Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THE ABOVE ANSWER IS CORRENT. I just need help understanding what was done with the $1,600 pay increase. Would a journal entry not be needed

THE ABOVE ANSWER IS CORRENT. I just need help understanding what was done with the $1,600 pay increase. Would a journal entry not be needed in year 2? Why not?

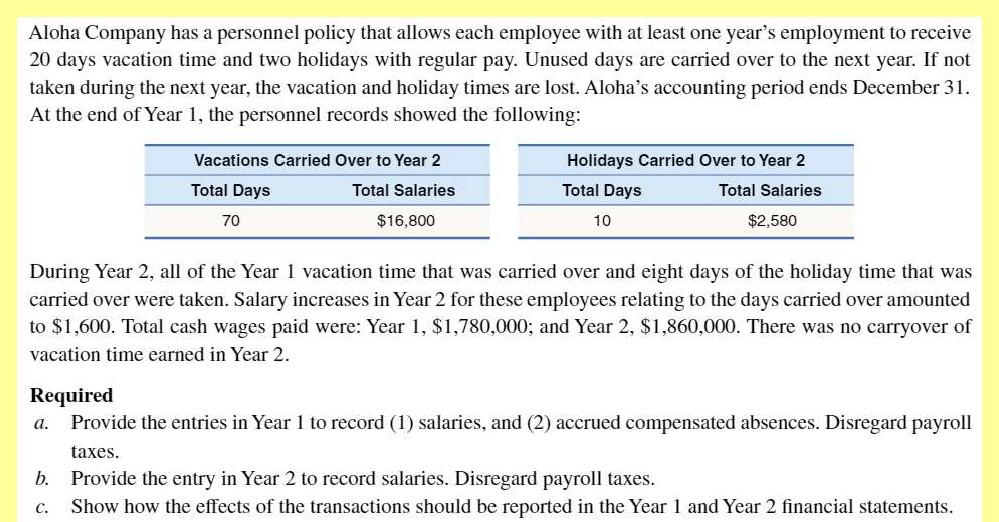

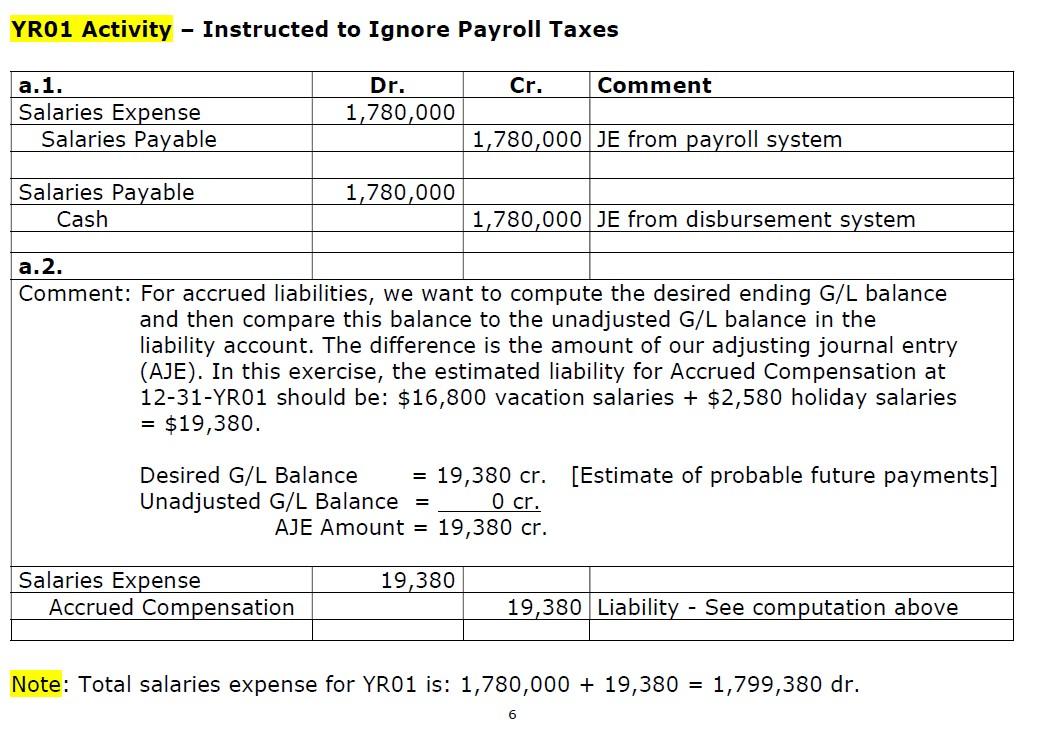

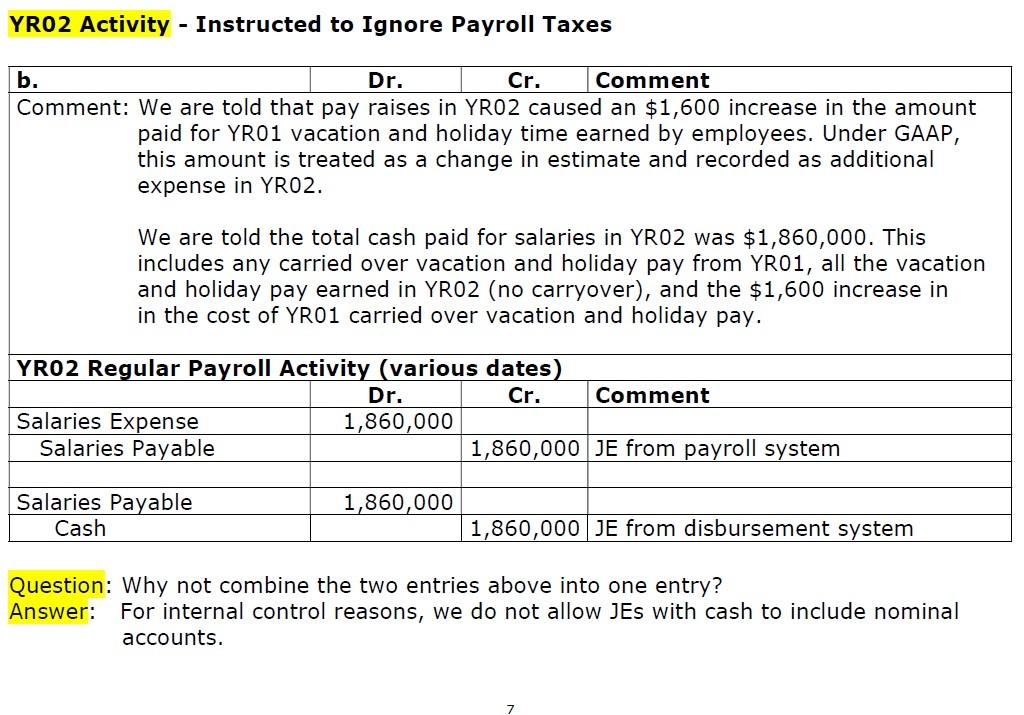

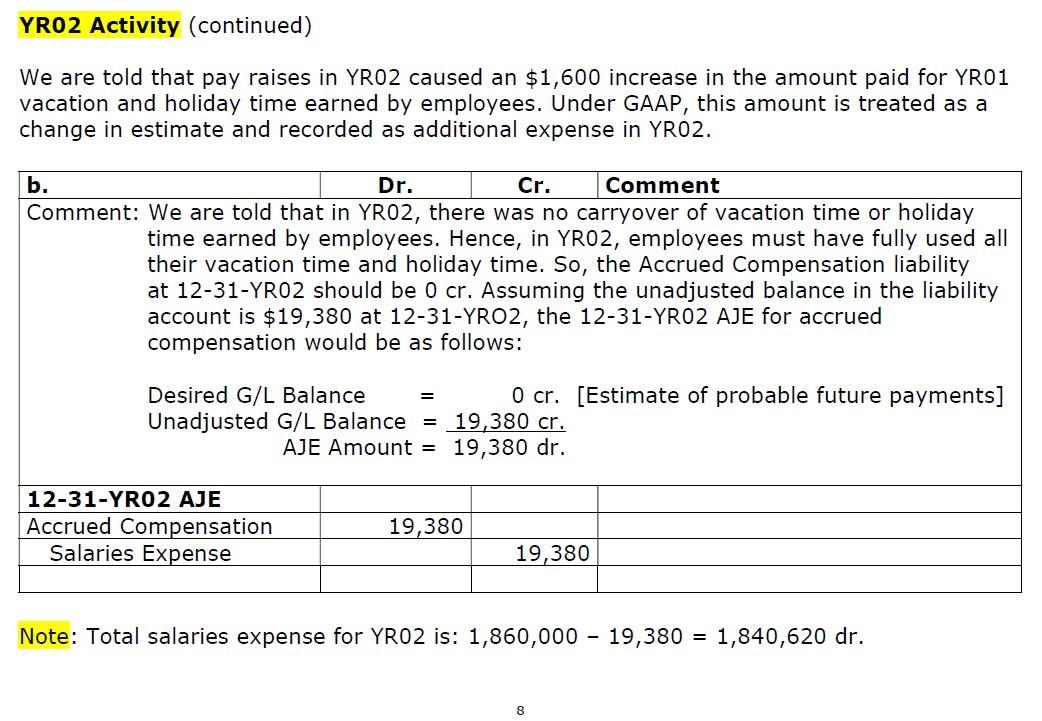

Aloha Company has a personnel policy that allows each employee with at least one year's employment to receive 20 days vacation time and two holidays with regular pay. Unused days are carried over to the next year. If not taken during the next year, the vacation and holiday times are lost. Aloha's accounting period ends December 31 . At the end of Year 1, the personnel records showed the following: During Year 2, all of the Year 1 vacation time that was carried over and eight days of the holiday time that was carried over were taken. Salary increases in Year 2 for these employees relating to the days carried over amounted to $1,600. Total cash wages paid were: Year 1,$1,780,000; and Year 2,$1,860,000. There was no carryover of vacation time earned in Year 2. Required a. Provide the entries in Year 1 to record (1) salaries, and (2) accrued compensated absences. Disregard payroll taxes. b. Provide the entry in Year 2 to record salaries. Disregard payroll taxes. c. Show how the effects of the transactions should be reported in the Year 1 and Year 2 financial statements. YR01 Activity - Instructed to Ignore Payroll Taxes Comment: For accrued liabilities, we want to compute the desired ending G/L balance and then compare this balance to the unadjusted G/L balance in the liability account. The difference is the amount of our adjusting journal entry (AJE). In this exercise, the estimated liability for Accrued Compensation at 1231YR01 should be: $16,800 vacation salaries +$2,580 holiday salaries =$19,380. Desired G/L Balance =19,380cr. [Estimate of probable future payments] Unadjusted G/L