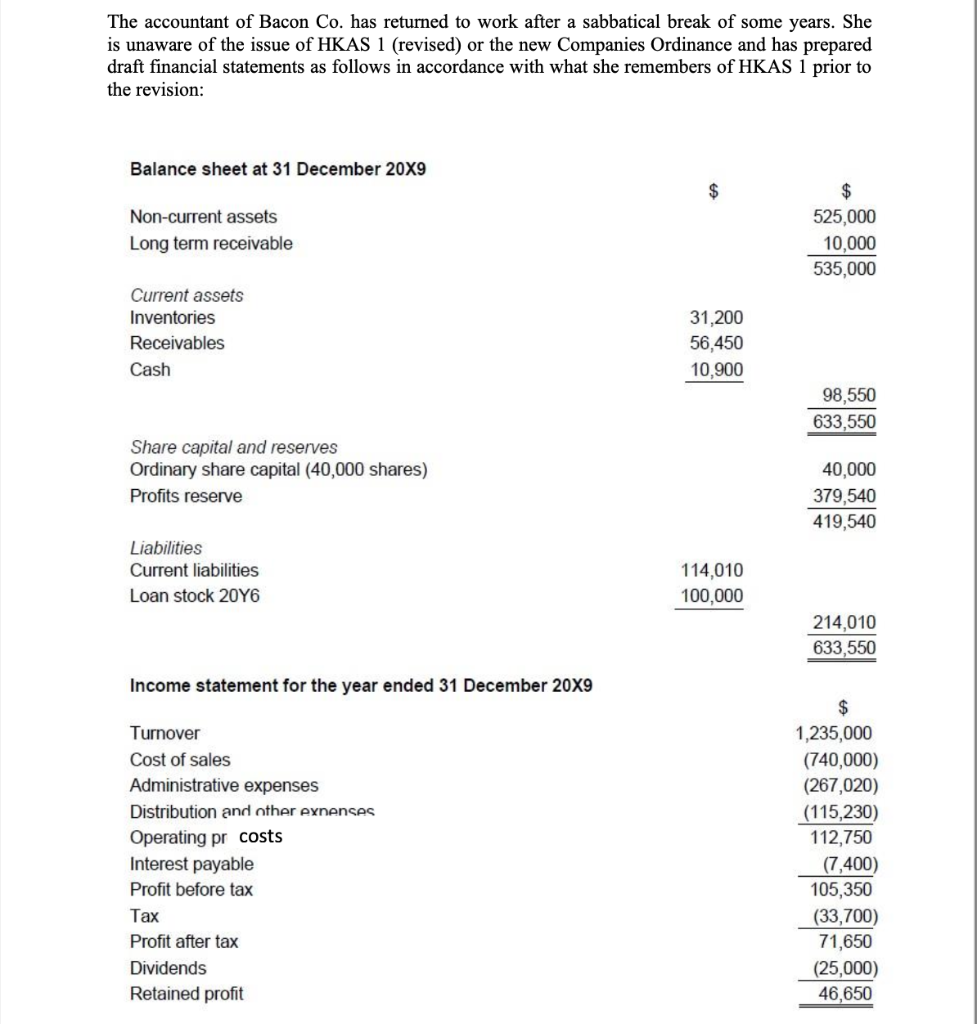

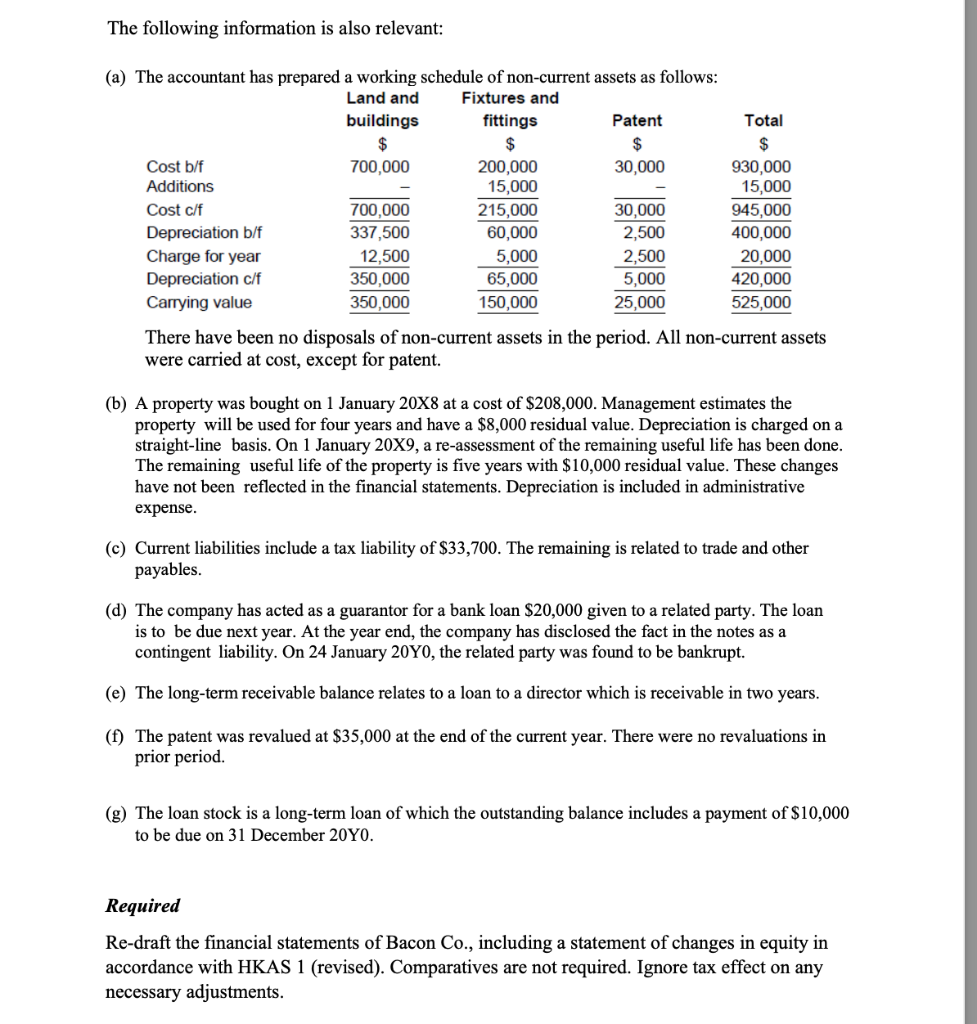

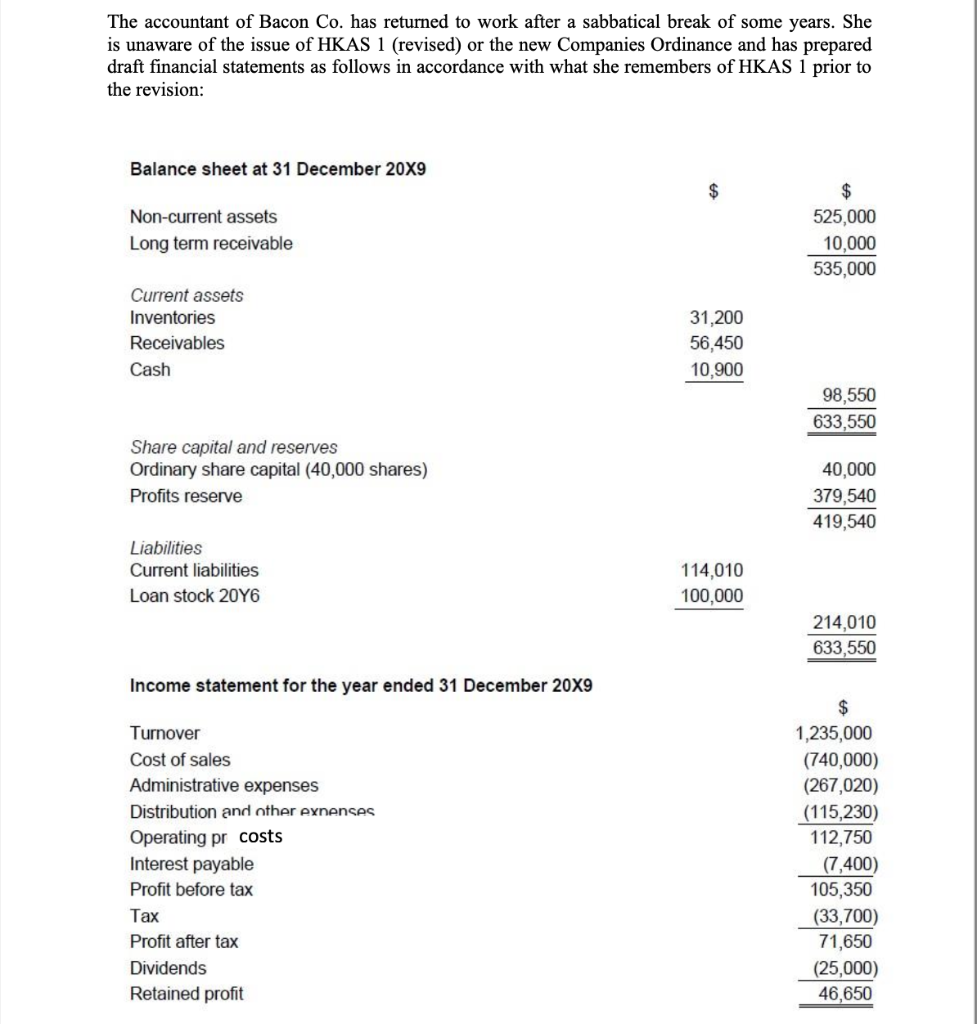

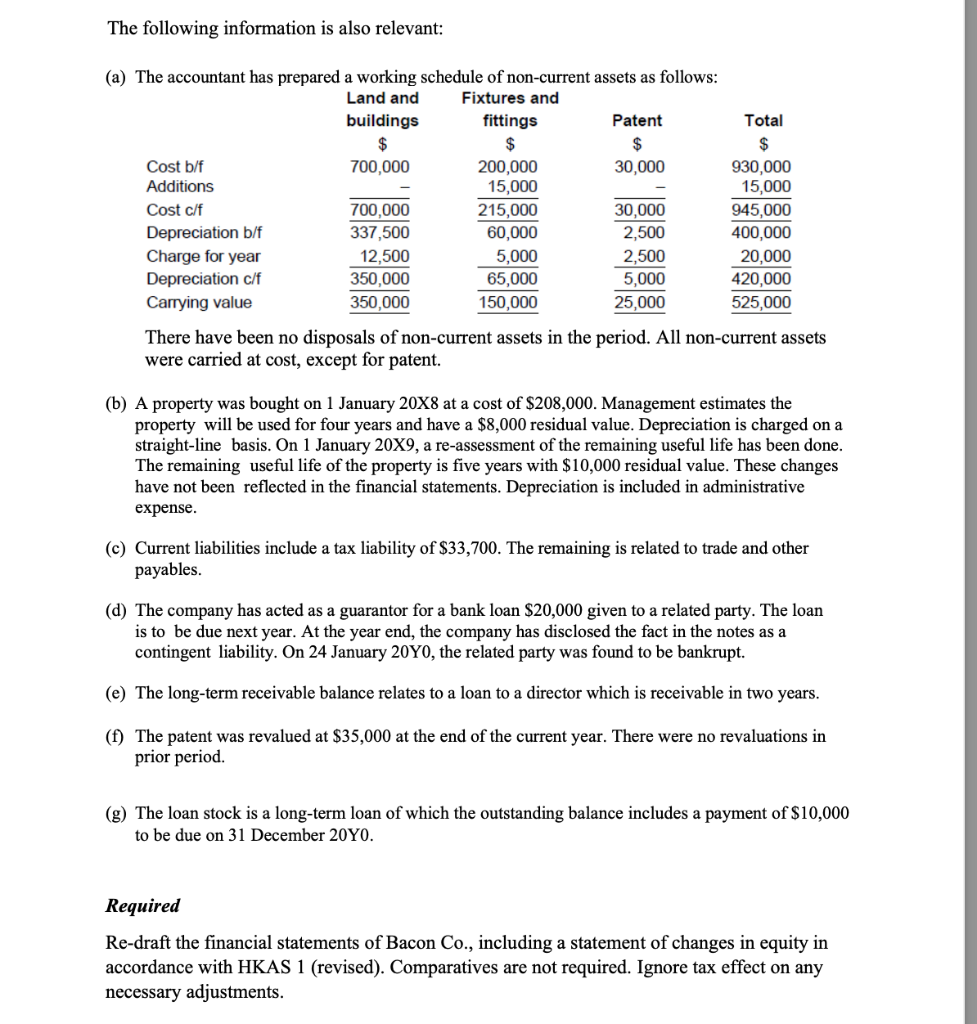

The accountant of Bacon Co. has returned to work after a sabbatical break of some years. She The following information is also relevant: (a) The accountant has prepared a working schedule of non-current assets as follows: There have been no disposals of non-current assets in the period. All non-current assets were carried at cost, except for patent. (b) A property was bought on 1 January 20X8 at a cost of $208,000. Management estimates the property will be used for four years and have a $8,000 residual value. Depreciation is charged on a straight-line basis. On 1 January 20X 9, a re-assessment of the remaining useful life has been done. The remaining useful life of the property is five years with $10,000 residual value. These changes have not been reflected