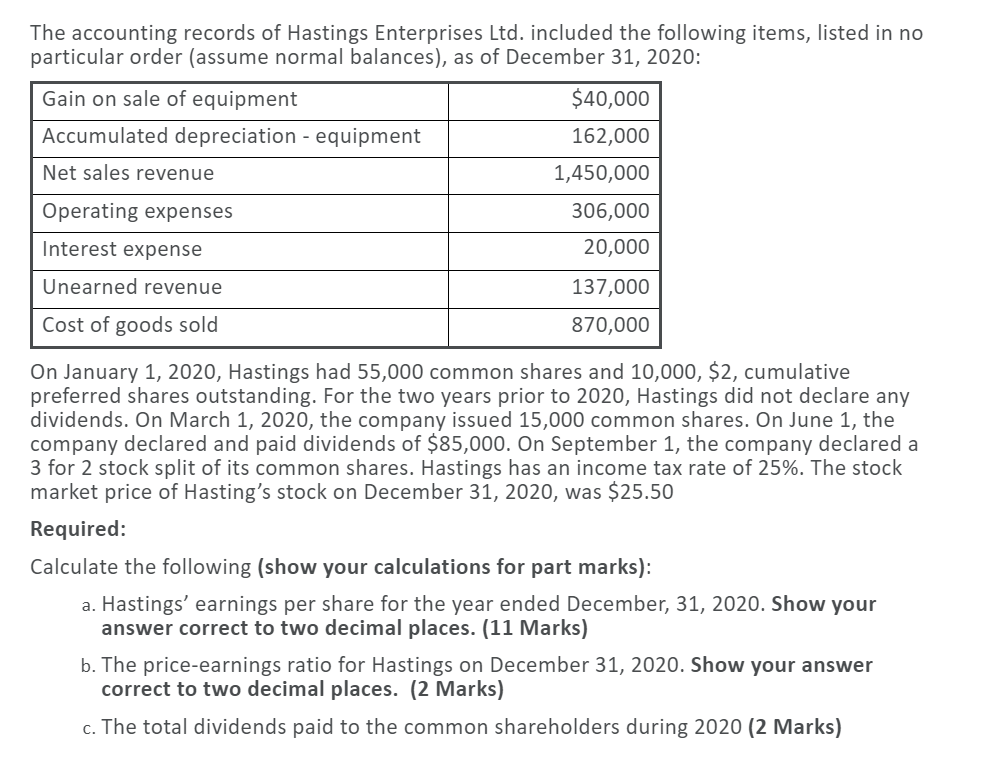

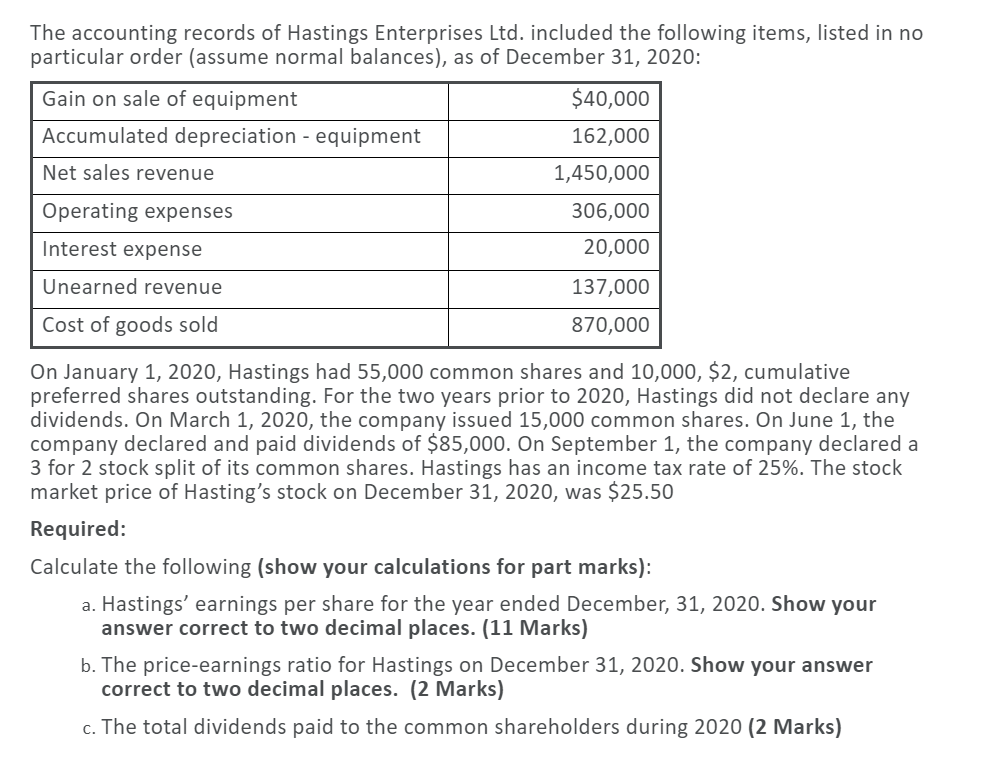

The accounting records of Hastings Enterprises Ltd. included the following items, listed in no particular order (assume normal balances), as of December 31, 2020: Gain on sale of equipment $40,000 Accumulated depreciation - equipment 162,000 Net sales revenue 1,450,000 Operating expenses 306,000 Interest expense 20,000 Unearned revenue 137,000 Cost of goods sold 870,000 On January 1, 2020, Hastings had 55,000 common shares and 10,000, $2, cumulative preferred shares outstanding. For the two years prior to 2020, Hastings did not declare any dividends. On March 1, 2020, the company issued 15,000 common shares. On June 1, the company declared and paid dividends of $85,000. On September 1, the company declared a 3 for 2 stock split of its common shares. Hastings has an income tax rate of 25%. The stock market price of Hasting's stock on December 31, 2020, was $25.50 Required: Calculate the following (show your calculations for part marks): a. Hastings' earnings per share for the year ended December, 31, 2020. Show your answer correct to two decimal places. (11 Marks) b. The price-earnings ratio for Hastings on December 31, 2020. Show your answer correct to two decimal places. (2 Marks) c. The total dividends paid to the common shareholders during 2020 (2 Marks) (a) Earnings per share (b) The price-earnings ratio on December 31, 2020 The accounting records of Hastings Enterprises Ltd. included the following items, listed in no particular order (assume normal balances), as of December 31, 2020: Gain on sale of equipment $40,000 Accumulated depreciation - equipment 162,000 Net sales revenue 1,450,000 Operating expenses 306,000 Interest expense 20,000 Unearned revenue 137,000 Cost of goods sold 870,000 On January 1, 2020, Hastings had 55,000 common shares and 10,000, $2, cumulative preferred shares outstanding. For the two years prior to 2020, Hastings did not declare any dividends. On March 1, 2020, the company issued 15,000 common shares. On June 1, the company declared and paid dividends of $85,000. On September 1, the company declared a 3 for 2 stock split of its common shares. Hastings has an income tax rate of 25%. The stock market price of Hasting's stock on December 31, 2020, was $25.50 Required: Calculate the following (show your calculations for part marks): a. Hastings' earnings per share for the year ended December, 31, 2020. Show your answer correct to two decimal places. (11 Marks) b. The price-earnings ratio for Hastings on December 31, 2020. Show your answer correct to two decimal places. (2 Marks) c. The total dividends paid to the common shareholders during 2020 (2 Marks) (a) Earnings per share (b) The price-earnings ratio on December 31, 2020