Question

The a2 Milk Company shares are trading at $6.22 per share. In one month's time, they will pay a 50 cent dividend. Interest rates

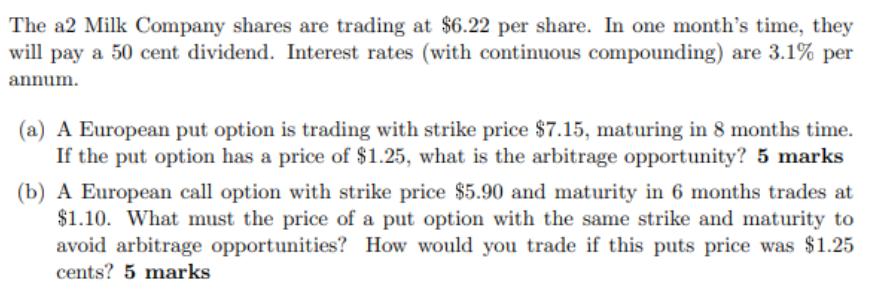

The a2 Milk Company shares are trading at $6.22 per share. In one month's time, they will pay a 50 cent dividend. Interest rates (with continuous compounding) are 3.1% per annum. (a) A European put option is trading with strike price $7.15, maturing in 8 months time. If the put option has a price of $1.25, what is the arbitrage opportunity? 5 marks (b) A European call option with strike price $5.90 and maturity in 6 months trades at $1.10. What must the price of a put option with the same strike and maturity to avoid arbitrage opportunities? How would you trade if this puts price was $1.25 cents? 5 marks

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a The arbitrage opportunity is to buy the put option and sell the underlying ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical financial management

Authors: William r. Lasher

5th Edition

0324422636, 978-0324422634

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App