Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The adjusted trial balance of Metlock at December 31 shows Inventory $25,400, Sales Revenue $163,500, Sales Returns and Allowances $4,550, Sales Discounts $2,950, Cost

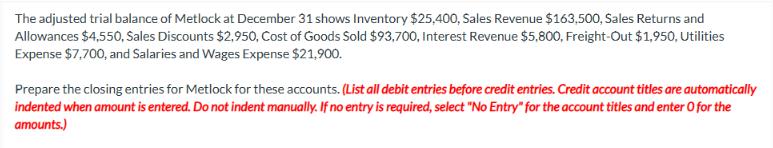

The adjusted trial balance of Metlock at December 31 shows Inventory $25,400, Sales Revenue $163,500, Sales Returns and Allowances $4,550, Sales Discounts $2,950, Cost of Goods Sold $93,700, Interest Revenue $5,800, Freight-Out $1,950, Utilities Expense $7,700, and Salaries and Wages Expense $21,900. Prepare the closing entries for Metlock for these accounts. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the closing entries for Metlock we need to transfer the balances of the temporary accounts revenue expense and dividend accounts to the retained earnings account The closing entries will zero out these temporary accounts in preparation for the next accounting period Here are the closing entries for the given accounts 1 Close Sales Revenue Debit Sales Revenue 163500 Credit Income Summary 163500 2 Close Sales Returns and Allowances Debit Income Summary 4550 Credit Sales Returns and Allowances 4550 3 Close Sales Discounts Debit Income Summary 2950 Credit Sales Discounts 2950 4 Close Cost of Goods Sold Debit Cost of Goods Sold 93700 Credit Income Summary 93700 5 Close Interest Revenue Debit Interest Revenue 5800 Credit Income Summary 5800 6 Close FreightOut Debit FreightOut 1950 Credit Income Summary 1950 7 Close Utilities Expense Debit Utilities Expense 7700 Credit Income Summary 7700 8 Close Salaries and Wages Expense Debit Salaries and Wages Expense 21900 Credit Income Summary 21900 9 Close Income Summary Debit Income Summary 283050 Credit Retained Earnings 283050 No entry is required for the Inventory account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started