Question

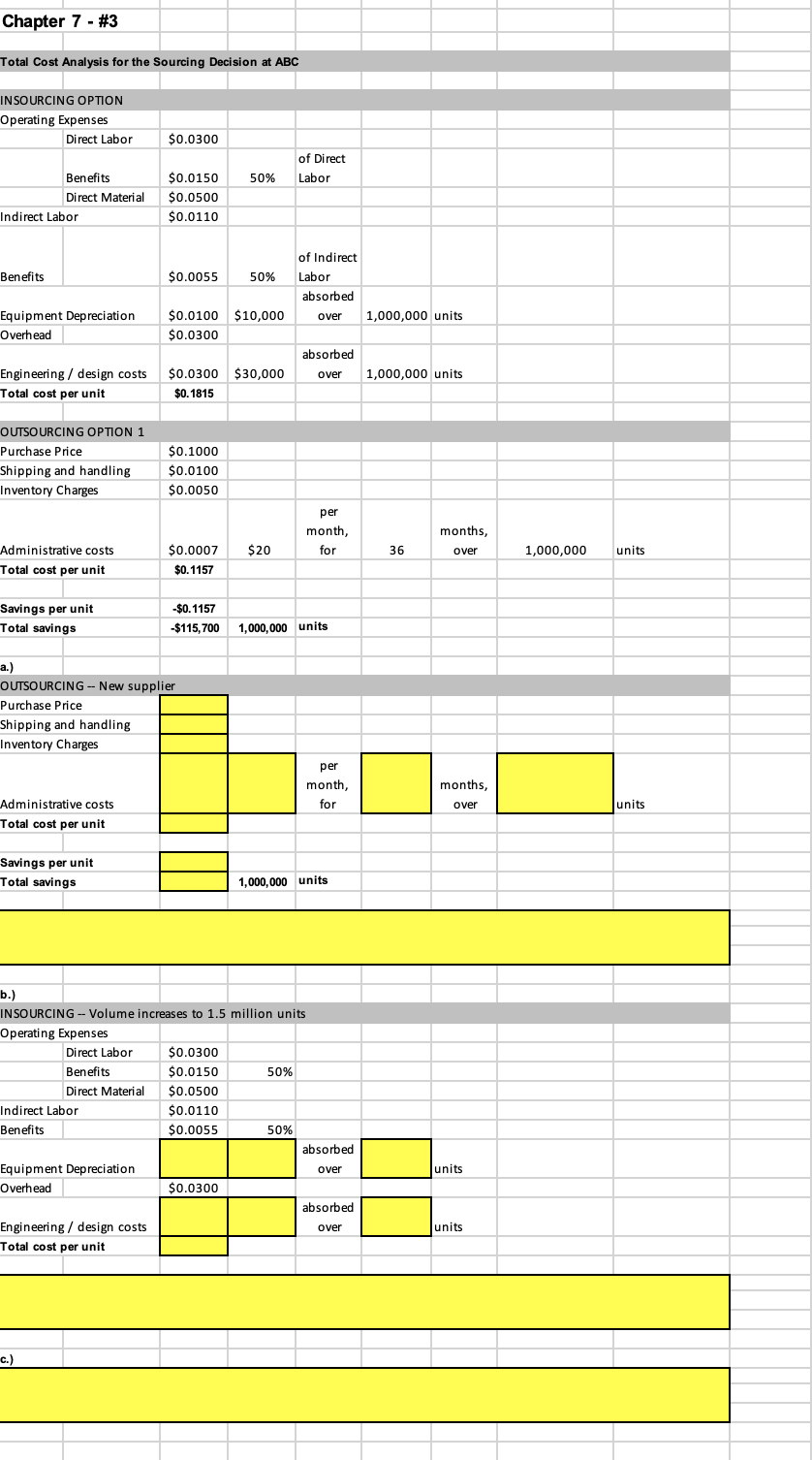

The ABC Company (Example 7.5) has identified another potential supplier for the molded plastic parts. The new supplier has bid $0.08 per part but also

The ABC Company (Example 7.5) has identified another potential supplier for the molded plastic parts. The new

supplier has bid $0.08 per part but also will impose a ship- ping and handling charge of $0.015 per unit. Additional

inventory handling charges should amount to $0.007 per unit. Finally, purchasing costs are estimated at $25 per month for the length of the 36-month contract. a. (*) Calculate the total costs for the new supplier. Which is cheaper: insourcing or outsourcing with the new supplier? b. (**) Suppose the three-year volume is expected to rise

to 1.5 million, rather than 1 million, molded plas- tic parts. Recalculate the total costs associated with

insourcing. What explains the difference?

c. (**) What other factors, other than costs, should ABC consider when deciding whether to make the molded parts in-house?

?

Chapter 7 - #3 Total Cost Analysis for the Sourcing Decision at ABC INSOURCING OPTION Operating Expenses Direct Labor $0.0300 of Direct 50% Labor Benefits Direct Material Indirect Labor $0.0150 $0.0500 $0.0110 Benefits $0.0055 50% of Indirect Labor absorbed over 1,000,000 units Equipment Depreciation Overhead $0.0100 $10,000 $0.0300 absorbed over 1,000,000 units Engineering / design costs Total cost per unit $0.0300 $30,000 $0.1815 $ OUTSOURCING OPTION 1 Purchase Price Shipping and handling Inventory Charges $0.1000 $0.0100 $0.0050 per month, for months, over $20 36 1,000,000 units Administrative costs Total cost per unit $ 0.0007 $0.1157 $0.1157 Savings per unit Total savings $115,700 1,000,000 units a.) OUTSOURCING - New supplier Purchase Price Shipping and handling Inventory Charges per months, month, for over units Administrative costs Total cost per unit Savings per unit Total savings 1,000,000 units b.) INSOURCING -- Volume increases to 1.5 million units Operating Expenses Direct Labor $0.0300 Benefits $0.0150 50% Direct Material $0.0500 Indirect Labor $0.0110 Benefits $0.0055 50% absorbed Equipment Depreciation over Overhead $0.0300 absorbed Engineering / design costs over Total cost per unit units units Chapter 7 - #3 Total Cost Analysis for the Sourcing Decision at ABC INSOURCING OPTION Operating Expenses Direct Labor $0.0300 of Direct 50% Labor Benefits Direct Material Indirect Labor $0.0150 $0.0500 $0.0110 Benefits $0.0055 50% of Indirect Labor absorbed over 1,000,000 units Equipment Depreciation Overhead $0.0100 $10,000 $0.0300 absorbed over 1,000,000 units Engineering / design costs Total cost per unit $0.0300 $30,000 $0.1815 $ OUTSOURCING OPTION 1 Purchase Price Shipping and handling Inventory Charges $0.1000 $0.0100 $0.0050 per month, for months, over $20 36 1,000,000 units Administrative costs Total cost per unit $ 0.0007 $0.1157 $0.1157 Savings per unit Total savings $115,700 1,000,000 units a.) OUTSOURCING - New supplier Purchase Price Shipping and handling Inventory Charges per months, month, for over units Administrative costs Total cost per unit Savings per unit Total savings 1,000,000 units b.) INSOURCING -- Volume increases to 1.5 million units Operating Expenses Direct Labor $0.0300 Benefits $0.0150 50% Direct Material $0.0500 Indirect Labor $0.0110 Benefits $0.0055 50% absorbed Equipment Depreciation over Overhead $0.0300 absorbed Engineering / design costs over Total cost per unit units units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started