Answered step by step

Verified Expert Solution

Question

1 Approved Answer

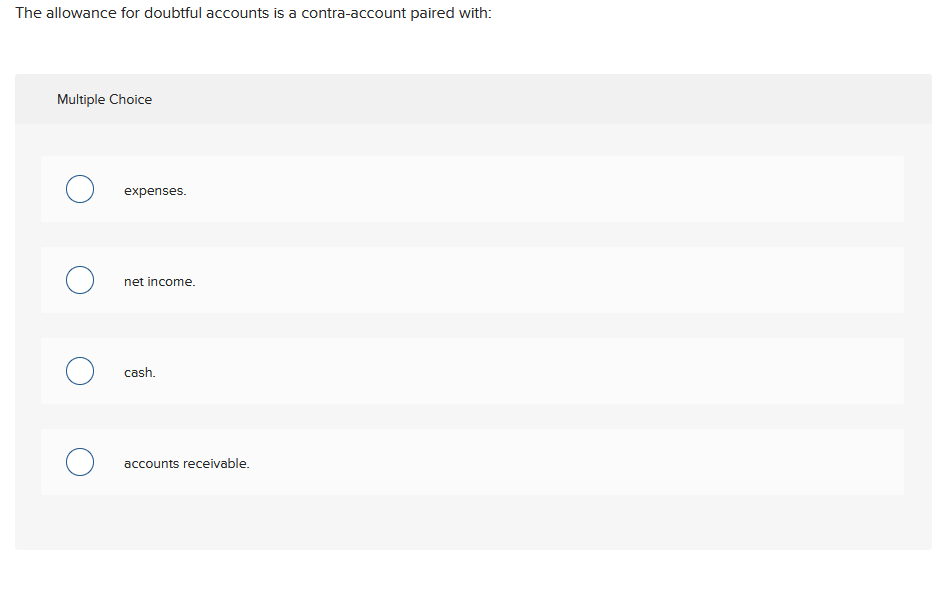

The allowance for doubtful accounts is a contra-account paired with: Multiple Choice expenses. net income. cash. accounts receivable. At the end of the accounting

