Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The account balances for perfect framing for the year ended August 31, 2018 are presented below in random order. net income for the year amounted

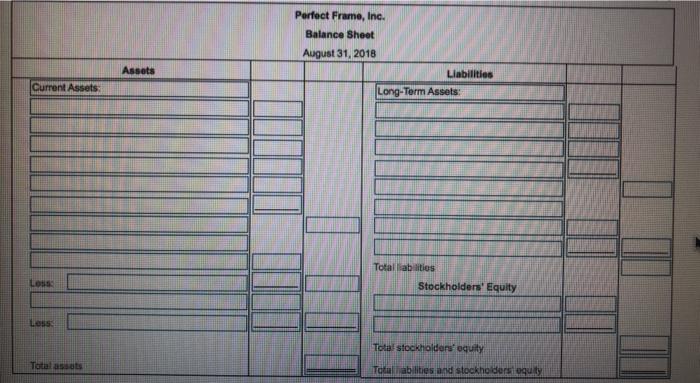

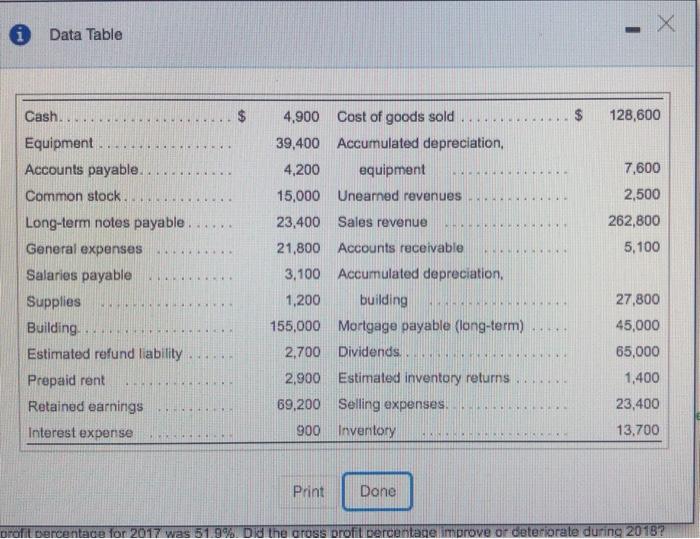

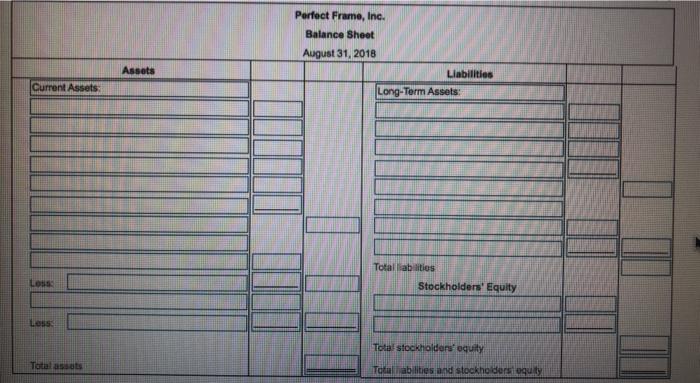

The account balances for perfect framing for the year ended August 31, 2018 are presented below in random order. net income for the year amounted to $89,250. 1. before we prepare the balance sheet let's determine the ending balance in the retained earnings account. Start by selecting the formula and then enter the amounts to calculate ending retained earnings. beginning retained earnings + ________ - _____ = end returnings. ______ + ______ - ______ = _____ 2. prepare the classified balance sheet start by completing the asset portion of the statement and then complete the liabilities and stockholders equity sections of the statement.

