Answered step by step

Verified Expert Solution

Question

1 Approved Answer

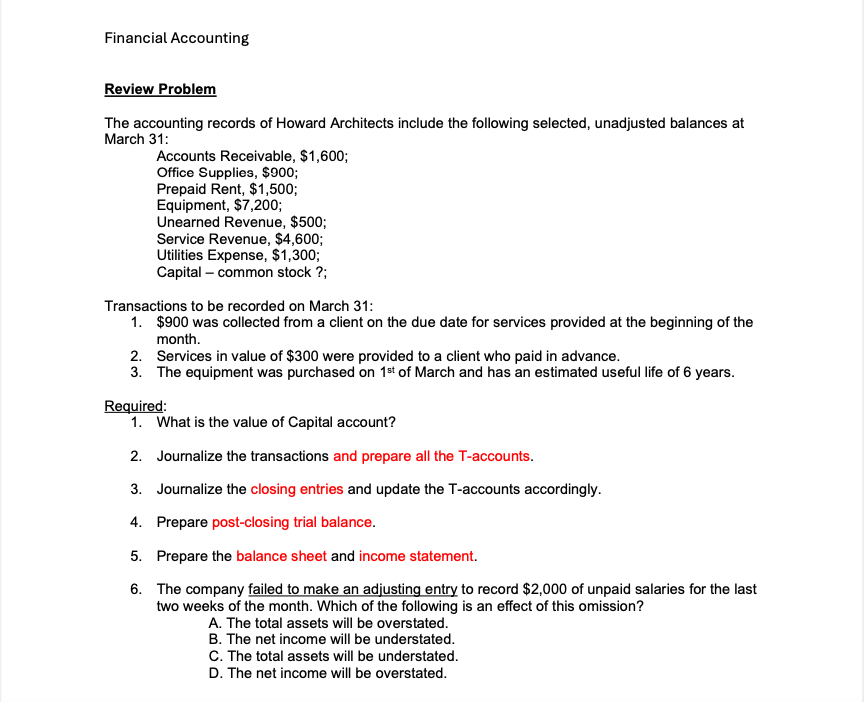

The accounting records of Howard Architects include the following selected, unadjusted balances at March 3 1 : Accounts Recievable - $ 1 , 6 0

The accounting records of Howard Architects include the following selected, unadjusted balances at March :

Accounts Recievable $; Office Supplies $; Prepaid Rent $; Equipment $; Unearned Revenue $; Service Revenue $; Utilities Expense $; Capital common stock ;

Transactions to be recorded on March :

$ was collected from a client on the due date for services provided at the beginning of the

month.

Services in value of $ were provided to a client who paid in advance.

The equipment was purchased on st of March and has an estimated useful life of years.

Required:

What is the value of Capital account?

Journalize the transactions and prepare all the Taccounts.

Journalize the closing entries and update the Taccounts accordingly.

Prepare postclosing trial balance.

Prepare the balance sheet and income statement.

The company failed to make an adjusting entry to record $ of unpaid salaries for the last two weeks of the month. Which of the following is an effect of this omission?

A The total assets will be overstated. B The net income will be understated. C The total assets will be understated. D The net income will be overstated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started