Answered step by step

Verified Expert Solution

Question

1 Approved Answer

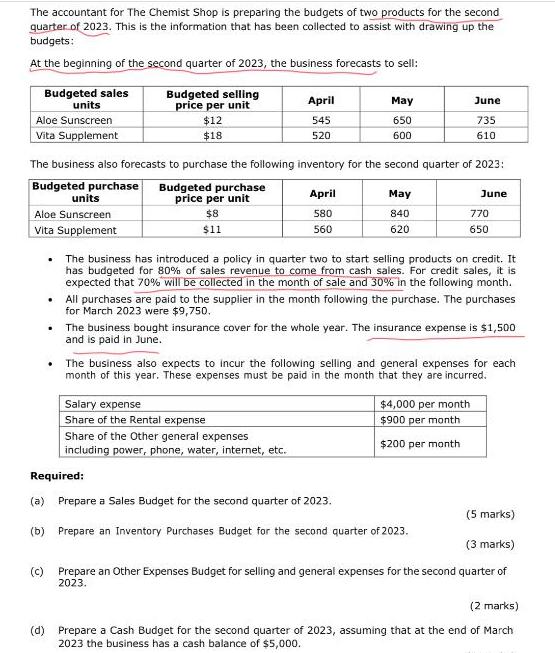

The accountant for The Chemist Shop is preparing the budgets of two products for the second quarter of 2023. This is the information that

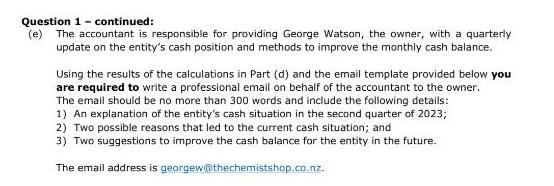

The accountant for The Chemist Shop is preparing the budgets of two products for the second quarter of 2023. This is the information that has been collected to assist with drawing up the budgets: At the beginning of the second quarter of 2023, the business forecasts to sell: Budgeted sales units Aloe Sunscreen Vita Supplement units Aloe Sunscreen Vita Supplement Budgeted selling price per unit . $12 $18 April 545 520 The business also forecasts to purchase the following inventory for the second quarter of 2023: Budgeted purchase Budgeted purchase price per unit $8 $11 May 650 600 April 580 560 May 840 620 Salary expense Share of the Rental expense Share of the Other general expenses including power, phone, water, internet, etc. June 735 610 The business has introduced a policy in quarter two to start selling products on credit. It has budgeted for 80% of sales revenue to come from cash sales. For credit sales, it is expected that 70% will be collected in the month of sale and 30% in the following month. June 770 650 All purchases are paid to the supplier in the month following the purchase. The purchases for March 2023 were $9,750. The business bought insurance cover for the whole year. The insurance expense is $1,500 and is paid in June. The business also expects to incur the following selling and general expenses for each month of this year. These expenses must be paid in the month that they are incurred. $4,000 per month $900 per month $200 per month Required: (a) Prepare a Sales Budget for the second quarter of 2023. (b) Prepare an Inventory Purchases Budget for the second quarter of 2023. (5 marks) (3 marks) (c) Prepare an Other Expenses Budget for selling and general expenses for the second quarter of 2023. (2 marks) (d) Prepare a Cash Budget for the second quarter of 2023, assuming that at the end of March 2023 the business has a cash balance of $5,000. Question 1 - continued: (e) The accountant is responsible for providing George Watson, the owner, with a quarterly update on the entity's cash position and methods to improve the monthly cash balance. Using the results of the calculations in Part (d) and the email template provided below you are required to write a professional email on behalf of the accountant to the owner. The email should be no more than 300 words and include the following details: 1) An explanation of the entity's cash situation in the second quarter of 2023; 2) Two possible reasons that led to the current cash situation; and 3) Two suggestions to improve the cash balance for the entity in the future. The email address is georgew@thechemistshop.co.nz.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started