Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 4 bold headings need to be filled in with the correct answers below each as well as answer the question what is the value

The 4 bold headings need to be filled in with the correct answers below each as well as answer the question what is the value of the swap.

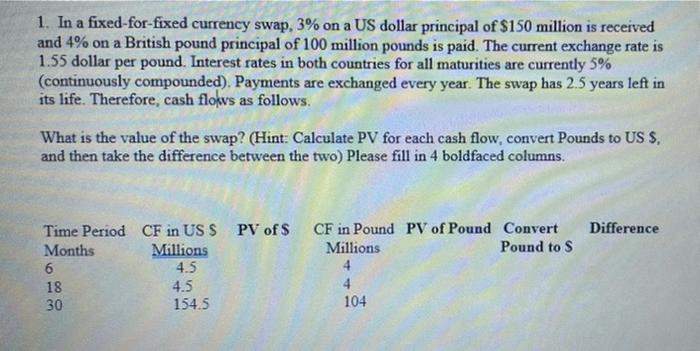

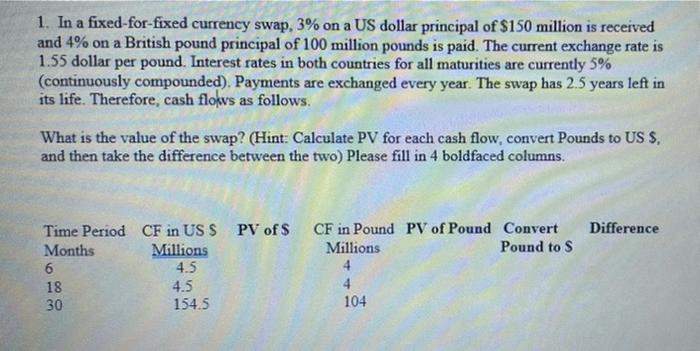

1. In a fixed-for-fixed currency swap. 3% on a US dollar principal of $150 million is received and 4% on a British pound principal of 100 million pounds is paid. The current exchange rate is 1.55 dollar per pound. Interest rates in both countries for all maturities are currently 5% (continuously compounded). Payments are exchanged every year. The swap has 2.5 years left in its life. Therefore, cash flows as follows. What is the value of the swap? (Hint: Calculate PV for each cash flow, convert Pounds to US S. and then take the difference between the two) Please fill in 4 boldfaced columns Difference Time Period CF in USS PV of $ CF in Pound PV of Pound Convert Months Millions Millions Pound to s 6 4.5 4 18 4.5 4 30 154.5 104

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started