in the financial statements. Depreciation is included in administrative expense. (c) Current liabilities include a tax liability of $33,700. The remaining is related to trade and other payables. (d) The company has acted as a guarantor for a bank loan $20,000 given to a related party. The loan is to be due next year. At the year end, the company has disclosed the fact in the notes as a contingent liability. On 24 January 20Y0, the related party was found to be bankrupt. (e) The long-term receivable balance relates to a loan to a director which is receivable in two years. (f) The patent was revalued at $35,000 at the end of the current year. There were no revaluations in prior period. (g) The loan stock is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 20Y0. Required Re-draft the financial statements of Bacon Co., including a statement of changes in equity in accordance with HKAS 1 (revised). Comparatives are not required. Ignore tax effect on any necessary adjustments. The accountant of Bacon Co. has returned to work after a sabbatical break of some years. She The following information is also relevant: (a) The accountant has prepared a working schedule of non-current assets as follows: There have been no disposals of non-current assets in the period. All non-current assets were carried at cost, except for patent. (b) A property was bought on 1 January 20X8 at a cost of $208,000. Management estimates the property will be used for four years and have a $8,000 residual value. Depreciation is charged on a straight-line basis. On 1 January 20X 9, a re-assessment of the remaining useful life has been done. The remaining useful life of the property is five years with $10,000 residual value. These changes have not been reflected in the financial statements. Depreciation is included in administrative expense. (c) Current liabilities include a tax liability of $33,700. The remaining is related to trade and other payables. (d) The company has acted as a guarantor for a bank loan $20,000 given to a related party. The loan is to be due next year. At the year end, the company has disclosed the fact in the notes as a contingent liability. On 24 January 20Y0, the related party was found to be bankrupt. (e) The long-term receivable balance relates to a loan to a director which is receivable in two years. (f) The patent was revalued at $35,000 at the end of the current year. There were no revaluations in prior period. (g) The loan stock is a long-term loan of which the outstanding balance includes a payment of $10,000 to be due on 31 December 20Y0. Required Re-draft the financial statements of Bacon Co., including a statement of changes in equity in accordance with HKAS 1 (revised). Comparatives are not required. Ignore tax effect on any necessary adjustments