Answered step by step

Verified Expert Solution

Question

1 Approved Answer

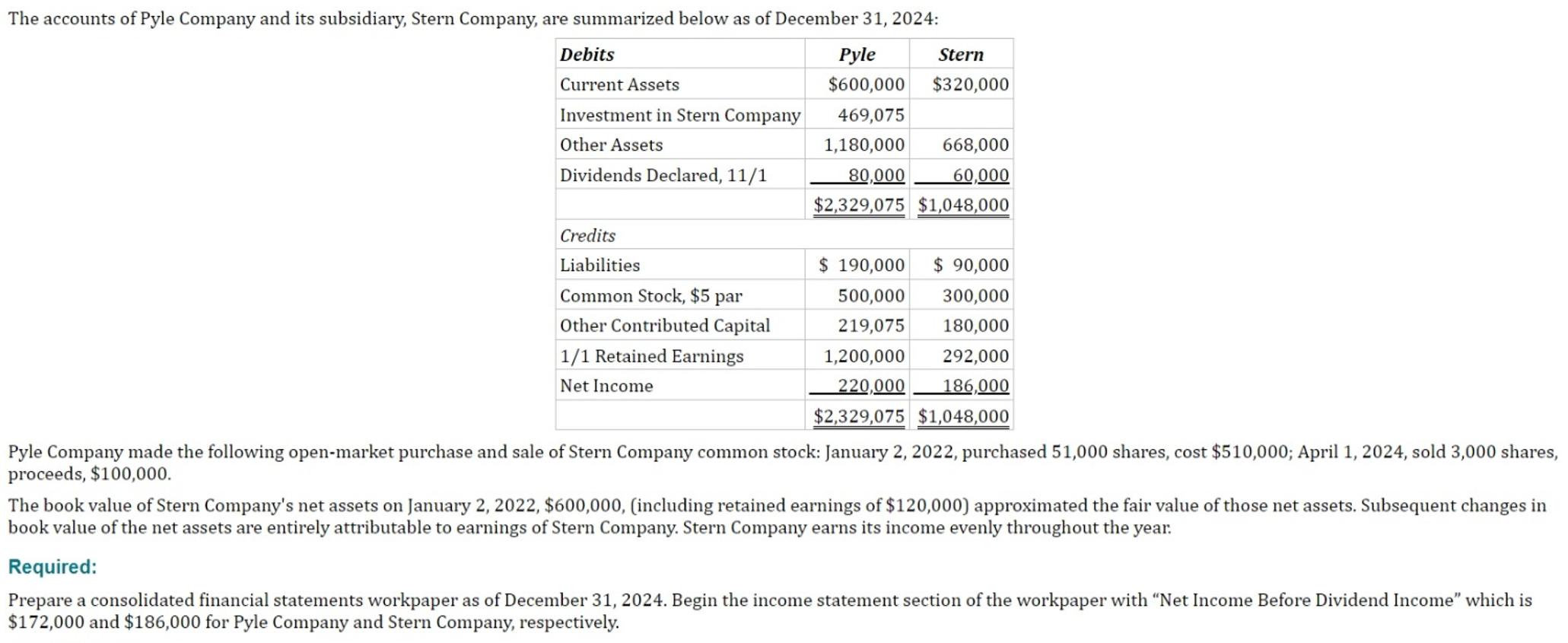

The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2024: Debits Current Assets Pyle Stern $600,000

The accounts of Pyle Company and its subsidiary, Stern Company, are summarized below as of December 31, 2024: Debits Current Assets Pyle Stern $600,000 $320,000 Investment in Stern Company Other Assets 469,075 1,180,000 668,000 Dividends Declared, 11/1 80,000 60,000 $2,329,075 $1,048,000 Credits Liabilities Common Stock, $5 par Other Contributed Capital 1/1 Retained Earnings Net Income $ 190,000 $ 90,000 300,000 500,000 219,075 180,000 1,200,000 292,000 220,000 186,000 $2,329,075 $1,048,000 Pyle Company made the following open-market purchase and sale of Stern Company common stock: January 2, 2022, purchased 51,000 shares, cost $510,000; April 1, 2024, sold 3,000 shares, proceeds, $100,000. The book value of Stern Company's net assets on January 2, 2022, $600,000, (including retained earnings of $120,000) approximated the fair value of those net assets. Subsequent changes in book value of the net assets are entirely attributable to earnings of Stern Company. Stern Company earns its income evenly throughout the year. Required: Prepare a consolidated financial statements workpaper as of December 31, 2024. Begin the income statement section of the workpaper with "Net Income Before Dividend Income" which is $172,000 and $186,000 for Pyle Company and Stern Company, respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started