Answered step by step

Verified Expert Solution

Question

1 Approved Answer

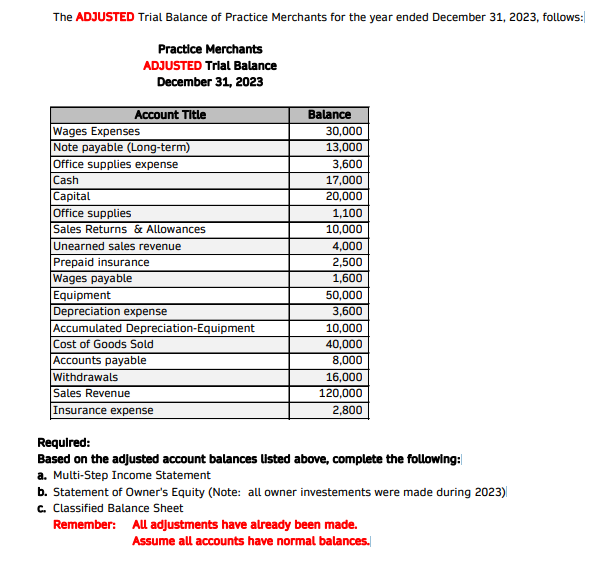

The ADJUSTED Trial Balance of Practice Merchants for the year ended December 31, 2023, follows: Practice Merchants ADJUSTED Trial Balance December 31, 2023 Account

The ADJUSTED Trial Balance of Practice Merchants for the year ended December 31, 2023, follows: Practice Merchants ADJUSTED Trial Balance December 31, 2023 Account Title Balance Wages Expenses 30,000 Note payable (Long-term) 13,000 Office supplies expense 3,600 Cash 17,000 Capital 20,000 Office supplies 1,100 Sales Returns & Allowances 10,000 Unearned sales revenue 4,000 Prepaid insurance 2,500 Wages payable 1,600 Equipment 50,000 Depreciation expense 3,600 Accumulated Depreciation-Equipment 10,000 Cost of Goods Sold 40,000 Accounts payable 8,000 Withdrawals 16,000 120,000 2,800 Sales Revenue Insurance expense Required: Based on the adjusted account balances listed above, complete the following: a. Multi-Step Income Statement b. Statement of Owner's Equity (Note: all owner investements were made during 2023)| c. Classified Balance Sheet Remember: All adjustments have already been made. Assume all accounts have normal balances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a MultiStep Income Statement for Practice Merchants for the year ended December 31 2023 Practice Mer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started