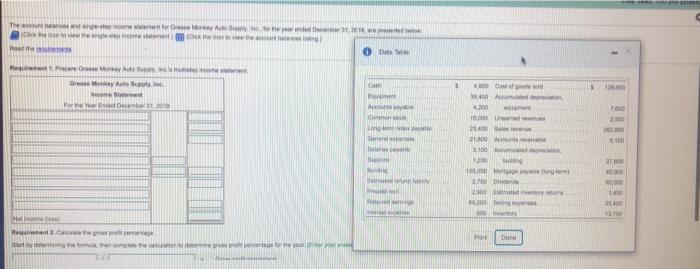

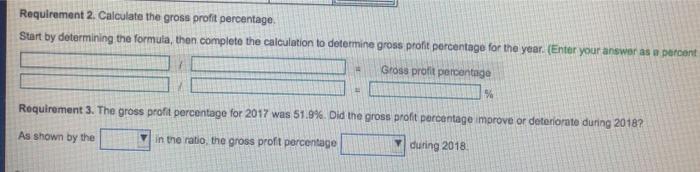

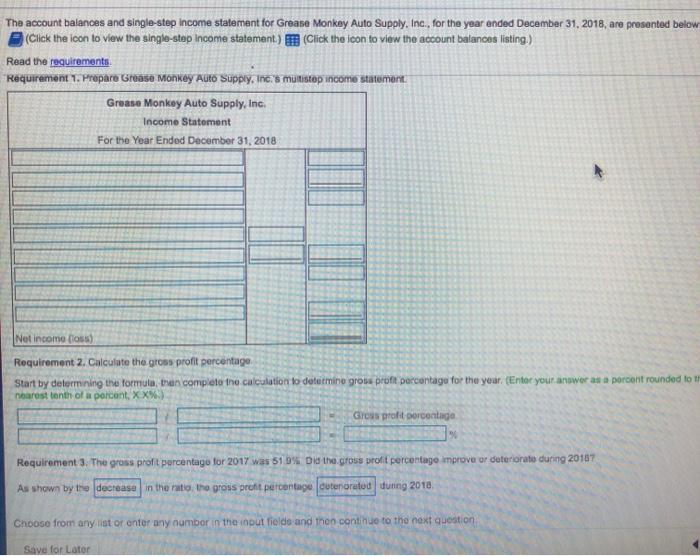

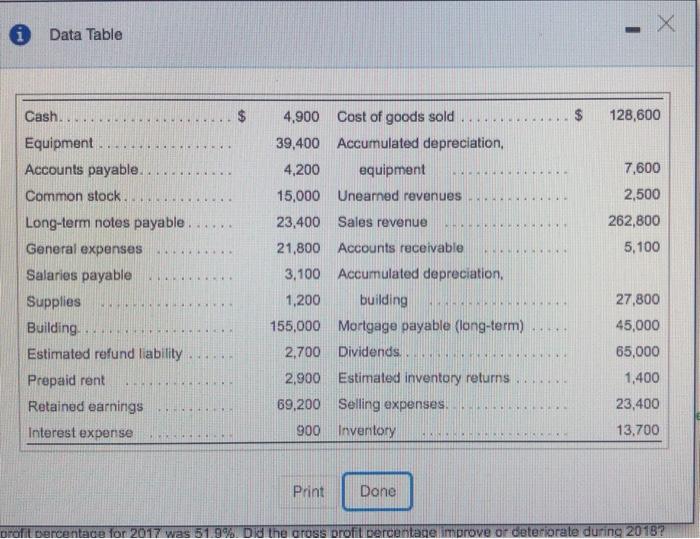

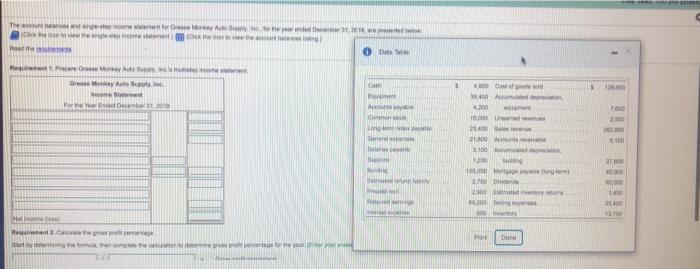

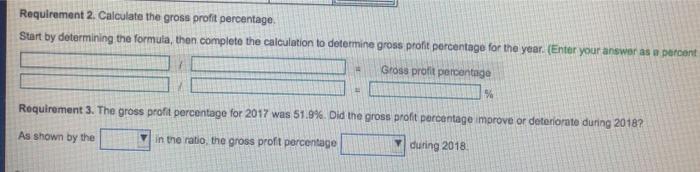

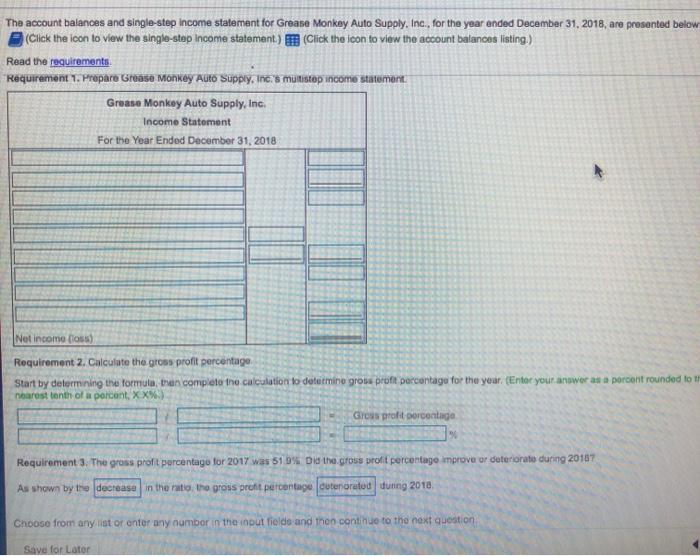

The account balances for perfect framing for the year ended August 31, 2018 are presented below in random order. net income for the year amounted to $89,250. 1. before we prepare the balance sheet let's determine the ending balance in the retained earnings account. Start by selecting the formula and then enter the amounts to calculate ending retained earnings. beginning retained earnings + ________ - _____ = end returnings. ______ + ______ - ______ = _____ 2. prepare the classified balance sheet start by completing the asset portion of the statement and then complete the liabilities and stockholders equity sections of the statement.  The age M mm 0 0 NA A poly Go $ 00 Od W.400A Porte AC . 100 201400 21.00 100 200 5100 die ORIE DOU 300 100 20 D 20 200 COFLE 00 Net Header dem w D Requirement 2. Calculate the gross profit percentage. Start by determining the formula, then complete the calculation to determine gross profit percentage for the year. (Enter your answer as a percent Gross profit percentage % Requirement 3. The gross profit percentage for 2017 was 51.9%. Did the gross profit percentage improve or deteriorate during 2018? As shown by the in the ratio, the gross proft percentage duting 2018 The account balances and single-step income statement for Grease Monkey Auto Supply, Inc., for the year ended December 31, 2018, are presented below Click the icon to view the single-step Income statement) Click the icon to view the account balances listing.) Read the