Question

The accounting rate of return is another non-discounting financial model commonly used in making capital investment decisions. Unlike the payback period model, the accounting rate

The accounting rate of return is another non-discounting financial model commonly used in making capital investment decisions. Unlike the payback period model, the accounting rate of return uses income rather than cash flow.

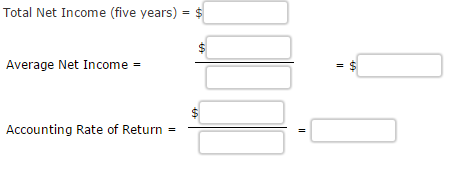

Assume that the investment is the same as before: Initial outlay of $100,000 with a five-year useful life and no salvage value under straight-line depreciation. The revenues are as follows: ( Year 1: $10,000, Year 2: $20,000, Year 3: $30,000, Year 4: $40,000 and Year 5: $50,000.)

Use the minus sign to indicate a net loss. If an amount is zero, enter "0". If required, enter the accounting rate of return as a decimal (i.e. 0.3).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started