Question

The adjusted balance at October 31,2021. the year-end date for Rosthern Company. You are required to make adjusting entries on this date, based upon the

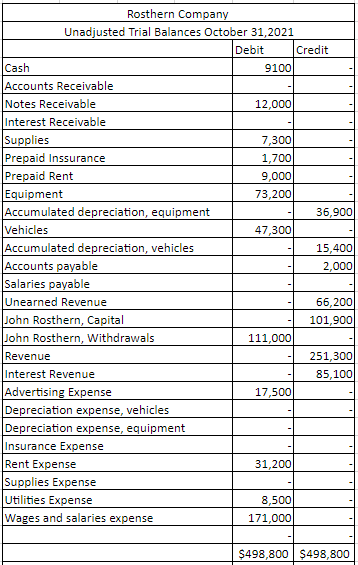

The adjusted balance at October 31,2021. the year-end date for Rosthern Company. You are required to make adjusting entries on this date, based upon the information. You are required to make adjusting entries on this date, based upon the following information. Instead of explanations for your entries, show any calculation that may be necessary, adjusted trial balance isn't needed. 1. Rosthern Company is open ever day of the week. Thus year, October 31, 2021 the year-end date- falls on a Sunday. The weekly pay period ends on Saturdays. If the daily cost of payroll is $3,448. Calculate the adjusting entry for year-end. 2. A customer provided a note to the company for $12,000 to settle their account on August 2, 2021 for a period of 120 days at an interest of 11.0%. No payment of interest or principal had happened as of year-end. Record the adjusting entry. 3. Rosthern Company counted unused supplies and calculate that there is still $3,562 worth of at year end. 4. At October 31, the business still has $518 of unexpired insurance. 5. Depreciation for the year of equipment is $20,709. 6. In September a customer contracted to receive services from Rosthern Company. The customer paid $6,200 in advance. At year end, only $4,926 of the money was unearned.

Rosthern Company Unadjusted Trial Balances October 31,2021 Debit 9100 12,000 7,300 1,700 9,000 73,200 47,300 111,000 17,500 31,200 8,500 171,000 $498,800 $498,800 Cash Accounts Receivable Notes Receivable Interest Receivable Supplies Prepaid Inssurance Prepaid Rent Equipment Accumulated depreciation, equipment Vehicles Accumulated depreciation, vehicles Accounts payable Salaries payable Unearned Revenue John Rosthern, Capital John Rosthern, Withdrawals Revenue Interest Revenue Advertising Expense Depreciation expense, vehicles Depreciation expense, equipment Insurance Expense Rent Expense Supplies Expense Utilities Expense Wages and salaries expense Credit 36,900 15,400 2,000 66,200 101,900 251,300 85,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started