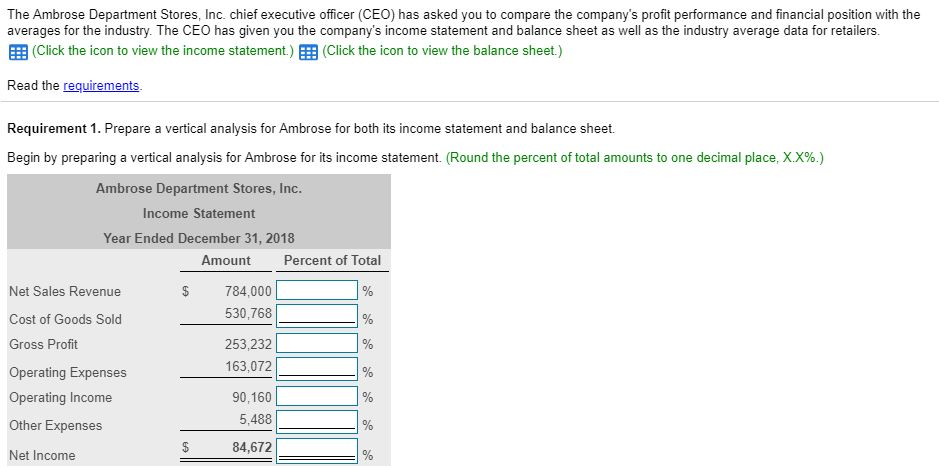

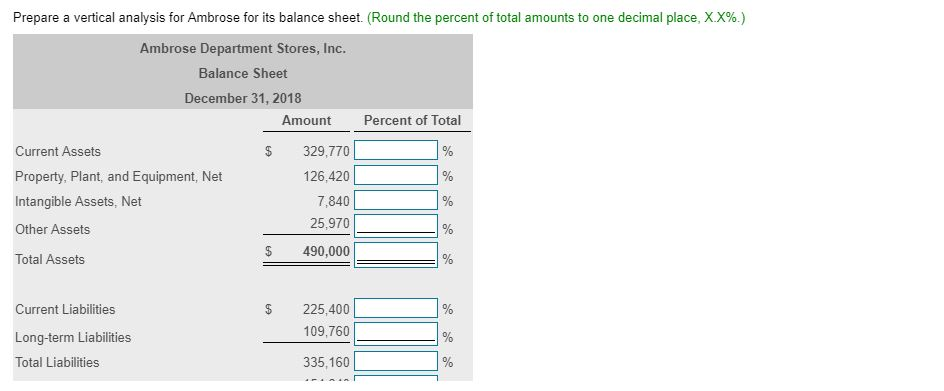

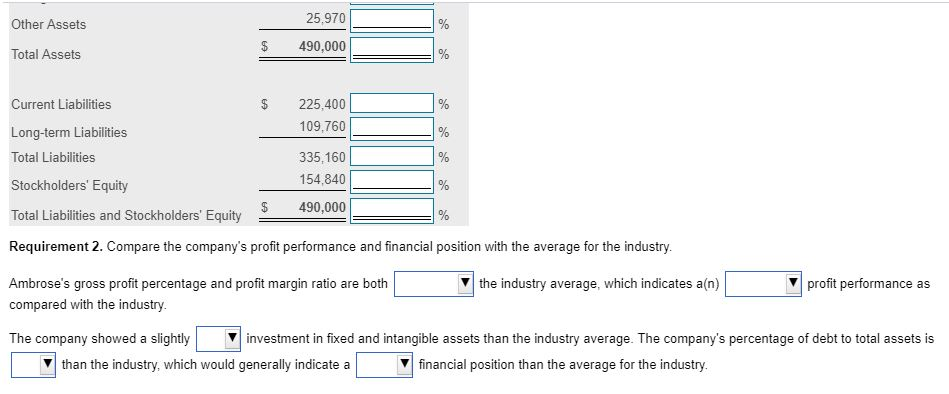

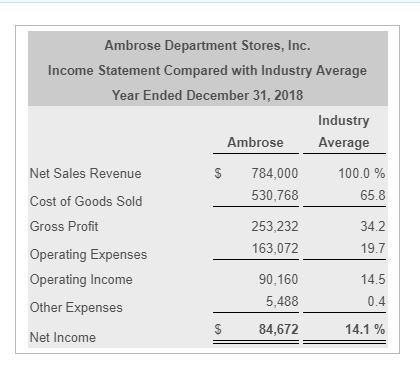

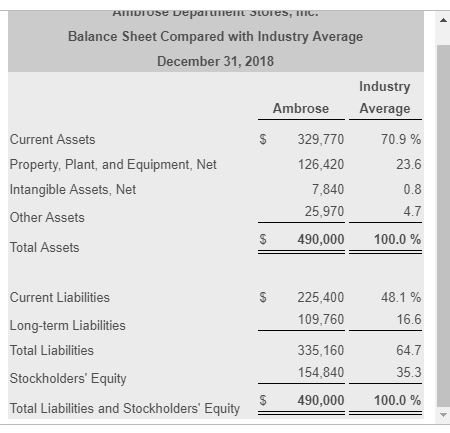

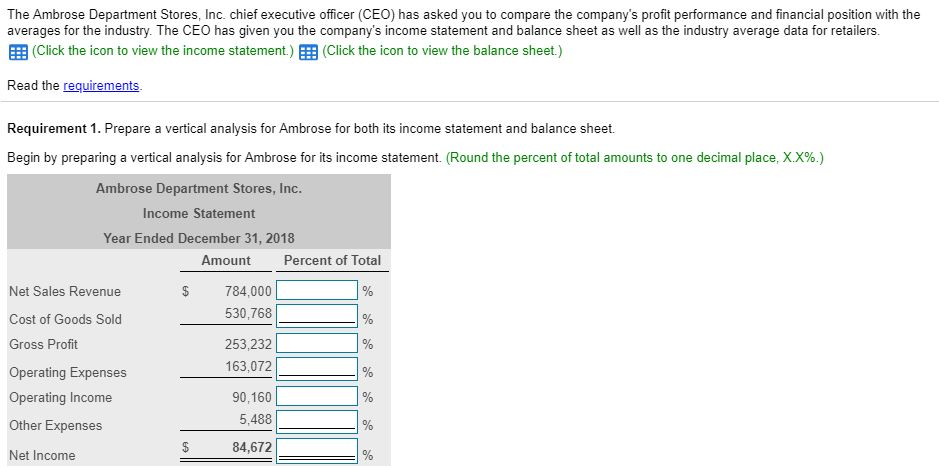

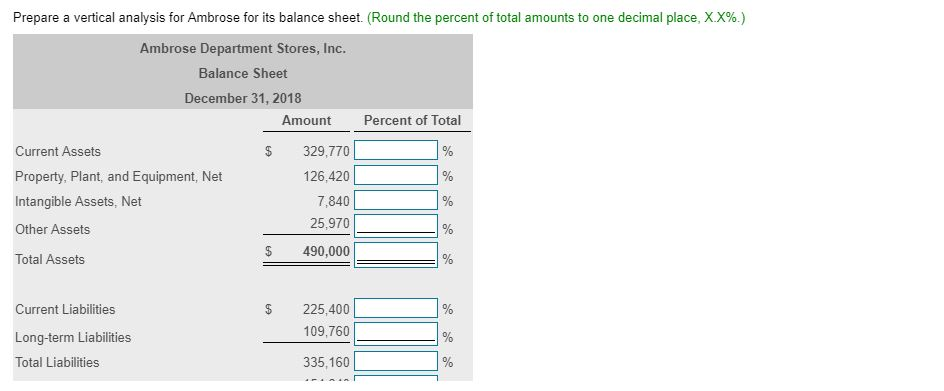

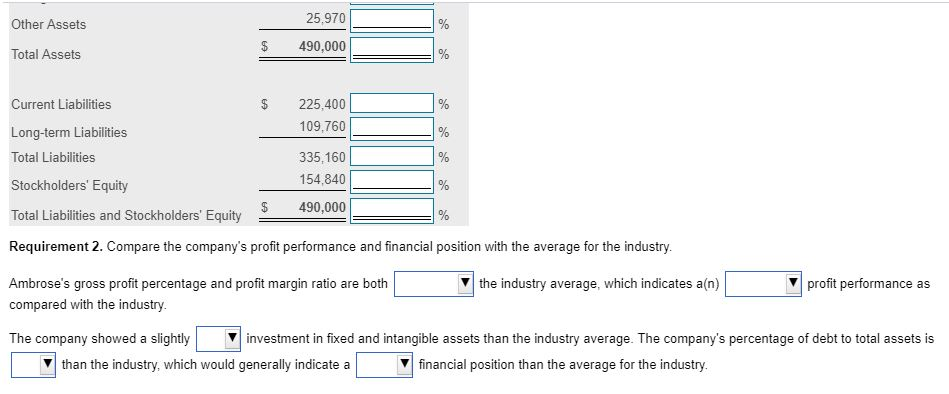

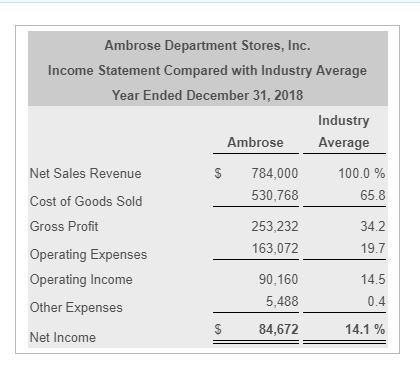

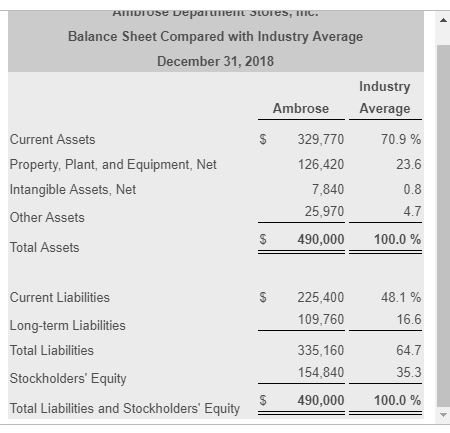

The Ambrose Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers EEB (Click the icon to view the income statement.) EB (Click the icon to view the balance sheet.) Read the requirements Requirement 1. Prepare a vertical analysis for Ambrose for both its income statement and balance sheet. Begin by preparing a vertical analysis for Ambrose for its income statement. (Round the percent of total amounts to one decimal place, XX%) Ambrose Department Stores, Inc Income Statement Year Ended December 31, 2018 Amount Percent of Total $ 784,000 530,768 