Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The ABC Corp. is in the 39% tax bracket and the interest on debt is 8.98 percent annually. Their preferred stock is currently selling at

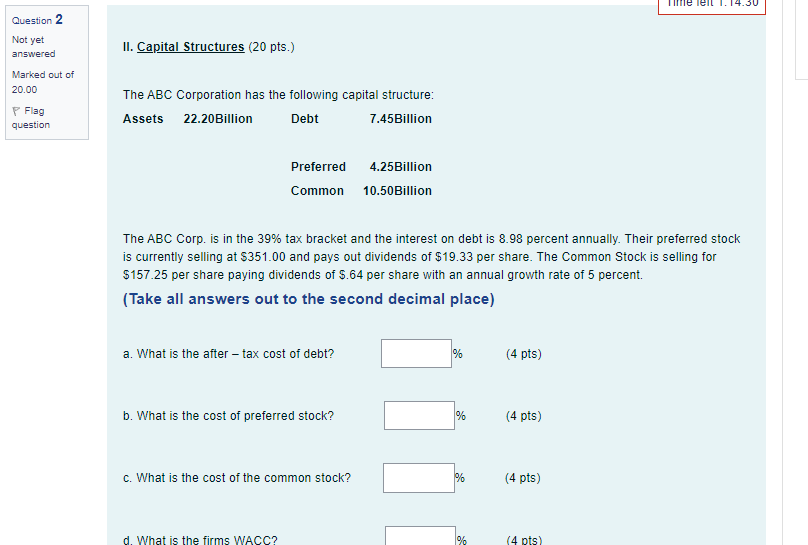

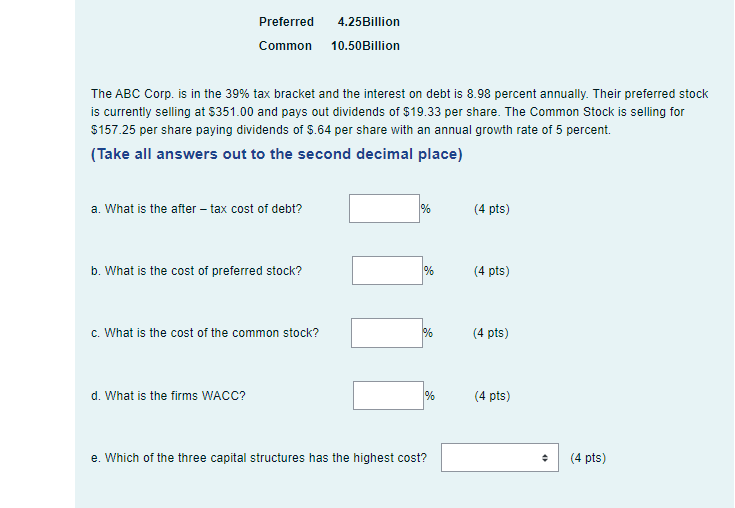

The ABC Corp. is in the 39% tax bracket and the interest on debt is 8.98 percent annually. Their preferred stock is currently selling at $351.00 and pays out dividends of $19.33 per share. The Common Stock is selling for $157.25 per share paying dividends of $.64 per share with an annual growth rate of 5 percent.

e options debt financing, common stock, preferred stock

me lell 1.14.30 Question 2 Not yet answered II. Capital Structures (20 pts.) Marked out of 20.00 Flag question The ABC Corporation has the following capital structure: Assets 22.20 Billion Debt 7.45Billion Preferred Common 4.25Billion 10.50 Billion The ABC Corp. is in the 39% tax bracket and the interest on debt is 8.98 percent annually. Their preferred stock is currently selling at $351.00 and pays out dividends of $19.33 per share. The Common Stock is selling for $157.25 per share paying dividends of $.64 per share with an annual growth rate of 5 percent. (Take all answers out to the second decimal place) a. What is the after tax cost of debt? % (4 pts) b. What is the cost of preferred stock? % (4 pts) c. What is the cost of the common stock? % (4 pts) d. What is the firms WACC? % (4 pts) 4.25 Billion Preferred Common 10.50 Billion The ABC Corp. is in the 39% tax bracket and the interest on debt is 8.98 percent annually. Their preferred stock is currently selling at $351.00 and pays out dividends of $19.33 per share. The Common Stock is selling for $157.25 per share paying dividends of $.64 per share with an annual growth rate of 5 percent. (Take all answers out to the second decimal place) a. What is the after tax cost of debt? % (4 pts) b. What is the cost of preferred stock? % (4 pts) c. What is the cost of the common stock? % (4 pts) d. What is the firms WACC? % (4 pts) e. Which of the three capital structures has the highest cost? (4 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started