Answered step by step

Verified Expert Solution

Question

1 Approved Answer

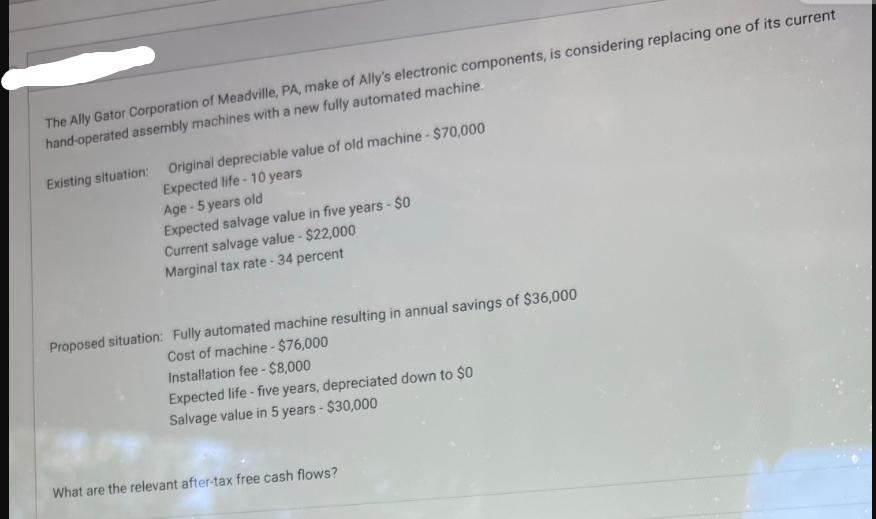

The Ally Gator Corporation of Meadville, PA, make of Ally's electronic components, is considering replacing one of its current hand-operated assembly machines with a

The Ally Gator Corporation of Meadville, PA, make of Ally's electronic components, is considering replacing one of its current hand-operated assembly machines with a new fully automated machine. Existing situation: Original depreciable value of old machine-$70,000 Expected life-10 years Age - 5 years old Expected salvage value in five years - $0 Current salvage value - $22,000 Marginal tax rate - 34 percent Proposed situation: Fully automated machine resulting in annual savings of $36,000 Cost of machine-$76,000 Installation fee-$8,000 Expected life-five years, depreciated down to $0 Salvage value in 5 years - $30,000 What are the relevant after-tax free cash flows?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the relevant aftertax free cash flows for Ally Gator Corporation to consider when deciding on replacing the handoperated machine with a fully ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642e7c596200_973100.pdf

180 KBs PDF File

6642e7c596200_973100.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started