Answered step by step

Verified Expert Solution

Question

1 Approved Answer

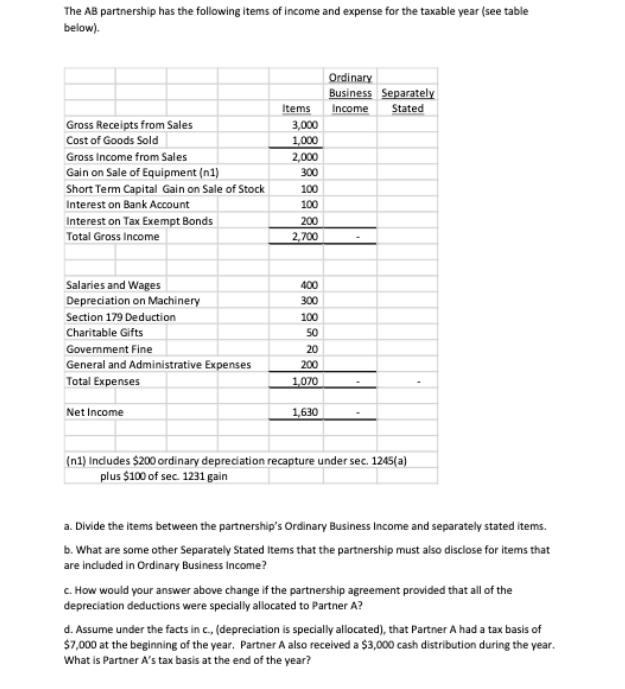

The AB partnership has the following items of income and expense for the taxable year (see table below). Gross Receipts from Sales Cost of

The AB partnership has the following items of income and expense for the taxable year (see table below). Gross Receipts from Sales Cost of Goods Sold Gross Income from Sales Gain on Sale of Equipment (n1) Short Term Capital Gain on Sale of Stock Interest on Bank Account Interest on Tax Exempt Bonds Total Gross Income Salaries and Wages Depreciation on Machinery Section 179 Deduction Charitable Gifts Government Fine General and Administrative Expenses Total Expenses Net Income Items 3,000 1,000 2,000 300 100 100 200 2,700 400 300 100 50 20 200 1,070 1,630 Ordinary Business Separately Income Stated (n1) Includes $200 ordinary depreciation recapture under sec. 1245(a) plus $100 of sec. 1231 gain a. Divide the items between the partnership's Ordinary Business Income and separately stated items. b. What are some other Separately Stated Items that the partnership must also disclose for items that are included in Ordinary Business Income? c. How would your answer above change if the partnership agreement provided that all of the depreciation deductions were specially allocated to Partner A? d. Assume under the facts in c., (depreciation is specially allocated), that Partner A had a tax basis of $7,000 at the beginning of the year. Partner A also received a $3,000 cash distribution during the year. What is Partner A's tax basis at the end of the year?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The Internal Revenue Service IRS requires the proper classification of income and expenses as either ordinary business income or separately stated i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started