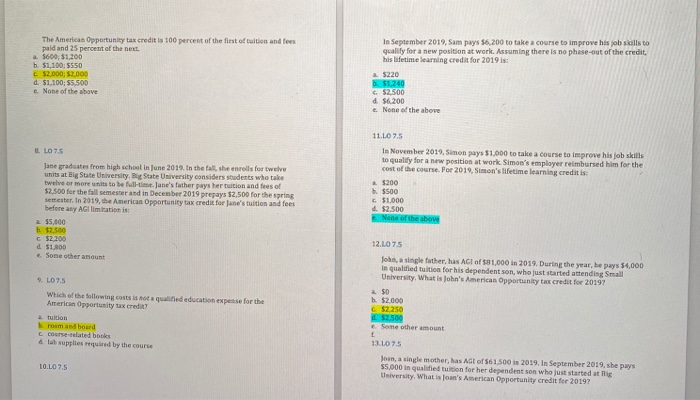

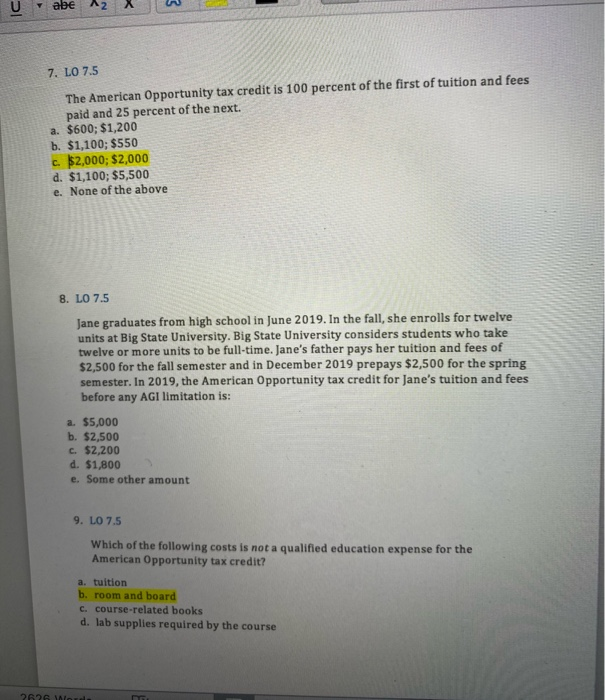

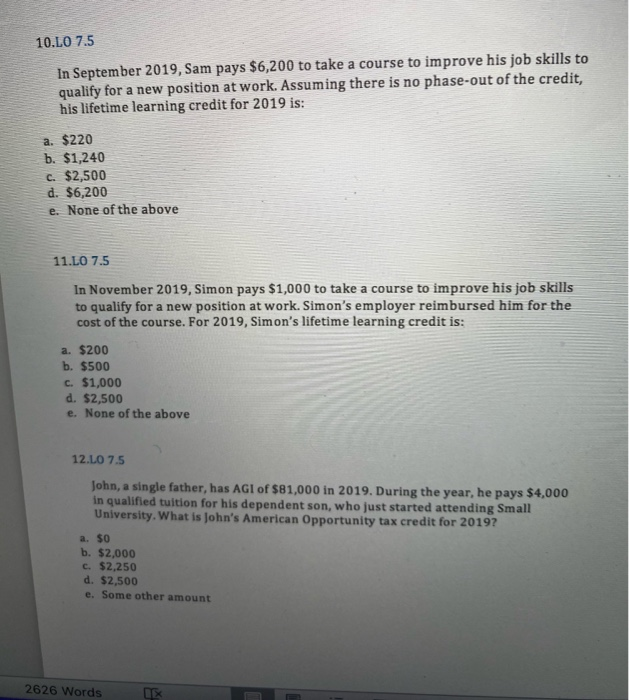

The American Opportunity tax credit is 100 percent of the first of tuition and fees paid and 25 percent of the next in September 2019, Sam pays $6,200 to take a course to improve his job skills to qualify for a new position at work. Assuming there is no phase-out of the credit, his lifetime learning credit for 2019 is: $1.100.5550 d. $1,100: $5.50 e None of the above $6200 e. None of the above 11.LO 7,5 3. LO 75 Jane graduates from high school in June 2019. In the fall, she enrols for twelve units at Big State University, Big State University considers students who take twelve or more units to be full-time Jane's father pays her tuition and foes of $2.500 for the fall semester and in December 2019 prepays $2.500 for the spring semester. In 2019, the American Opportunity tax credit for Jane's tuition and fees before any AGIlimitation is In November 2014. Simon pays $1,000 to take a course to improve his job skills to qualify for a new position at work. Simon's employer reimbursed him for the cost of the course. For 2019, Simon's lifetime learning credit is $200 $500 12.00 75 Some other amount John, a single father, has Act of 181,000 in 2019. During the year, be pays $4.000 In qualified tuition for his dependent son, who just started attending Small University, What is John's American Opportunity tax credit for 2019? % LO 7.5 Which of the following costs is not qualified education expense for the American Opportunity tax ret? me other amount 1 room and board C counse-related books dlab supplies required by the course 13.107.5 10.LO 7.5 Joan, a single mother, has Adt of 561.500 in 2019. In September 2019, she pays $5.000 in qualified tuition for her dependent son who just started at lig University. What is Joan's American Opportunity credit for 2019? Uabe 12 XW 7. LO 7.5 The American Opportunity tax credit is 100 percent of the first of tuition and fees paid and 25 percent of the next. a. $600; $1,200 b. $1,100; $550 c. $2,000; $2,000 d. $1,100; $5,500 e. None of the above 8. LO 7.5 Jane graduates from high school in June 2019. In the fall, she enrolls for twelve units at Big State University, Big State University considers students who take twelve or more units to be full-time. Jane's father pays her tuition and fees of $2,500 for the fall semester and in December 2019 prepays $2,500 for the spring semester. In 2019, the American Opportunity tax credit for Jane's tuition and fees before any AGI limitation is: a. $5,000 b. $2,500 c. $2,200 d. $1,800 e. Some other amount 9. LO 7.5 Which of the following costs is not a qualified education expense for the American Opportunity tax credit? a. tuition b. room and board c. course-related books d. lab supplies required by the course 2620 10.LO 7.5 In September 2019, Sam pays $6,200 to take a course to improve his job skills to qualify for a new position at work. Assuming there is no phase-out of the credit, his lifetime learning credit for 2019 is: a. $220 b. $1,240 c. $2,500 d. $6,200 e. None of the above 11.LO 7.5 In November 2019, Simon pays $1,000 to take a course to improve his job skills to qualify for a new position at work. Simon's employer reimbursed him for the cost of the course. For 2019, Simon's lifetime learning credit is: a. $200 b. $500 c. $1,000 d. $2,500 e. None of the above 12.LO 7.5 John, a single father, has AGI of $81,000 in 2019. During the year, he pays $4,000 in qualified tuition for his dependent son, who just started attending Small University. What is John's American Opportunity tax credit for 20192 a. $0 b. $2,000 c. $2,250 d. $2,500 e. Some other amount 2626 Words *