Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounting records of LeClaire Delivery Services show the following assets and liabilities as of the end of 2023 and 2022: Cash Accounts receivable

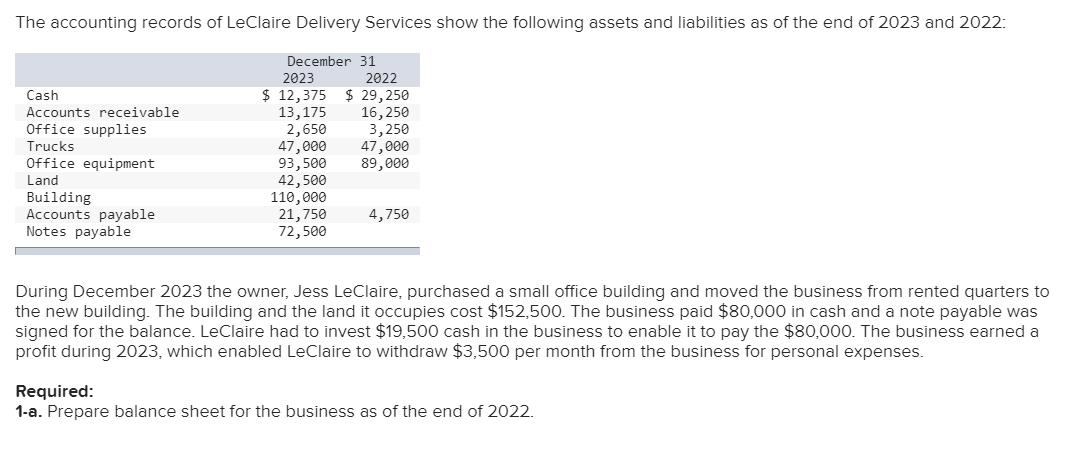

The accounting records of LeClaire Delivery Services show the following assets and liabilities as of the end of 2023 and 2022: Cash Accounts receivable Office supplies Trucks Office equipment Land Building Accounts payable Notes payable December 31 2023 2022 $ 12,375 $ 29,250 13,175 16,250 2,650 3,250 47,000 47,000 93,500 89,000 42,500 110,000 21,750 72,500 4,750 During December 2023 the owner, Jess LeClaire, purchased a small office building and moved the business from rented quarters to the new building. The building and the land it occupies cost $152,500. The business paid $80,000 in cash and a note payable was signed for the balance. LeClaire had to invest $19,500 cash in the business to enable it to pay the $80,000. The business earned a profit during 2023, which enabled LeClaire to withdraw $3,500 per month from the business for personal expenses. Required: 1-a. Prepare balance sheet for the business as of the end of 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the balance sheet for LeClaire Delivery Services as of the end of 2022 LeClaire Delivery Ser...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started