at profe The firm's analysts estimate the building been taken into considoration when cojt termination. This "salvage value" has not installation freigh perincaces tor the six to be depreciated on a five-year MACRS basis. Depreciation pers catages tor the six years respectively are: 20%,32%,19%,12%,11%, and 6%. It is believed the equipment could be sold for 3 million upon project termination. 7. In order to manufacture the running shos, two of the firm's working capital accounts are expected to increase inmediately. Approximately $15 million of inventory would be needed quickly to fill the supply chain, and accounts payable were expected to increase by $5 milion. By the end of 2023 , the accounts receivable balance would be 8% of project revenue; the inventory balance would be 25% of the project's variable costs; and accounts payable would be 20% of the project's variable costs. All working capital would be recovered at the end of the project by the end of the fourth year. 8. The patent will cost $2 million upfront, and the private jet the company promised to purchase is a 2007 Beechcraft that is worth approximately $4.5 million on the market. Mr. Beans requires a $2 million compensation upfront for managing the project. 9. Selling, general, and administrative expenses are $3 million per year. 10. The UO Athletes will be paid a total of S0.7million for their endorsement. 11. The company has already spent $2 million in research and development for the running shoe project. 12. Assume that the financing for the running/shoe project does not change the cost of capital of the company. The company is currently financed by 60% debt and 40% equity, with a cost of debt of 5%, and cost of equity of 8%. 13. The tax rate for this company is 40%. Analyze this case usi vel. And answer the following questions: 1. The shareholders worry that the research and development resources that had already been poured into the running shoe project will be wasted. Is their concern reasonable? 2. What is the cost of capital of this company? 3. Is this a profitable project? Calculate the NPV and IRR of the project