requirements Requirement 1. Prepare Grease Monkey Auto Supply, Inc.'s munistop income statement Grease Monkey Auto Supply, Inc. Income Statement For the Year Ended December 31, 2018 Net Income os) Requirement 2. Calculate the gross profit percentage Start by determining the formula, tran complete the calculation to detutmine gross profit percentage for the year. (Enter your answer as a porcent rounded to nearest tenth of a porcent, XX%) Gross profit porcentage Requirement 3. The gross profit percentage for 2017 was 51 % Did the gross profit percentago improve or deteriorate during 20187 As shown by the decrease in the ratio the gross profit percentage outerorated during 2018 Choose from any list or enter any number in the input fields and then continue to the next question Save for Lator i Data Table $ $ 128,600 7,600 2,500 262,800 5,100 .. Cash.... Equipment Accounts payable.. Common stock Long-term notes payable. General expenses Salaries payable Supplies Building Estimated refund liability Prepaid rent Retained earnings ... 4,900 Cost of goods sold 39,400 Accumulated depreciation, 4,200 equipment 15,000 Unearned revenues 23,400 Sales revenue 21,800 Accounts receivable 3,100 Accumulated depreciation, 1,200 building 155,000 Mortgage payable (long-term) 2,700 Dividends, 2,900 Estimated inventory returns 69,200 Selling expenses, 900 Inventory 14 -- ++++ +++ 27,800 45,000 65,000 1,400 23,400 13,700 + +++ Interest expense Print Done urolitercentade for 2017 was 51 94 Did the gross profil percentage improve or deteriorate during 2018? Perfect Frame, Inc. Balance Sheet August 31, 2018 Liabilities Long-Term Assets Assets Current Assets Lots Total liabilities Stockholders' Equity Less Total stockholders' equity Total asets Total abilities and stockholders equity

