Question

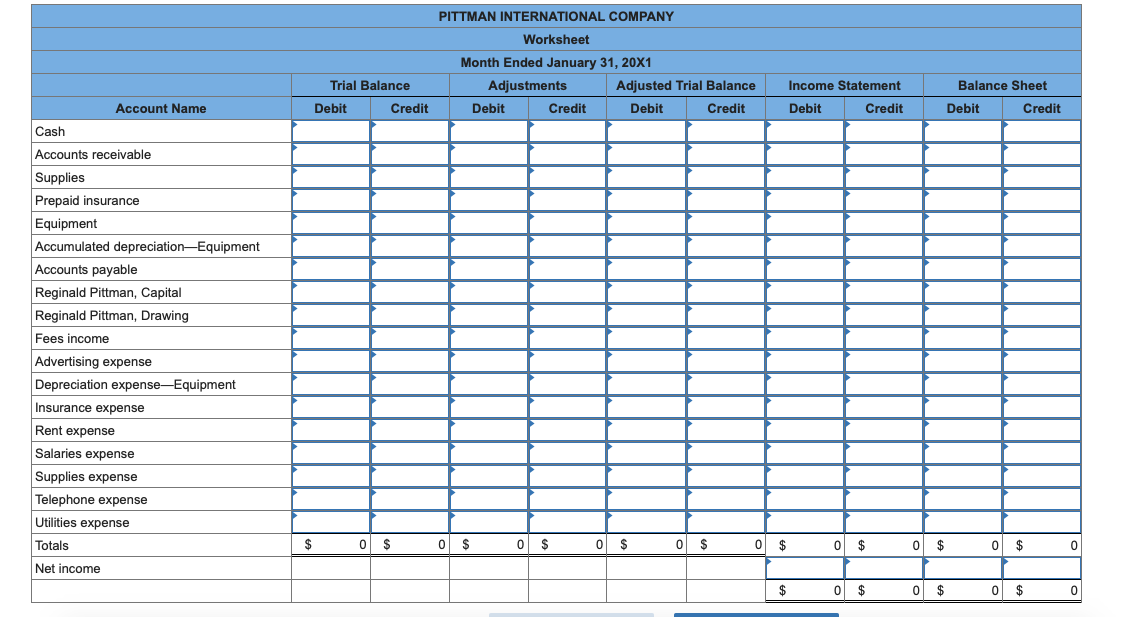

The account balances for the Pittman International Company on January 31, 20X1, follow. The balances shown are after the first month of operations. 101 Cash

The account balances for the Pittman International Company on January 31, 20X1, follow. The balances shown are after the first month of operations.

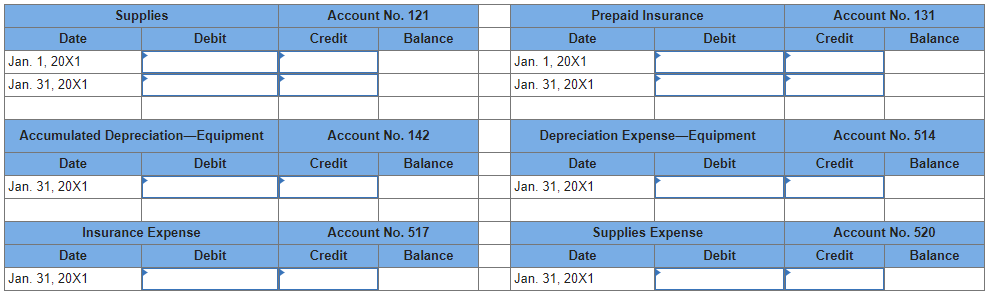

| 101 | Cash | $ | 18,515 | 401 | Fees income | $ | 31,065 | ||||

| 111 | Accounts receivable | 3,400 | 511 | Advertising expense | 1,520 | ||||||

| 121 | Supplies | 2,180 | 514 | Depreciation expenseEquipment | 0 | ||||||

| 131 | Prepaid insurance | 15,150 | 517 | Insurance expense | 0 | ||||||

| 141 | Equipment | 24,500 | 518 | Rent expense | 2,500 | ||||||

| 142 | Accumulated depreciationEquipment | 0 | 519 | Salaries expense | 6,740 | ||||||

| 202 | Accounts payable | 6,050 | 520 | Supplies expense | 0 | ||||||

| 301 | Reginald Pittman, Capital | 40,650 | 523 | Telephone expense | 350 | ||||||

| 302 | Reginald Pittman, Drawing | 2,050 | 524 | Utilities expense | 860 | ||||||

