Question

The ABC Oil Company is exposed to the fluctuations of the crude oil price. The risk profile of its net income for the current fiscal

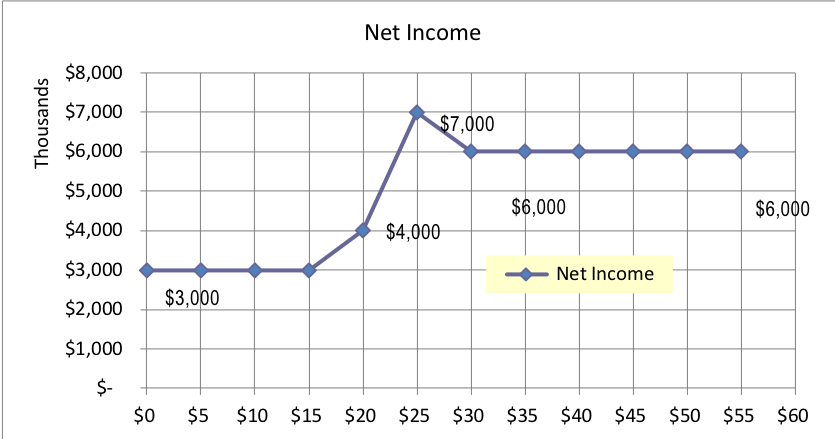

The ABC Oil Company is exposed to the fluctuations of the crude oil price. The risk profile of its net income for the current fiscal year as a function of the crude oil price (spot on March 15, 2001) is given in the graph. The company wishes to make its income independent of the crude oil price using the call options with various exercise prices. The contract size of the option is 1000 barrel of crude oil and the net income is in thousands.

A) What is the appropriate hedging strategy using call options?

B) What is the cash flow of the hedging strategy? Indicate whether or not the cash flows will be positive or negative for the ABC company.

C) What is the level of income with the hedging strategy?

Indicate your strategy?

The net cash flow required for the hedging?

Hedged income?

| Exercise Price | Option Premium | |

| Call Option #1 | $10/bbl | $11.00 |

| Call Option #2 | $15/bbl | $6.50 |

| Call Option #3 | $20/bbl | $5.00 |

| Call Option #4 | $25/bbl | $3.00 |

| Call Option #5 | $30/bbl | $1.00 |

| Call Option #6 | $35/bbl | $0.75 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started