Question

The accountant for Sea to Sky Corp. has developed the following 2021 information for the company's defined benefit pension plan: Unrecognized past service costs, as

The accountant for Sea to Sky Corp. has developed the following 2021 information for the company's defined benefit pension plan:

Unrecognized past service costs, as at Dec. 31, 2020 $300,000dr

Expected average remaining service life – past service employees 6 yrs

Benefits paid to retirees, paid out evenly over 2021 $80,000

Opening Accrued benefit obligation (ABO), per books, Dec. 31, 2020 $5,000,000cr

Current service cost, earned at end of year $220,000

Cash contribution to the plan, made November 30, 2021 $950,000

Expected rate of return on plan assets 4.0%

Discount rate for ABO 5.0%

Other pension detail/ information:

ABO info:

The Accumulated Pension Obligation (ABO) liability was determined by an actuary to be $5,582,917cr at the year end on December 31, 2021.

Assume that Sea to Sky amortizes any actuarial (experience) net gains or losses on the PA or ABO to Other Comprehensive Income (OCI) in the year they occur.

PA info:

The opening market value of the Plan Assets (PA) back on Dec. 31, 2020 was $4,900,000dr.

The pension plan assets had a market value of $5,342,000dr at the end of the year on December 31, 2021.

Required:

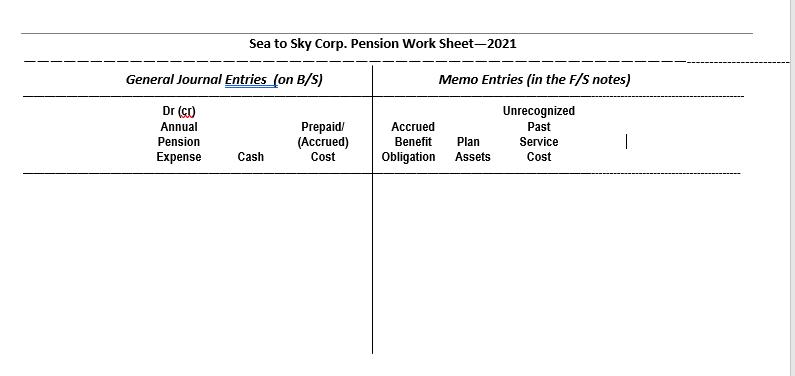

- Using the above information for Sea to Sky Corp., prepare a completed pension worksheet for 2021 on the NEXT page. Please indicate credit entries either by parentheses “( )” or by “dr” and “cr”.

- Provide prepare the pension journal entry below (AFTER completing pension worksheet on the following page):

Sea to Sky Corp. Pension Work Sheet-2021 General Journal Entries_(on B/S) Dr (Cr) Annual Pension Expense Cash Prepaid/ (Accrued) Cost Memo Entries (in the F/S notes) Unrecognized Past Accrued Plan Benefit Obligation Assets Service Cost |

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Using above Informat for 2021 Puzx Service 6 Cost Cost Car Contributi Pensim Benefit Paid Dec ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started