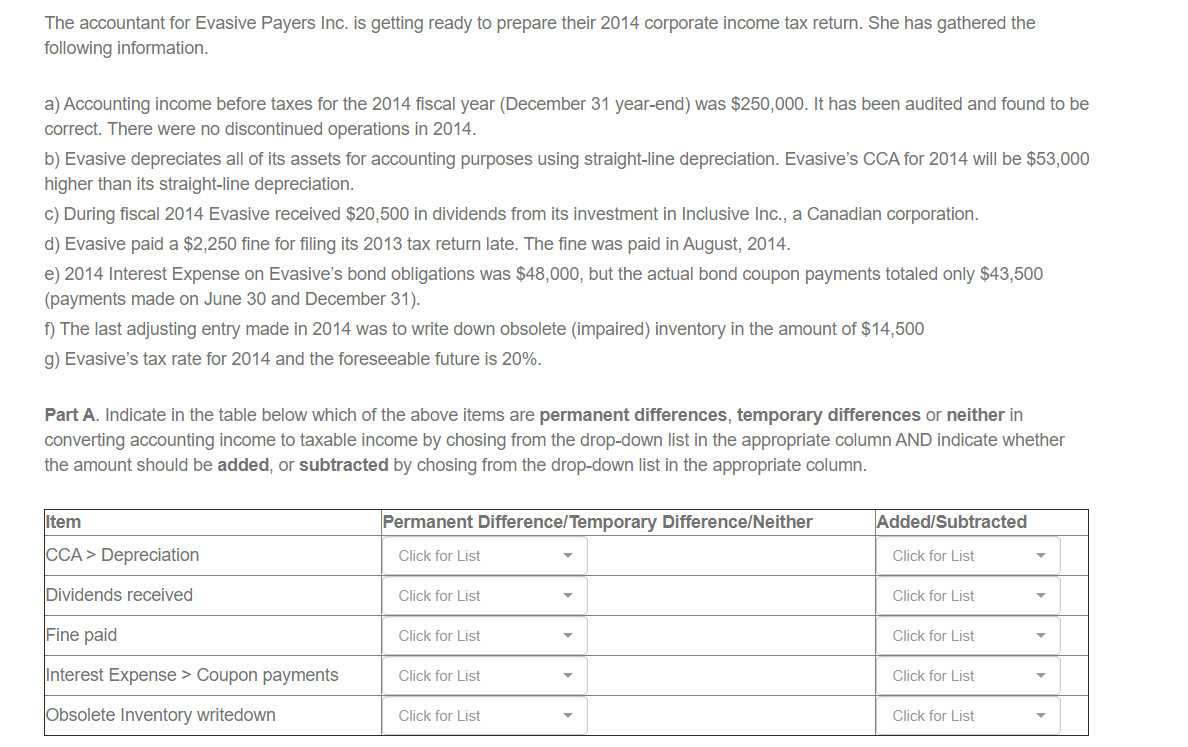

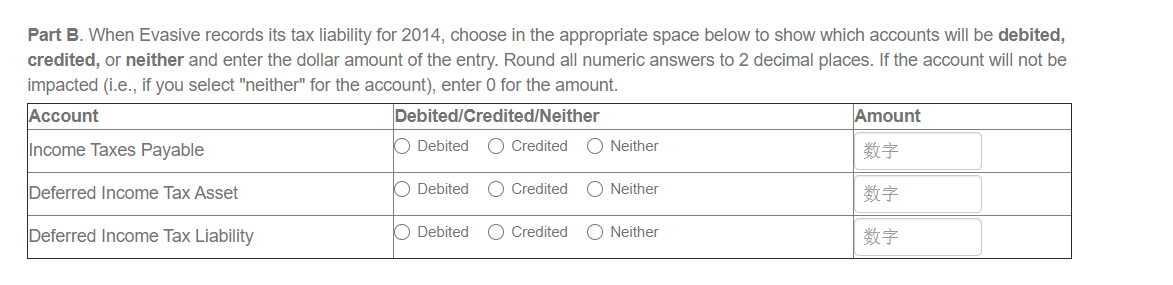

The accountant for Evasive Payers Inc. is getting ready to prepare their 2014 corporate income tax return. She has gathered the following information. a) Accounting income before taxes for the 2014 fiscal year (December 31 year-end) was $250,000. It has been audited and found to be correct. There were no discontinued operations in 2014. b) Evasive depreciates all of its assets for accounting purposes using straight-line depreciation. Evasive's CCA for 2014 will be $53,000 higher than its straight-line depreciation. c) During fiscal 2014 Evasive received $20,500 in dividends from its investment in Inclusive Inc., a Canadian corporation. d) Evasive paid a $2,250 fine for filing its 2013 tax return late. The fine was paid in August, 2014. e) 2014 Interest Expense on Evasive's bond obligations was $48,000, but the actual bond coupon payments totaled only $43,500 (payments made on June 30 and December 31). f) The last adjusting entry made in 2014 was to write down obsolete (impaired) inventory in the amount of $14,500 g) Evasive's tax rate for 2014 and the foreseeable future is 20%. Part A. Indicate in the table below which of the above items are permanent differences, temporary differences or neither in converting accounting income to taxable income by chosing from the drop-down list in the appropriate column AND indicate whether the amount should be added, or subtracted by chosing from the drop-down list in the appropriate column. Item Permanent Difference/Temporary Difference/Neither Added/Subtracted CCA > Depreciation Click for List Click for List Dividends received Click for List Click for List Fine paid Click for List Click for List Interest Expense > Coupon payments Click for List Click for List Obsolete Inventory writedown Click for List Click for List Part B. When Evasive records its tax liability for 2014, choose in the appropriate space below to show which accounts will be debited, credited, or neither and enter the dollar amount of the entry. Round all numeric answers to 2 decimal places. If the account will not be impacted (i.e., if you select "neither" for the account), enter 0 for the amount. Account Debited/Credited/Neither Amount Income Taxes Payable O Debited O Credited ONeither Deferred Income Tax Asset O Debited O Credited O Neither Deferred Income Tax Liability O Debited O Credited ONeither