Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounting year-end for Flowers Ltd. is on 30th June. On 30th June 2020, the accountant of Flowers Ltd. provides the following balances for

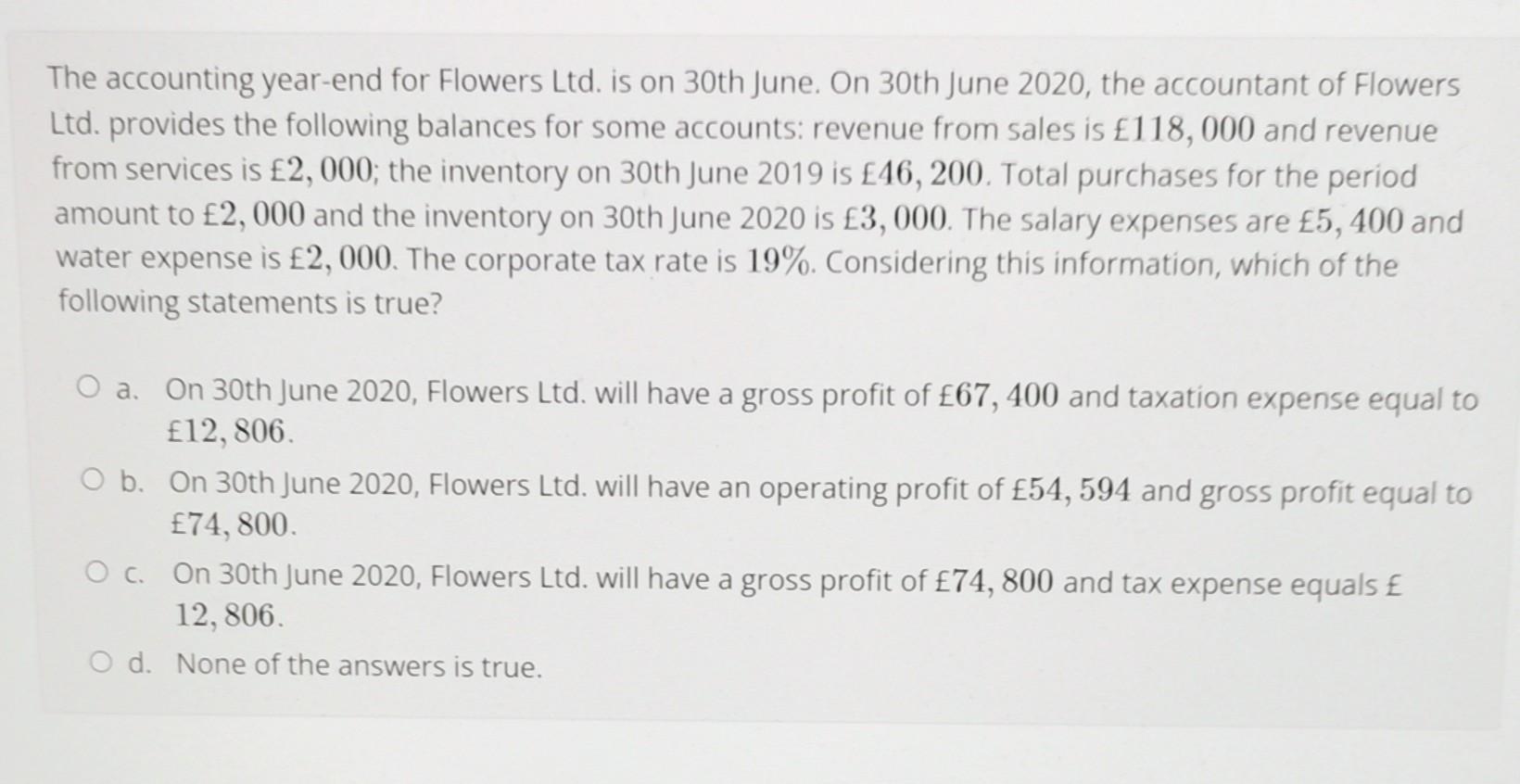

The accounting year-end for Flowers Ltd. is on 30th June. On 30th June 2020, the accountant of Flowers Ltd. provides the following balances for some accounts: revenue from sales is 118, 000 and revenue from services is 2, 000; the inventory on 30th June 2019 is 46, 200. Total purchases for the period amount to 2, 000 and the inventory on 30th June 2020 is 3, 000. The salary expenses are 5, 400 and water expense is 2, 000. The corporate tax rate is 19%. Considering this information, which of the following statements is true? a. On 30th June 2020, Flowers Ltd. will have a gross profit of 67, 400 and taxation expense equal to 12, 806. O b. On 30th June 2020, Flowers Ltd. will have an operating profit of 54, 594 and gross profit equal to 74, 800. O . On 30th June 2020, Flowers Ltd. will have a gross profit of 74, 800 and tax expense equals 12, 806. O d. None of the answers is true.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

solo The option C is true comon Gnoss profi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started