Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The ABC general partnership is a newly formed venture in which the partners expect the first few years to produce losses. The written partnership

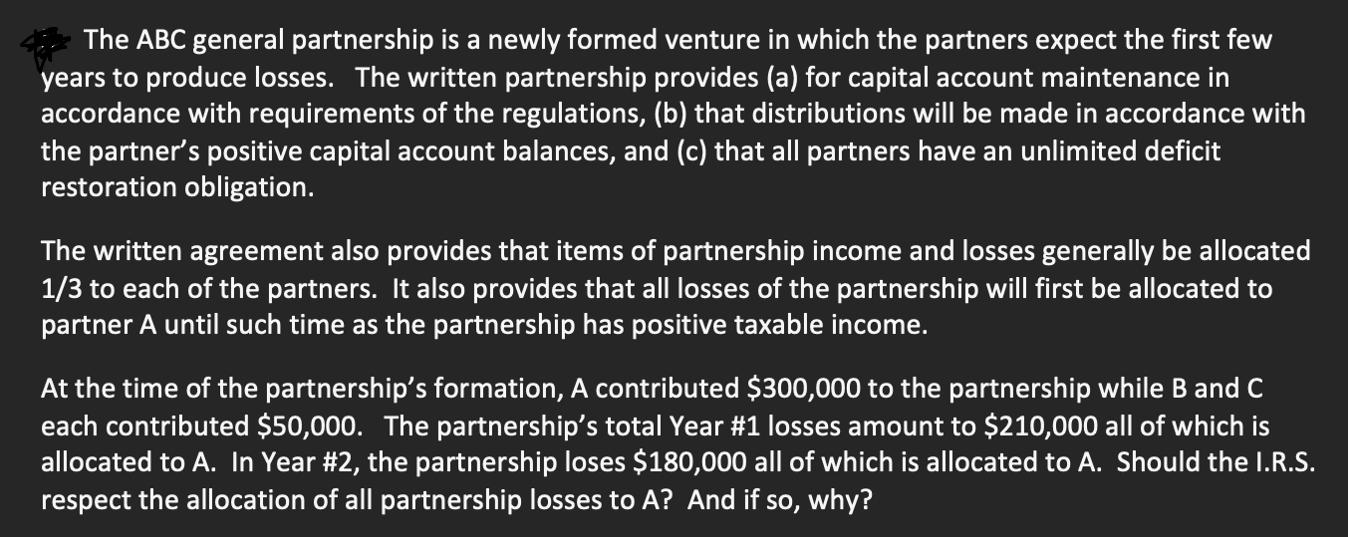

The ABC general partnership is a newly formed venture in which the partners expect the first few years to produce losses. The written partnership provides (a) for capital account maintenance in accordance with requirements of the regulations, (b) that distributions will be made in accordance with the partner's positive capital account balances, and (c) that all partners have an unlimited deficit restoration obligation. The written agreement also provides that items of partnership income and losses generally be allocated 1/3 to each of the partners. It also provides that all losses of the partnership will first be allocated to partner A until such time as the partnership has positive taxable income. At the time of the partnership's formation, A contributed $300,000 to the partnership while B and C each contributed $50,000. The partnership's total Year #1 losses amount to $210,000 all of which is allocated to A. In Year #2, the partnership loses L80,000 all of which is allocated to A. Should the I.R.S. respect the allocation of all partnership losses to A? And if so, why?

Step by Step Solution

★★★★★

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Yes the IRS should respect the allocation of all partnership losses to Partner A This is because the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started