The age M mm 0 0 NA A poly Go $ 00 Od W.400A Porte AC . 100 201400 21.00 100 200 5100 die ORIE DOU 300 100 20 D 20 200 COFLE 00 Net Header dem w D Requirement 2. Calculate the gross profit percentage. Start by determining the formula, then complete the calculation to determine gross profit percentage for the year. (Enter your answer as a percent Gross profit percentage % Requirement 3. The gross profit percentage for 2017 was 51.9%. Did the gross profit percentage improve or deteriorate during 2018? As shown by the in the ratio, the gross proft percentage duting 2018 The account balances and single-step income statement for Grease Monkey Auto Supply, Inc., for the year ended December 31, 2018, are presented below Click the icon to view the single-step Income statement) Click the icon to view the account balances listing.) Read the requirements Requirement 1. Prepare Grease Monkey Auto Supply, Inc.'s munistop income statement Grease Monkey Auto Supply, Inc. Income Statement For the Year Ended December 31, 2018 Net Income os) Requirement 2. Calculate the gross profit percentage Start by determining the formula, tran complete the calculation to detutmine gross profit percentage for the year. (Enter your answer as a porcent rounded to nearest tenth of a porcent, XX%) Gross profit porcentage Requirement 3. The gross profit percentage for 2017 was 51 % Did the gross profit percentago improve or deteriorate during 20187 As shown by the decrease in the ratio the gross profit percentage outerorated during 2018 Choose from any list or enter any number in the input fields and then continue to the next question Save for Lator i Data Table $ $ 128,600 7,600 2,500 262,800 5,100 .. Cash.... Equipment Accounts payable.. Common stock Long-term notes payable. General expenses Salaries payable Supplies Building Estimated refund liability Prepaid rent Retained earnings ... 4,900 Cost of goods sold 39,400 Accumulated depreciation, 4,200 equipment 15,000 Unearned revenues 23,400 Sales revenue 21,800 Accounts receivable 3,100 Accumulated depreciation, 1,200 building 155,000 Mortgage payable (long-term) 2,700 Dividends, 2,900 Estimated inventory returns 69,200 Selling expenses, 900 Inventory 14 -- ++++ +++ 27,800 45,000 65,000 1,400 23,400 13,700 + +++ Interest expense Print Done urolitercentade for 2017 was 51 94 Did the gross profil percentage improve or deteriorate during 2018? Perfect Frame, Inc. Balance Sheet August 31, 2018 Liabilities Long-Term Assets Assets Current Assets Lots Total liabilities Stockholders' Equity Less Total stockholders' equity Total asets Total abilities and stockholders equity

net income for the year amounted to $89,250.

1. before we prepare the balance sheet let's determine the ending balance in the retained earnings account. Start by selecting the formula and then enter the amounts to calculate ending retained earnings.

beginning retained earnings + ________ - _____ = end returnings.

______ + ______ - ______ = _____

2. prepare the classified balance sheet start by completing the asset portion of the statement and then complete the liabilities and stockholders equity sections of the statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started