Balance =0cr. AJE Amount =19,380cr. Note: Total salaries expense for YR01 is: 1,780,000+19,380=1,799,380dr. YR02 Activity - Instructed to Ignore Payroll Taxes \begin{tabular}{|l|c|c|c|} \hline b. & Dr. & Cr. & Comment \\ \hline Comment: We are told that pay raises in YR02 caused an $1,600 increase in the amount \\ paid for YR01 vacation and holiday time earned by employees. Under GAAP, \\ this amount is treated as a change in estimate and recorded as additional \\ expense in YR02. \\ We are told the total cash paid for salaries in YR02 was $1,860,000. This \\ includes any carried over vacation and holiday pay from YR01, all the vacation \\ and holiday pay earned in YR02 (no carryover), and the $1,600 increase in \\ in the cost of YR01 carried over vacation and holiday pay. \end{tabular} Question: Why not combine the two entries above into one entry? Answer: For internal control reasons, we do not allow JEs with cash to include nominal accounts. YR02 Activity (continued) We are told that pay raises in YR02 caused an $1,600 increase in the amount paid for YR01 vacation and holiday time earned by employees. Under GAAP, this amount is treated as a change in estimate and recorded as additional expense in YRO2. Note: Total salaries expense for YR02 is: 1,860,00019,380=1,840,620dr. Aloha Company has a personnel policy that allows each employee with at least one year's employment to receive 20 days vacation time and two holidays with regular pay. Unused days are carried over to the next year. If not taken during the next year, the vacation and holiday times are lost. Aloha's accounting period ends December 31 . At the end of Year 1, the personnel records showed the following: During Year 2, all of the Year 1 vacation time that was carried over and eight days of the holiday time that was carried over were taken. Salary increases in Year 2 for these employees relating to the days carried over amounted to $1,600. Total cash wages paid were: Year 1,$1,780,000; and Year 2,$1,860,000. There was no carryover of vacation time earned in Year 2. Required a. Provide the entries in Year 1 to record (1) salaries, and (2) accrued compensated absences. Disregard payroll taxes. b. Provide the entry in Year 2 to record salaries. Disregard payroll taxes. c. Show how the effects of the transactions should be reported in the Year 1 and Year 2 financial statements. YR01 Activity - Instructed to Ignore Payroll Taxes Comment: For accrued liabilities, we want to compute the desired ending G/L balance and then compare this balance to the unadjusted G/L balance in the liability account. The difference is the amount of our adjusting journal entry (AJE). In this exercise, the estimated liability for Accrued Compensation at 1231YR01 should be: $16,800 vacation salaries +$2,580 holiday salaries =$19,380. Desired G/L Balance =19,380cr. [Estimate of probable future payments] Unadjusted G/L Balance =0cr. AJE Amount =19,380cr. Note: Total salaries expense for YR01 is: 1,780,000+19,380=1,799,380dr. YR02 Activity - Instructed to Ignore Payroll Taxes \begin{tabular}{|l|c|c|c|} \hline b. & Dr. & Cr. & Comment \\ \hline Comment: We are told that pay raises in YR02 caused an $1,600 increase in the amount \\ paid for YR01 vacation and holiday time earned by employees. Under GAAP, \\ this amount is treated as a change in estimate and recorded as additional \\ expense in YR02. \\ We are told the total cash paid for salaries in YR02 was $1,860,000. This \\ includes any carried over vacation and holiday pay from YR01, all the vacation \\ and holiday pay earned in YR02 (no carryover), and the $1,600 increase in \\ in the cost of YR01 carried over vacation and holiday pay. \end{tabular} Question: Why not combine the two entries above into one entry? Answer: For internal control reasons, we do not allow JEs with cash to include nominal accounts. YR02 Activity (continued) We are told that pay raises in YR02 caused an $1,600 increase in the amount paid for YR01 vacation and holiday time earned by employees. Under GAAP, this amount is treated as a change in estimate and recorded as additional expense in YRO2. Note: Total salaries expense for YR02 is: 1,860,00019,380=1,840,620drStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started