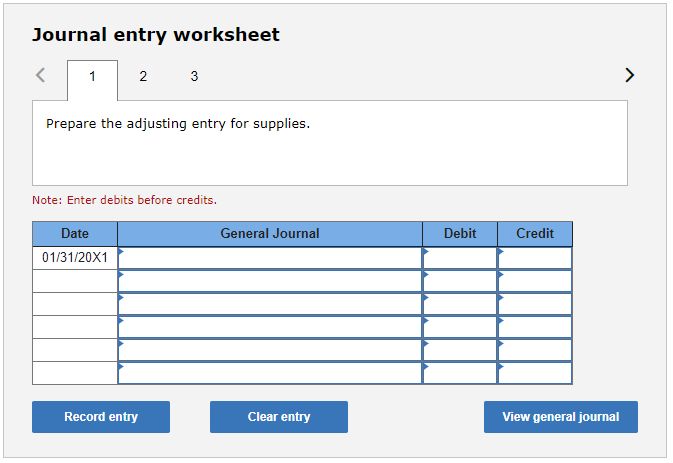

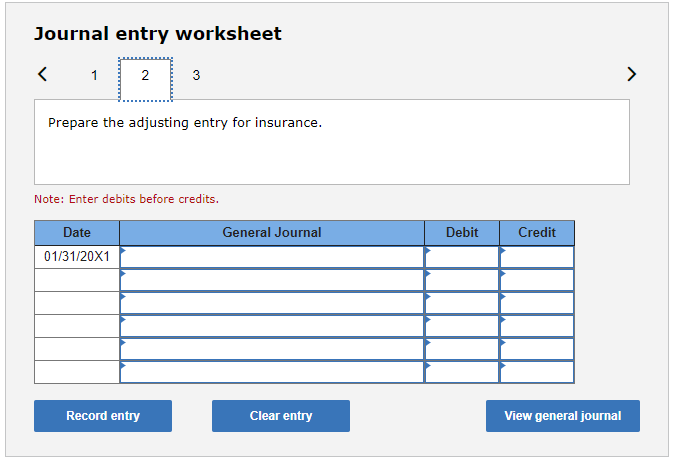

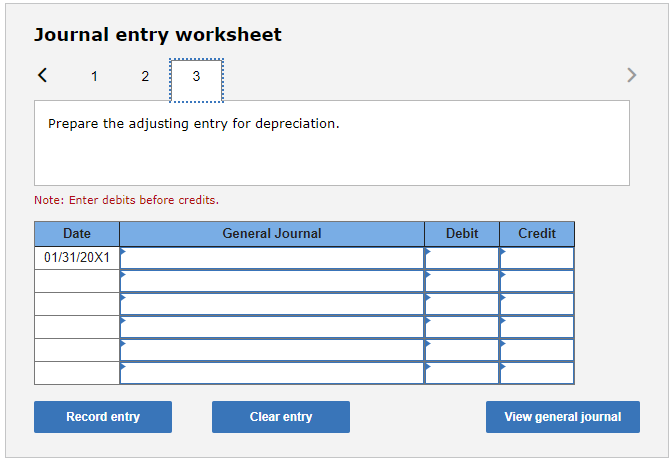

Adjustments:

Supplies used during the month amounted to $1,065.

The amount in the Prepaid Insurance account represents a payment made on January 1, 20X1, for 6 months of insurance coverage.

The equipment, purchased on January 1, 20X1, has an estimated useful life of 10 years with no salvage value. The firm uses the straight-line method of depreciation.

Required:

Complete the worksheet.

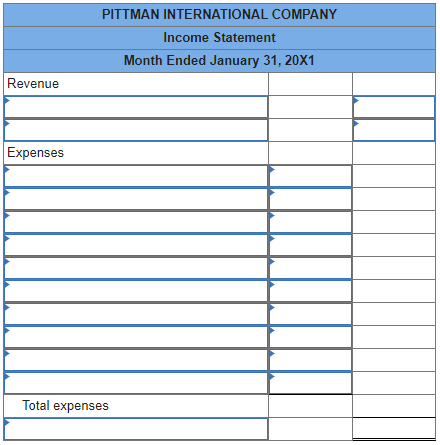

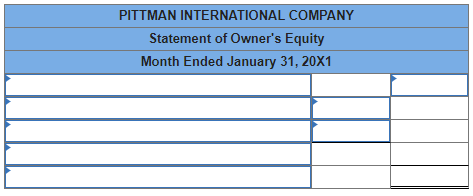

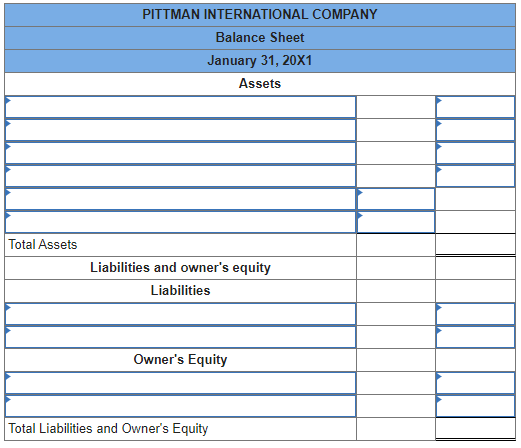

Prepare an income statement, statement of owners equity, and balance sheet.

Record the balances in the selected general ledger accounts, then journalize and post the adjusting entries.

Analyze:

If the useful life of the equipment had been 12 years instead of 10 years, how would net income have been affected?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started