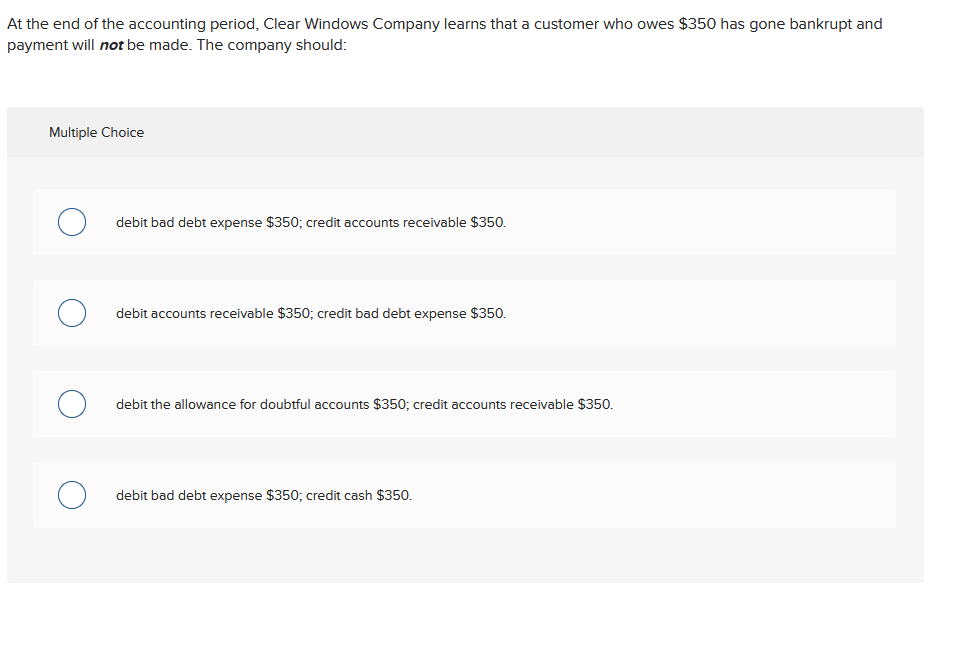

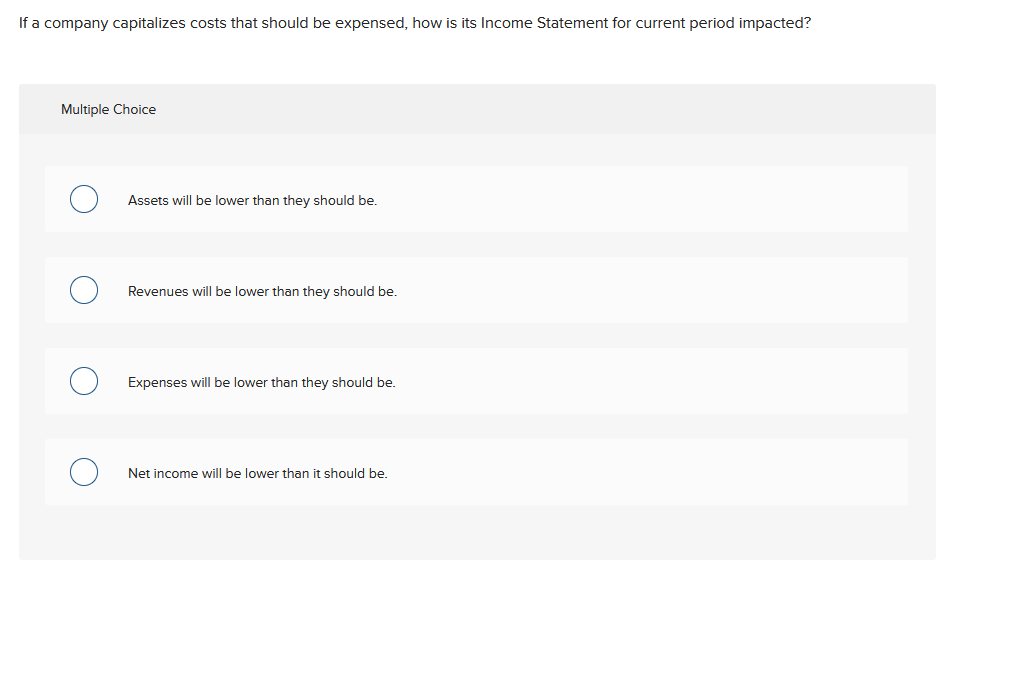

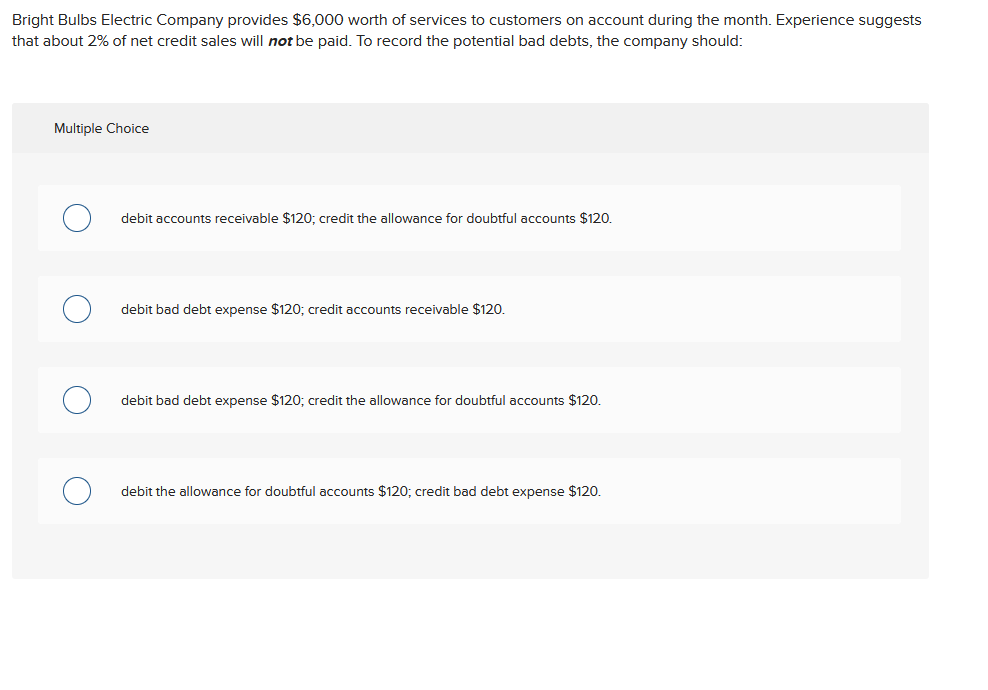

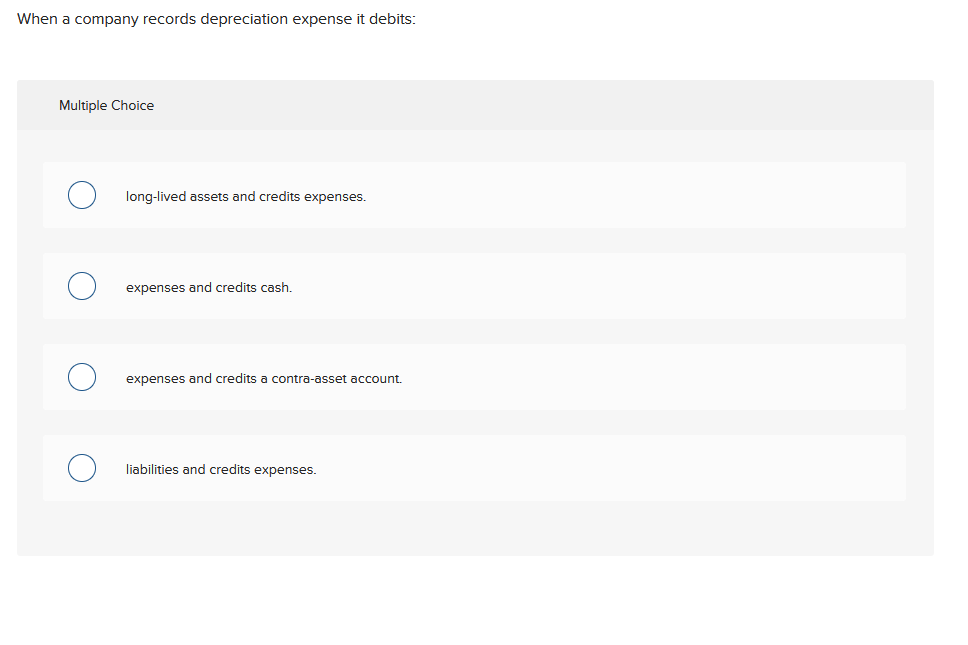

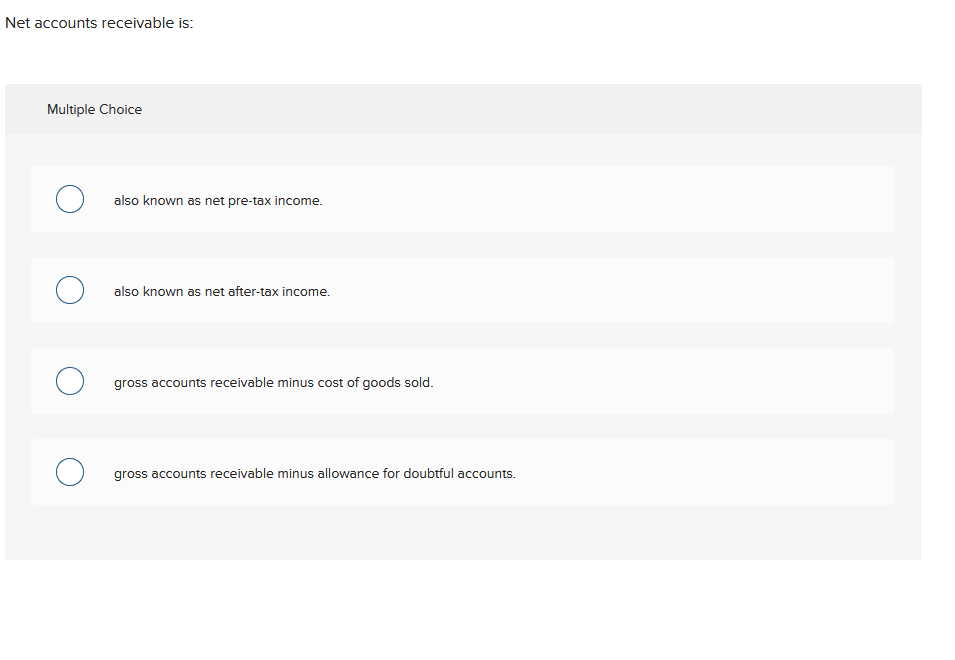

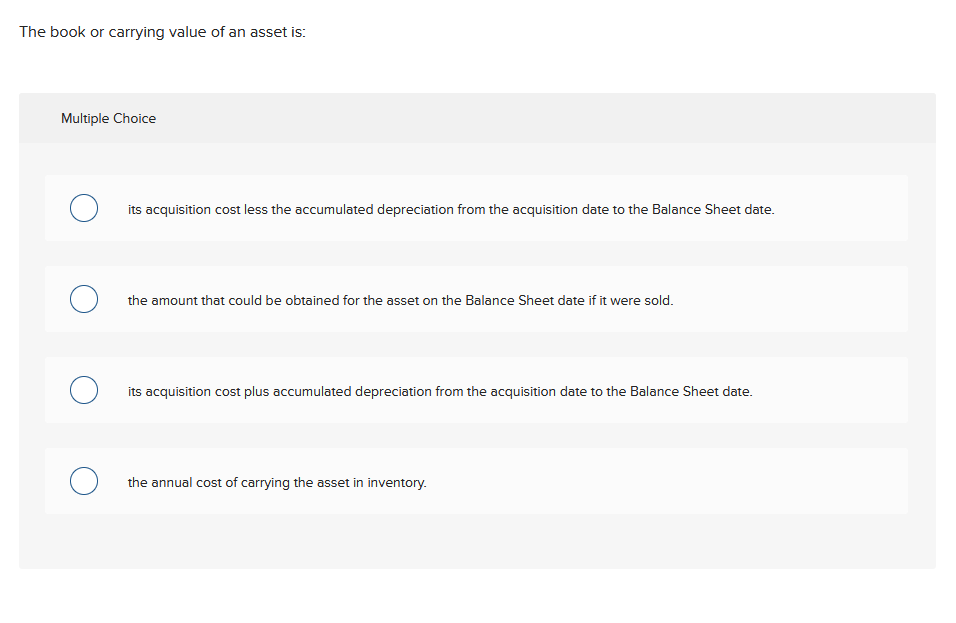

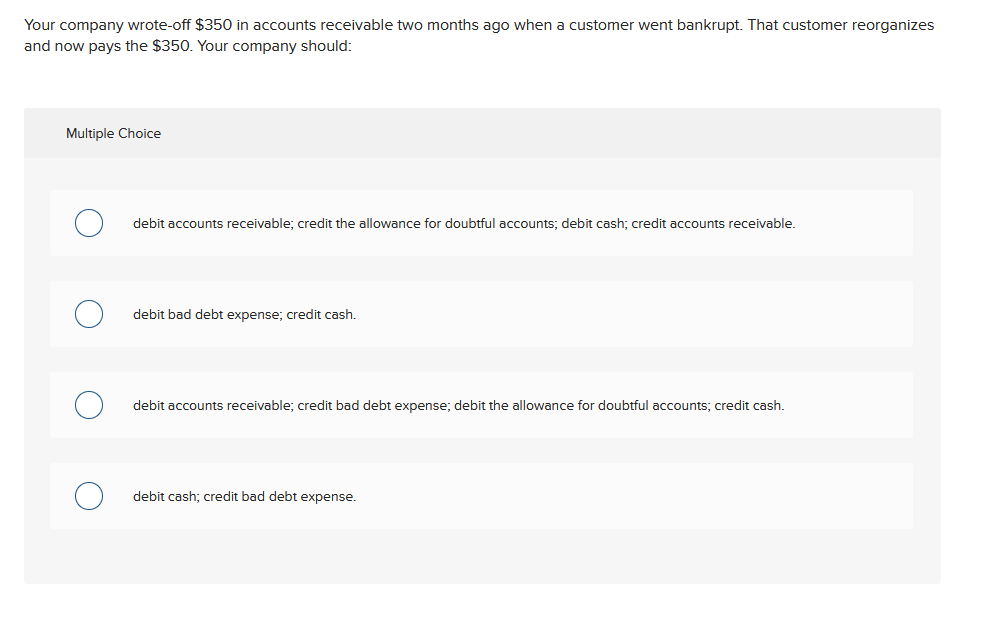

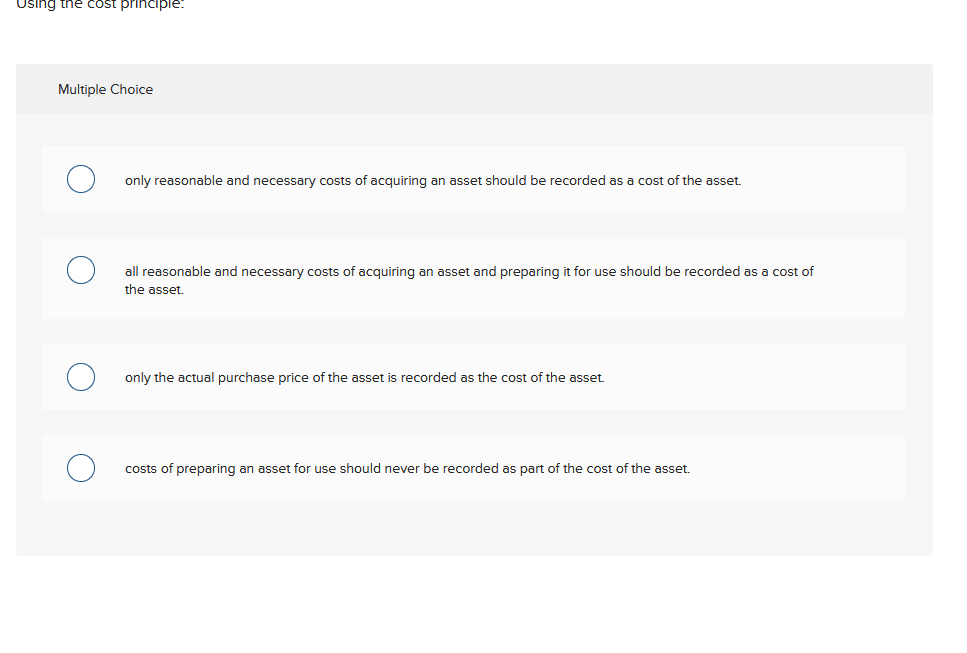

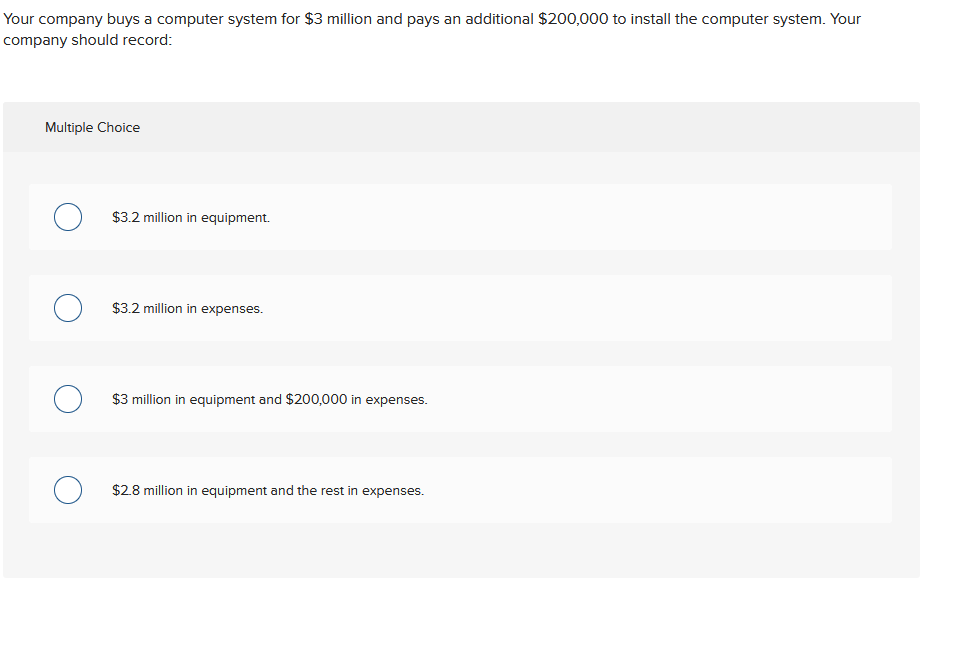

The allowance for doubtful accounts is a contra-account paired with: Multiple Choice expenses. net income. cash. accounts receivable. At the end of the accounting period, Clear Windows Company learns that a customer who owes $350 has gone bankrupt and payment will not be made. The company should: Multiple Choice O debit bad debt expense $350; credit accounts receivable $350. debit accounts receivable $350; credit bad debt expense $350. debit the