Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Amazing Drug Company has four lines of drugs (Goofy, Dooty, Woofy, & Poofy). Anson and Anika both work as accountants at the Amazing

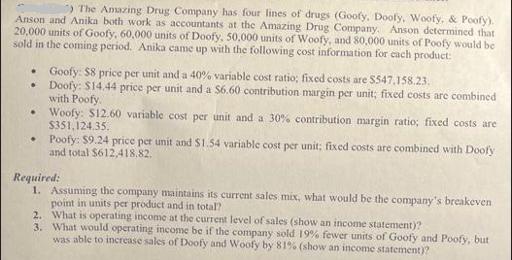

The Amazing Drug Company has four lines of drugs (Goofy, Dooty, Woofy, & Poofy). Anson and Anika both work as accountants at the Amazing Drug Company. Anson determined that 20,000 units of Goofy, 60,000 units of Doofy, 50,000 units of Woofy, and 80,000 units of Poofy would be sold in the coming period. Anika came up with the following cost information for each product: Goofy: $8 price per unit and a 40% variable cost ratio; fixed costs are S547,158.23. Doofy: $14.44 price per unit and a $6.60 contribution margin per unit; fixed costs are combined with Poofy. Woofy: $12.60 variable cost per unit and a 30% contribution margin ratio; fixed costs are $351,124.35. . . Poofy: $9.24 price per unit and $1.54 variable cost per unit; fixed costs are combined with Doofy and total $612,418,82. Required: 1. Assuming the company maintains its current sales mix, what would be the company's breakeven point in units per product and in total? 2. What is operating income at the current level of sales (show an income statement)? 3. What would operating income be if the company sold 19% fewer units of Goofy and Poofy, but was able to increase sales of Doofy and Woofy by 81% (show an income statement)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the companys breakeven point in units and in total we need to determine the total contribution margin for each product line and then divide the fixed costs by the weighted average contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started