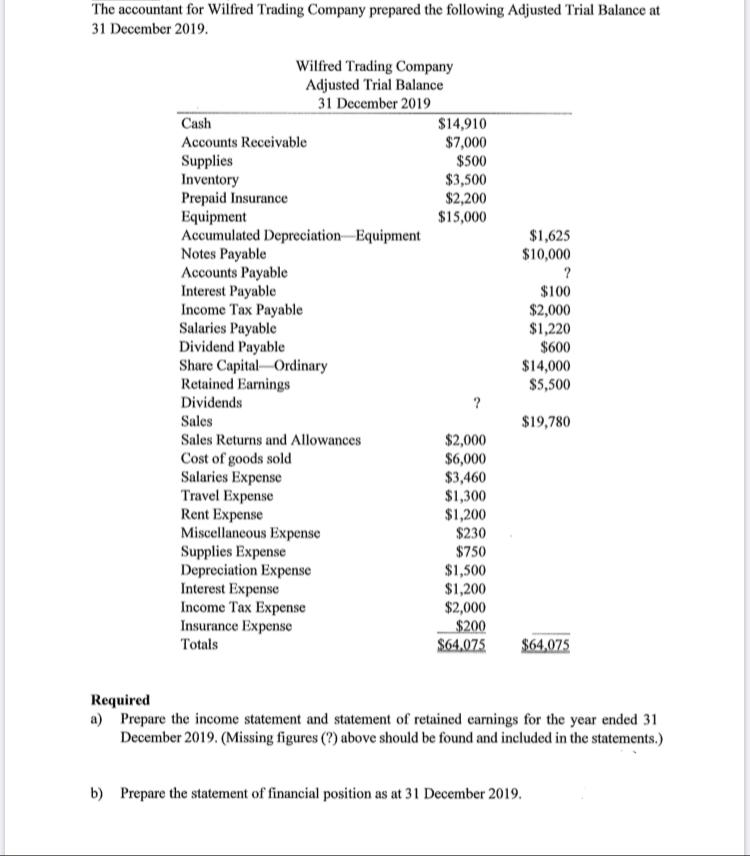

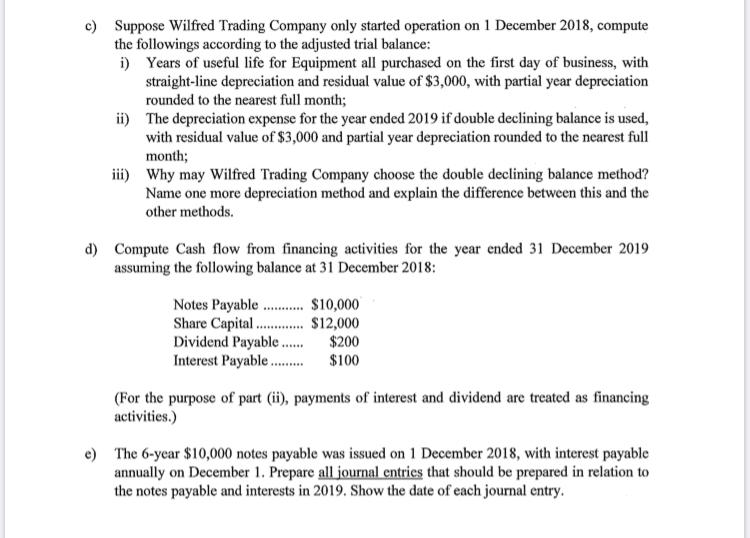

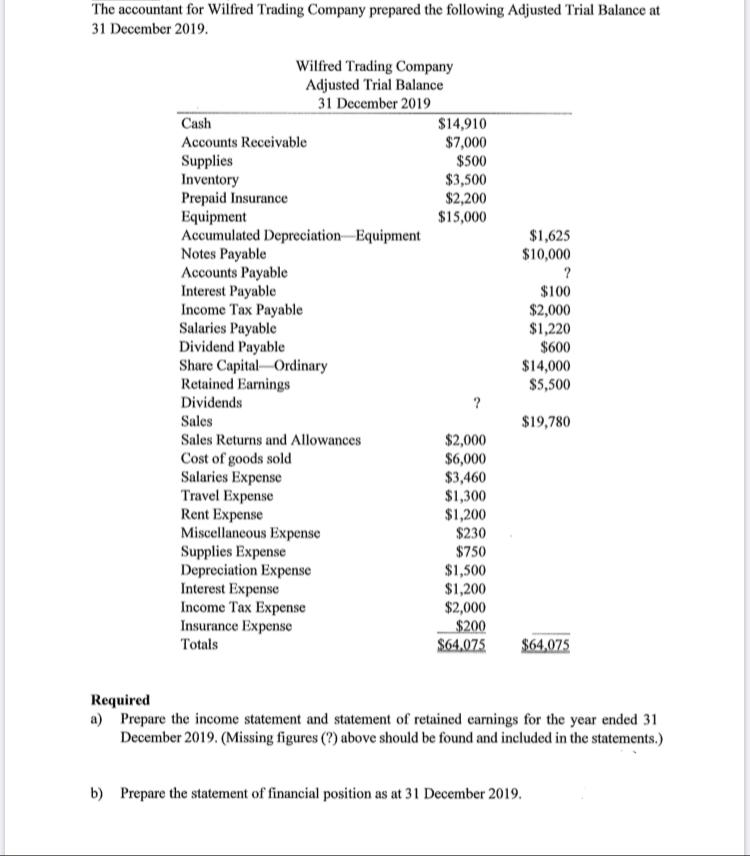

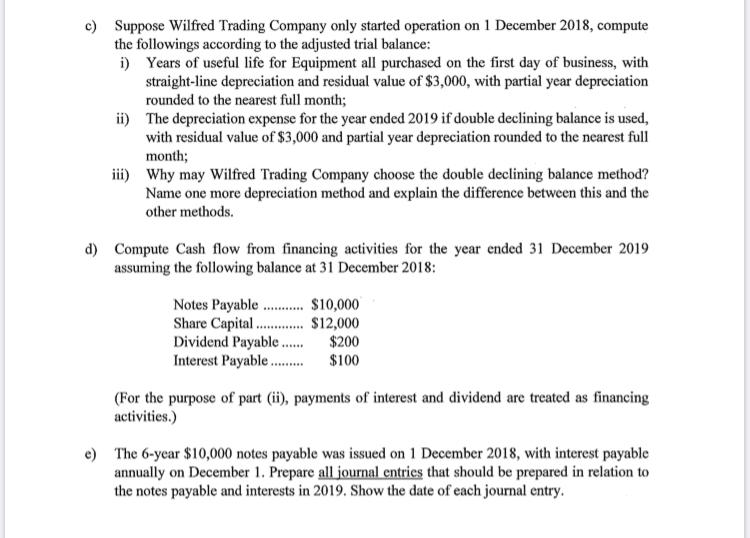

The accountant for Wilfred Trading Company prepared the following Adjusted Trial Balance at 31 December 2019. $1,625 $10,000 Wilfred Trading Company Adjusted Trial Balance 31 December 2019 Cash $14,910 Accounts Receivable $7,000 Supplies $500 Inventory $3,500 Prepaid Insurance $2,200 Equipment $15,000 Accumulated Depreciation Equipment Notes Payable Accounts Payable Interest Payable Income Tax Payable Salaries Payable Dividend Payable Share Capital Ordinary Retained Earnings Dividends Sales Sales Returns and Allowances $2,000 Cost of goods sold $6,000 Salaries Expense $3,460 Travel Expense $1,300 Rent Expense $1,200 Miscellaneous Expense $230 Supplies Expense $750 Depreciation Expense $1,500 Interest Expense $1,200 Income Tax Expense $2,000 Insurance Expense $200 Totals $64,075 $100 $2,000 $1,220 $600 $14,000 $5,500 $19.780 $64.075 Required a) Prepare the income statement and statement of retained earnings for the year ended 31 December 2019. (Missing figures (?) above should be found and included in the statements.) b) Prepare the statement of financial position as at 31 December 2019. c) ii) Suppose Wilfred Trading Company only started operation on 1 December 2018, compute the followings according to the adjusted trial balance: i) Years of useful life for Equipment all purchased on the first day of business, with straight-line depreciation and residual value of $3,000, with partial year depreciation rounded to the nearest full month; The depreciation expense for the year ended 2019 if double declining balance is used, with residual value of $3,000 and partial year depreciation rounded to the nearest full month; Why may Wilfred Trading Company choose the double declining balance method? Name one more depreciation method and explain the difference between this and the other methods. iii) d) Compute Cash flow from financing activities for the year ended 31 December 2019 assuming the following balance at 31 December 2018: Notes Payable ......... $10,000 Share Capital ............. $12,000 Dividend Payable...... $200 Interest Payable....... $100 (For the purpose of part (ii), payments of interest and dividend are treated as financing activities.) The 6-year $10,000 notes payable was issued on 1 December 2018, with interest payable annually on December 1. Prepare all journal entries that should be prepared in relation to the notes payable and interests in 2019. Show the date of each journal entry