Answered step by step

Verified Expert Solution

Question

1 Approved Answer

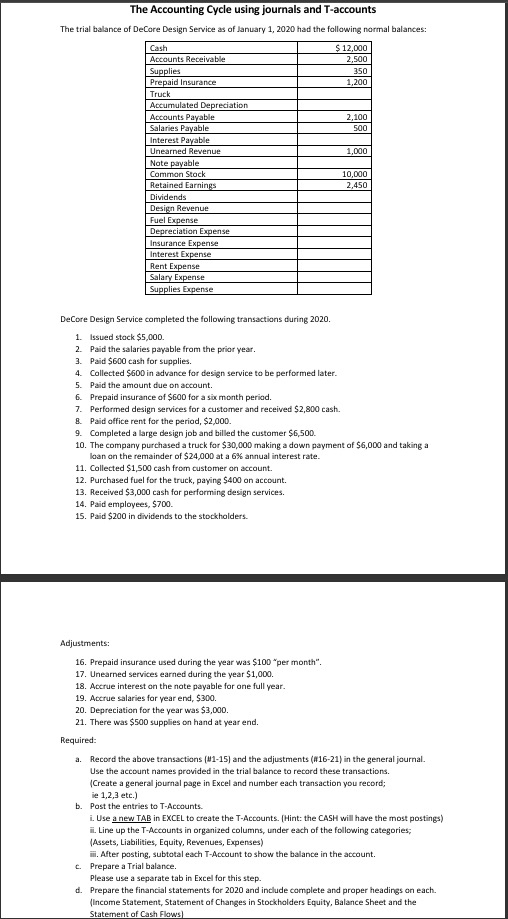

The Accounting Cycle using journals and T - accounts The trial balance of DeCore Design Service as of January 1 , 2 0 2 0

The Accounting Cycle using journals and Taccounts

The trial balance of DeCore Design Service as of January had the following normal balances:

DeCore Design Service completed the following transactions during

Issued stack $

Paid the salaries payable from the prior year.

Paid $ cash for supplies.

Collected $ in advance for design service to be performed later.

Paid the amount due on account.

Prepaid insurance of $ for a six month period.

Performed design services for a customer and received $cash.

Paid office rent for the period, $

Completed a large design job and billed the customer $

The company purchased a truck for $ making a down payment of $ and taking a

loan on the remainder of $ at a annual interest rate.

Collected $ cash from customer on account.

Purchased fuel for the truck, paying $ on account.

Received $ cash for performing design services.

Paid employees, $

Paid $ in dividends to the stockholders.

Adjustments:

Prepaid insurance used during the year was $ "per month".

Unearned services earned during the year $

Accrue interest on the note payable for one full year.

Accrue salaries for year end, $

Depreciation for the year was $

There was $ supplies on hand at year end.

Required:

a Record the above transactions and the adjustments in the general journal.

Use the account names provided in the trial balance to record these transactions.

Create a general journal page in Excel and number each transaction you record;

ie etc.

b Post the entries to TAccounts.

i Use a new TAB in EXCEL to create the TAccounts. Hint: the CASH will have the most postings

ii Line up the TAccounts in organized columns, under each of the following categories;

Assets Liabilities, Equity, Revenues, Expenses

ii After posting, subtotal each TAccount to show the balance in the account.

c Prepare a Trial balance.

Please use a separate tab in Excel for this step.

d Prepare the financial statements for and include complete and proper headings on each.

Income Statement, Statement of Changes in Stockholders Equity, Balance Sheet and the

Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started