Answered step by step

Verified Expert Solution

Question

1 Approved Answer

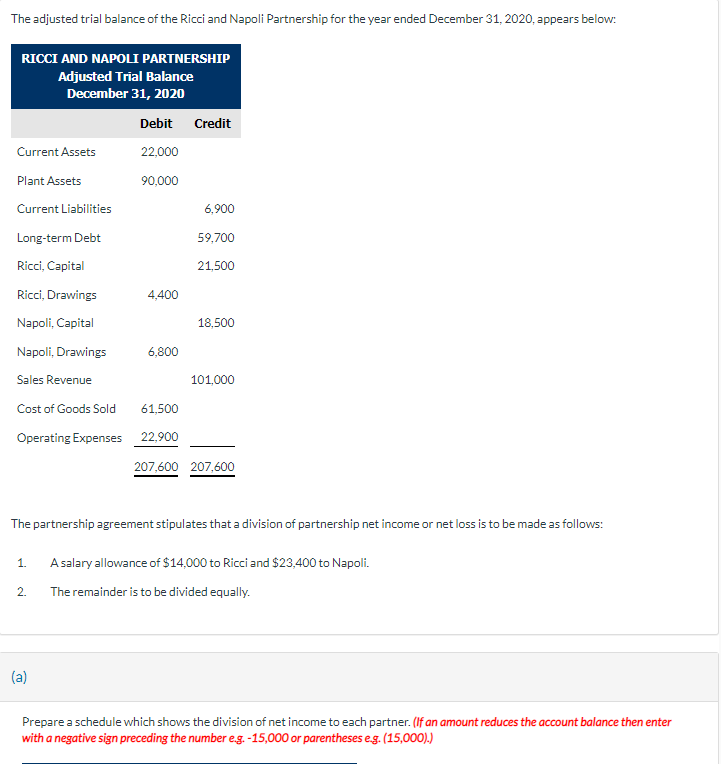

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31, 2020, appears below: RICCI AND NAPOLI PARTNERSHIP Adjusted

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31, 2020, appears below: RICCI AND NAPOLI PARTNERSHIP Adjusted Trial Balance December 31, 2020 Debit Credit Current Assets 22,000 Plant Assets 90,000 Current Liabilities 6,900 Long-term Debt 59,700 Ricci, Capital 21,500 Ricci, Drawings 4,400 Napoli, Capital 18,500 Napoli, Drawings 6,800 Sales Revenue 101,000 Cost of Goods Sold 61,500 Operating Expenses 22,900 207,600 207,600 The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows: 1. A salary allowance of $14,000 to Ricci and $23,400 to Napoli. 2. The remainder is to be divided equally. (a) Prepare a schedule which shows the division of net income to each partner. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g. -15,000 or parentheses e.g. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

RICCI AND NAPOLI INCOME STATEMENT AND APPROPRIATION ACCOUNT FOR THE ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started