253,232 163,072 90,160 5,488 84,672 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Income Other Expenses Net Income Prepare a vertical analysis for Ambrose for its balance sheet. (Round the percent of total amounts to one decimal place, XX%.) Ambrose Department Stores, Inc. Balance Sheet December 31, 2018 Amount Percent of Total $ 329,770 126,420 7,840 25,970 $ 490,000 Current Assets Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Total Assets $ 225,400 109,760 335,160 Current Liabilities Long-term Liabilities Total Liabilities 1 1% 25,970 Other Assets $ 490,000 Total Assets $ 225,400 Current Liabilities Long-term Liabilities Total Liabilities Stockholders Equity Total Liabilities and Stockholders' Equity Requirement 2. Compare the company's profit performance and financial position with the average for the industry Ambrose's gross profit percentage and profit margin ratio are both compared with the industry The company showed a slightly investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is 109,760 335,160 154,840 $490,000 V the industry average, which indicates a(n) V profit performance as | than the industry, which would generally indicate a V financial position than the average for the industry Ambrose Department Stores, Inc. Income Statement Compared with Industry Average Year Ended December 31, 2018 Industry Average Ambrose Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Income Other Expenses Net Income S 784,000 530,768 253,232 163,072 90,160 5,488 84,672 100.0 % 65.8 34.2 19.7 14.5 0.4 14.1 % Balance Sheet Compared with Industry Average December 31, 2018 Industry Ambrose Arage Current Assets Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Total Assets 329,770 126,420 7,840 25,970 70.9% 23.6 0.8 490,000 100.0% 481 % 16.6 64.7 35.3 $ 490,000 100.0 % $ 225,400 109,760 Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Total Liabilities and Stockholders' Equity 335,160 154,840