allowance for doubtful accounts $350; credit accounts receivable $350. debit bad debt expense $350; credit cash $350. If a company capitalizes costs that should be expensed, how is its Income Statement for current period impacted? Multiple Choice Assets will be lower than they should be. Revenues will be lower than they should be. Expenses will be lower than they should be. Net income will be lower than it should be. Bright Bulbs Electric Company provides $6,000 worth of services to customers on account during the month. Experience suggests that about 2% of net credit sales will not be paid. To record the potential bad debts, the company should: Multiple Choice debit accounts receivable $120; credit the allowance for doubtful accounts $120. debit bad debt expense $120; credit accounts receivable $120. debit bad debt expense $120; credit the allowance for doubtful accounts $120. debit the allowance for doubtful accounts $120; credit bad debt expense $120. When a company records depreciation expense it debits: Multiple Choice long-lived assets and credits expenses. expenses and credits cash. expenses and credits contra-asset account. liabilities and credits expenses. Net accounts receivable is: Multiple Choice O also known as net pre-tax income. O also known as net after-tax income. O gross accounts receivable minus cost of goods sold. O gross accounts receivable minus allowance for doubtful accounts. The book or carrying value of an asset is: Multiple Choice its acquisition cost less the accumulated depreciation from the acquisition date to the Balance Sheet date. the amount that could be obtained for the asset on the Balance Sheet