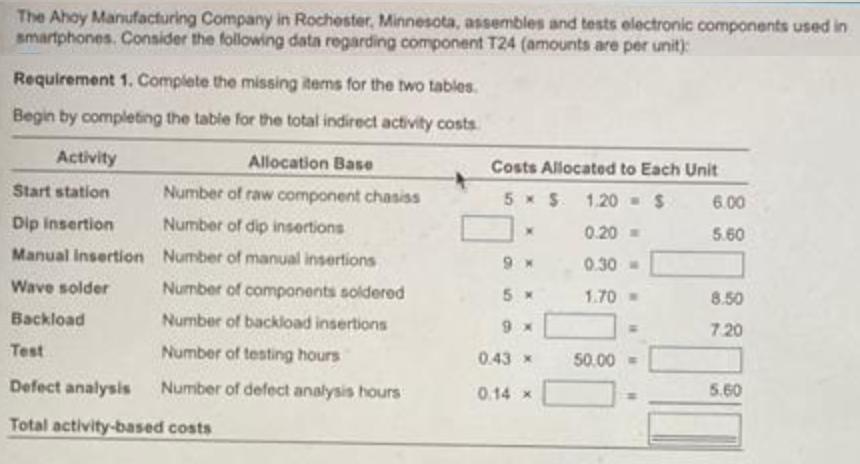

The Ahoy Manufacturing Company in Rochester, Minnesota, assembles and tests electronic components used in smartphones. Consider the following data regarding component T24 (amounts are

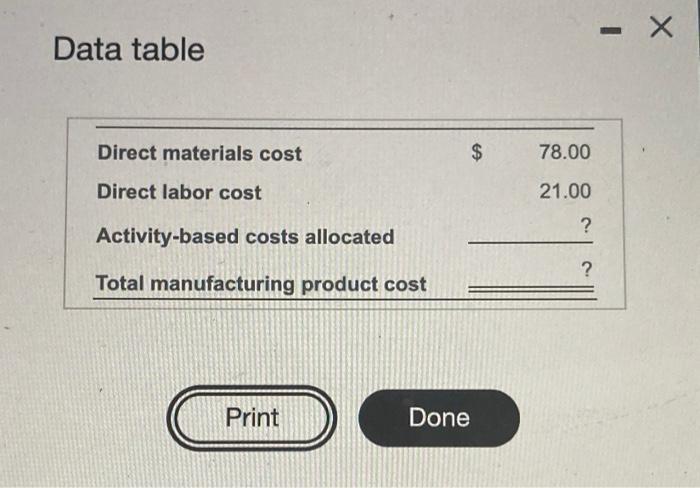

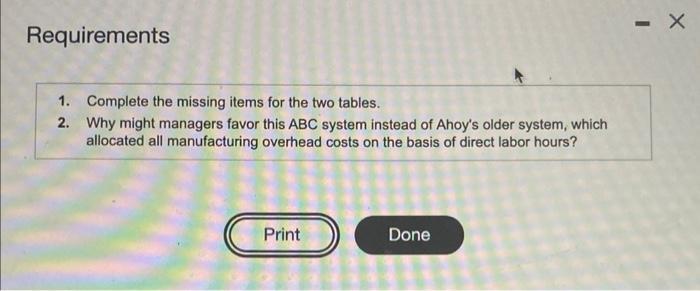

The Ahoy Manufacturing Company in Rochester, Minnesota, assembles and tests electronic components used in smartphones. Consider the following data regarding component T24 (amounts are per unit): Requirement 1. Complete the missing items for the two tables. Begin by completing the table for the total indirect activity costs Activity Allocation Base Costs Allocated to Each Unit Start station Number of raw component chasiss 5 S1.20 - 6.00 Dip Insertion Number of dip insertions 0.20 = 5.60 Manual insertion Number of manual insertions 0.30 Wave solder Number of components soldered 5. 1.70 8.50 Backload Number of backload insertions 9 x 7.20 Test Number of testing hours 0.43 x 50.00= Defect analysis Number of defect analysis hours 0.14 x 5.60 Total activity-based costs Data table Direct materials cost 78.00 Direct labor cost 21.00 Activity-based costs allocated Total manufacturing product cost Print Done %24 Requirements 1. Complete the missing items for the two tables. 2. Why might managers favor this ABC system instead of Ahoy's older system, which allocated all manufacturing overhead costs on the basis of direct labor hours? Print Done

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The table that shows total indirect activity cost per uni...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started