Answered step by step

Verified Expert Solution

Question

1 Approved Answer

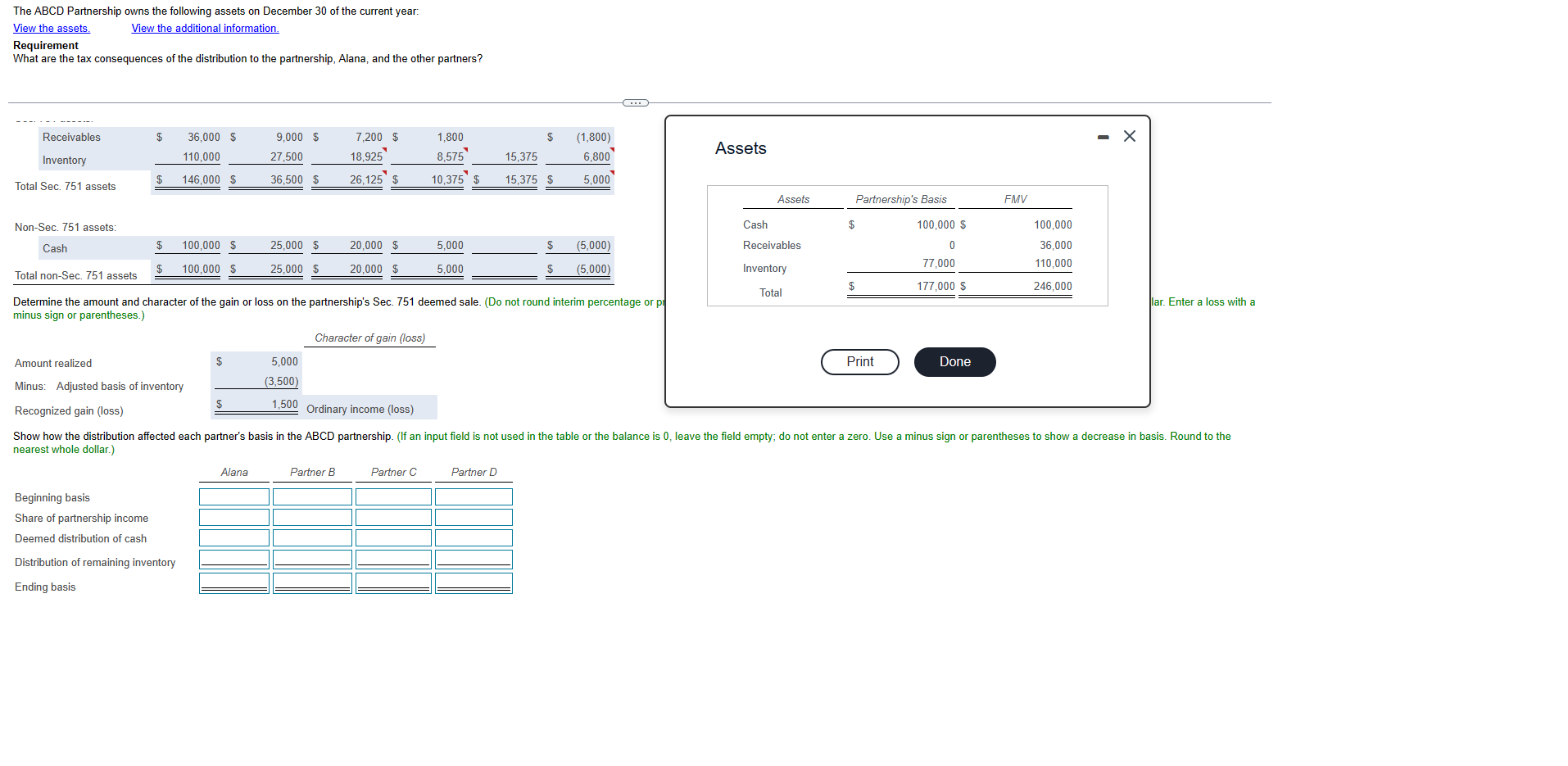

The ABCD Partnership owns the following assets on December 30 of the current year: Requirement What are the tax consequences of the distribution to the

The ABCD Partnership owns the following assets on December 30 of the current year: Requirement What are the tax consequences of the distribution to the partnership, Alana, and the other partners? Determine the amount and character of the gain or loss on the partnership's Sec. 751 deemed sale. (Do not round interim percentage or pi minus sign or parentheses.) Assets lar. Enter a loss with a

The ABCD Partnership owns the following assets on December 30 of the current year: Requirement What are the tax consequences of the distribution to the partnership, Alana, and the other partners? Determine the amount and character of the gain or loss on the partnership's Sec. 751 deemed sale. (Do not round interim percentage or pi minus sign or parentheses.) Assets lar. Enter a loss with a Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started