The Ajax Company uses a portfolio approach to manage their research and development (R&D) projects. Ajax wants to keep a mix of projects to balance

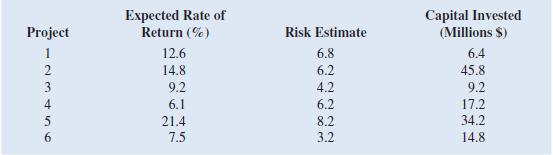

The Ajax Company uses a portfolio approach to manage their research and development (R&D) projects. Ajax wants to keep a mix of projects to balance the expected return and risk profiles of their R&D activities. Consider the situation where Ajax has six R&D projects as characterized in the table. Each project is given an expected rate of return and a risk assessment, which is a value between 1 and 10 where 1 is the least risky and 10 is the most risky. Ajax would like to visualize their current R&D projects to keep track of the overall risk and return of their R&D portfolio.

a. Create a bubble chart where the expected rate of return is along the horizontal axis, the risk estimate is on the vertical axis, and the size of the bubbles represents the amount of capital invested. Format this chart for best presentation by adding axes labels and labeling each bubble with the project number.

b. The efficient frontier of R&D projects represents the set of projects that have the highest expected rate of return for a given level of risk. In other words, any project that has a smaller expected rate of return for an equivalent, or higher, risk estimate cannot be on the efficient frontier. From the bubble chart in part a., what projects appear to be located on the efficient frontier?

Capital Invested (Millions $) Expected Rate of Project Return (%) Risk Estimate 1 12.6 6.8 6.4 14.8 6.2 45.8 3 9.2 4.2 9.2 17.2 34.2 4 6.1 6.2 5 21.4 8.2 7.5 3.2 14.8

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Answer A b Projects appea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started