date if it were sold. its acquisition cost plus accumulated depreciation from the acquisition date to the Balance Sheet date. the annual cost of carrying the asset in inventory. Your company wrote-off $350 in accounts receivable two months ago when a customer went bankrupt. That customer reorganizes and now pays the $350. Your company should: Multiple Choice debit accounts receivable; credit the allowance for doubtful accounts; debit cash; credit accounts receivable. debit bad debt expense; credit cash. debit accounts receivable; credit bad debt expense; debit the allowance for doubtful accounts; credit cash. debit cash; credit bad debt expense. Using the cost principle: Multiple Choice only reasonable and necessary costs of acquiring an asset should be recorded as a cost of the asset. all reasonable and necessary costs of acquiring an asset and preparing it for use should be recorded as a cost of the asset. only the actual purchase price of the asset is recorded as the cost of the asset. costs of preparing an asset for use should never be recorded as part of the cost of the asset. Your company buys a computer system for $3 million and pays an additional $200,000 to install the computer system. Your company should record: Multiple Choice $3.2 million in equipment. $3.2 million in expenses. $3 million in equipment and $200,000 in expenses. $2.8 million in equipment and the rest in expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The correct answer is accounts receivable The allowance for doubtful accounts is a contraaccount that is paired with accounts receivable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started