Question

The above chart reflects the inventory turnover for Coca Cola (in blue) and Pepsi Cola (in red) for 2014 through 2018. The inventory turnover is

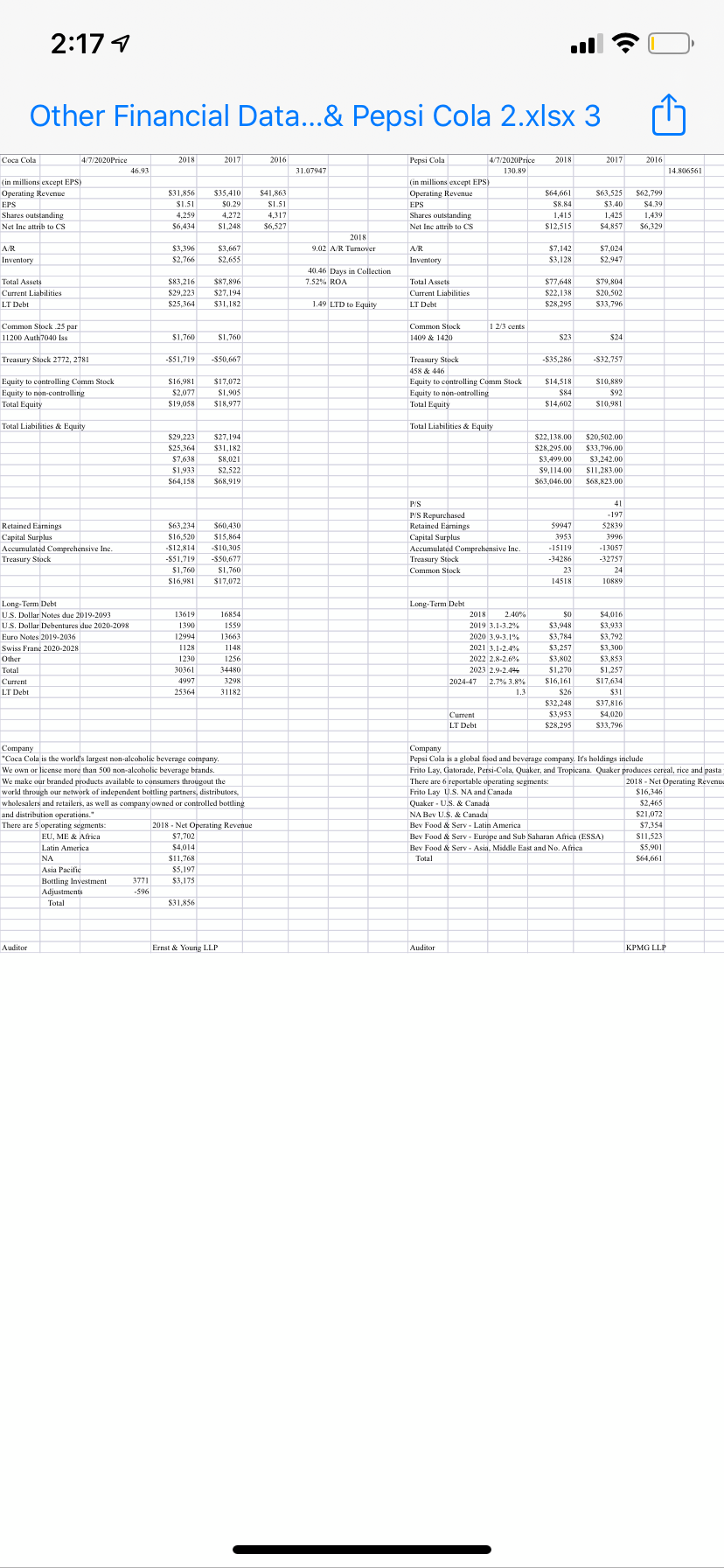

The above chart reflects the inventory turnover for Coca Cola (in blue) and Pepsi Cola (in red) for 2014 through 2018. The inventory turnover is calculated by dividing the cost of goods sold (or sales) by the average inventory. It is a measure of the speed at which inventory is sold. The ratio for Coca Cola fell between 5.61 in 2014 and 4.34 in 2018. The average inventory turnover value for Coca Cola over the five-year period was 5.33. The ratio of Pepsi Cola fell between 9.43 in 2014 and 9.67 in 2018. The average inventory turnover value for Pepsi Cola over the five-year period was 9.86. Pepsi Cola experienced an inventory turnover ratio that was 85% higher than that of Coca Cola.

The chart above reflects the days in inventory for Coca Cola (in blue) and Pepsi Cola (in red) for 2014 through 2018. The days in inventory is a measure of the number of days it takes to sell inventory. The number of days in inventory for Coca Cola fell between 65 days in 2014 and 84 days in 2018. The average number of days in inventory for Coca Cola over the five-year period was 69 days. The number of days in inventory for Pepsi Cola fell between 39 in 2014 and 38 in 2018. The average number of days in inventory for Pepsi Cola over the five-year period was 37 days.

The above chart reflects the accounts receivable turnover for Coca Cola (in blue) and Pepsi Cola (in red) for 2014 through 2018. The accounts receivable turnover is calculated by dividing net sales by the average accounts receivable. This ratio is a measure of the speed at which accounts receivable turn over. The ratio for Coca Cola fell between 9.85 in 2014 and 9.02 in 2018. The average accounts receivable turnover value for Coca Cola over the five-year period was 9.91. The ratio of Pepsi Cola fell between 11.12 in 2014 and 12.75 in 2018. The average inventory turnover value for Pepsi Cola over the five-year period was 11.02. Pepsi Cola experienced an inventory turnover ratio that was 11% higher than that of Coca Cola.

The chart above reflects the days in accounts receivable for Coca Cola (in blue) and Pepsi Cola (in red) for 2014 through 2018. The days in accounts receivable is a measure of the number of days it takes to collect accounts receivable. The number of days in accounts receivable for Coca Cola fell between 37.05 days in 2014 and 40.46 days in 2018. The average number of days in inventory for Coca Cola over the five-year period was 37 days. The number of days in accounts receivable for Pepsi Cola fell between 32.83 in 2014 and 33.97 in 2018. The average number of days in accounts receivable for Pepsi Cola over the five-year period was 33.13 days.

Coke: Tot Debt __+Tot EQ to Com. _______+ Tot EQ to non Cont______= TA $83,216

Pepsi : Tot Debt ________+Tot EQ to Com. _______+ Tot EQ to non Cont______= TA $77,648

Coke : FY2018 Current Debt = _______% of Total Debt, LTDebt = _______% of Total Debt.

Pepsi : FY2018 Current Debt = _______% of Total Debt, LTDebt = _______% of Total De

Which operating segment of Coca Cola generated the largest operating revenue in FY2018?

Which operating segment of Pepsi Cola generated the largest operating revenue in FY2018?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started