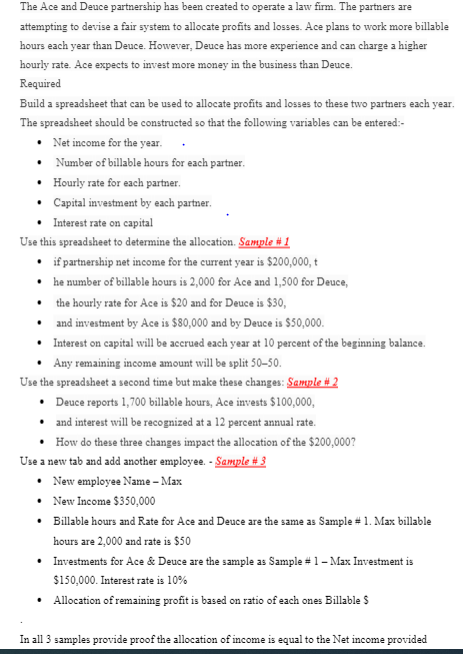

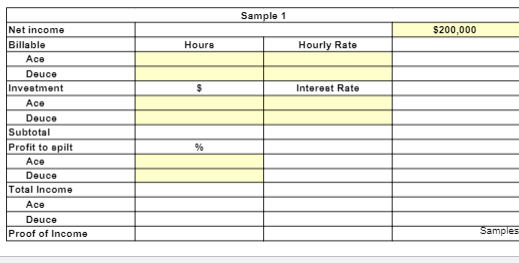

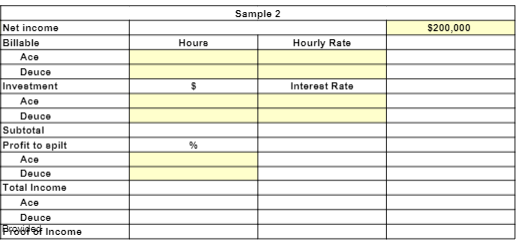

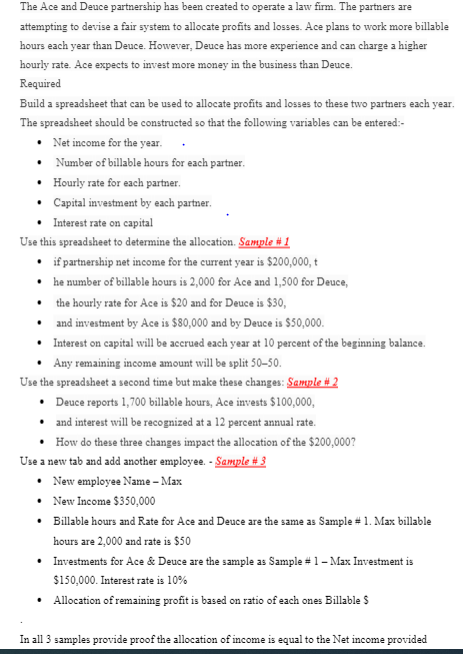

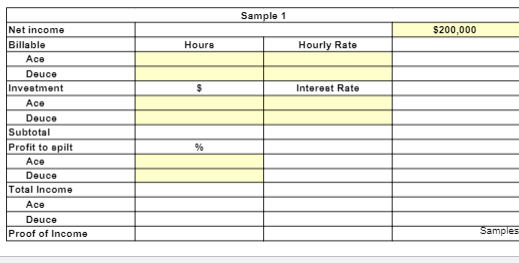

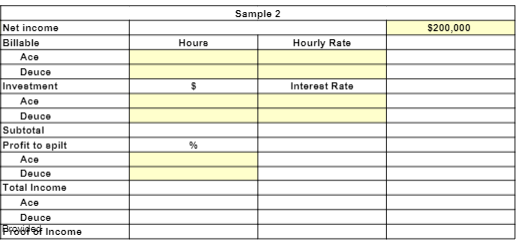

The Ace and Deuce partnership has been created to operate a law firm. The partners are attempting to devise a fair system to allocate profits and losses. A ce plans to work more billable hours each year than Deuce. However, Deuce has more experience and can charge a higher hourly rate. Ace expects to invest more money in the business than Deuce. Required Build a spreadsheet that can be used to allocate profits and losses to these two partners each year. The spreadsheet should be constructed so that the following variables can be entered:- Net income for the year Number of billable hours for each partner, Hourly rate for each partner Capital investment by each partner. Interest rate on capital Use this spreadsheet to determine the allocation. Sample #1 if partnership net income for the current year is $200,000, t he number of billable hours is 2,000 for Ace and 1,500 for Deuce, the hourly rate for Ace is $20 and for Deuce is $30, and investment by Ace is $80,000 and by Deuce is $50,000. Interest on capital will be accrued each year at 10 percent of the beginning balance. Any remaining income amount will be split 5050. Use the spreadsheet a second time but make these changes: Sample #2 Deuce reports 1,700 billable hours, Ace invests $100,000, and interest will be recognized at a 12 percent annual rate. How do these three changes impact the allocation of the $200,000? Use a new a new tab and add another employee. - Sample #3 New employee Name - Max New Income $350,000 Billable hours and Rate for Ace and Deuce are the same as Sample # 1. Max billable hours are 2,000 and rate is $50 Investments for Ace & Deuce are the sample as Sample # 1 - Max Investment is $150,000. Interest rate is 10% Allocation of remaining profit is based on ratio of each ones Billables In all 3 samples provide proof the allocation of income is equal to the Net income provided Sample 1 $200,000 Houre Hourly Rate $ Interest Rate Net income Billable Ace Deuce Investment Ace Douco Subtotal Profit to spilt Ace Douce Total Income Aco Deuce Proof of Income % Samples Sample 2 $200,000 Hours Hourly Rate $ Interest Rate Net income Billable Ace Deuce Investment Aco Douce Subtotal Profit to spilt Ace Deuce Total Income Ace Deuce Proost Income % Sample 3 $350,000 Hours Hourly Rate Net income Billable Ace Deuce Max Investment Ace Deuce Max Subtotal Profit to spilt Ace Deuce Max Total Income Ace Deuce Max Proof of Income Max Sample 3