Question

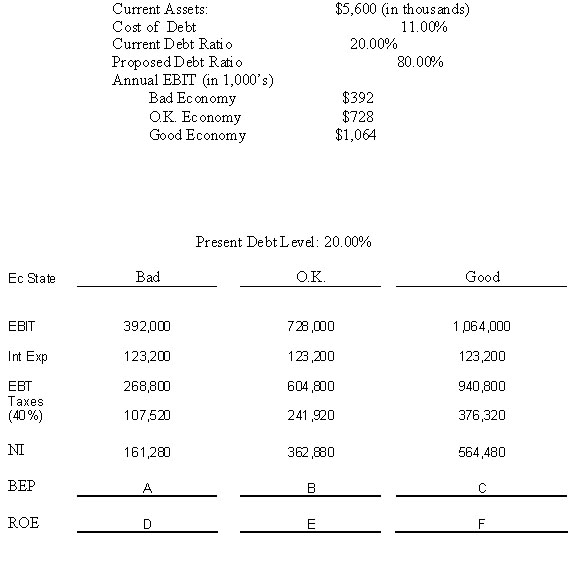

The above data describes certain features of Orfendi Ice Cream Inc., a small company that has developed a cult following as a sort of local

The above data describes certain features of Orfendi Ice Cream Inc., a small company that has developed a cult following as a sort of local Ben and Jerrys that supplies non-chain grocery stores and convenience stores with exotic ice cream flavors that can not be purchased elsewhere. It is a family owned company that has assets of $5.6 million and enjoys profits of around $362,000 per year. The core source of employment in the area is based on the aero space business which is highly cyclical but they have always managed to eke out a profit even in the worst of times. Recently a business consultant has advised them they are not getting the return on equity that might be expected from a firm of this kind and recommends that they increase their leverage. Below are data describing their current situation under different economic conditions. The scenario analysis follows.

In the tables above, the cell named 'A' should be? And D should be?

$5,600 in thous ands) Current Assets Cost of Debt Current Debt Rati o ProposedDebt Rati o Annual EBIT in 1,000's) 11.00% 20,00% 20.00% Bad Economy OK. Economy Good Econ S392 $728 $1,064 omy Present Debt Level: 20.00% Ec State Bad O.K Good EBIT 392,000 123,200 268,800 107,520 161,280 726,000 123,200 604 ,800 241 920 362 880 1 064,000 123,200 940,800 376,320 564,480 Int Exp EBT Taxes (40 %) NI BEP ROE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started