Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The annuity I found from the the hypothetical values I plugged in that he gave us. Just need help with finding the answers for the

The annuity I found from the the hypothetical values I plugged in that he gave us. Just need help with finding the answers for the last three parts. Thank you.

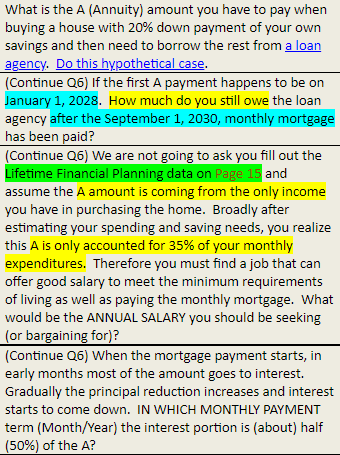

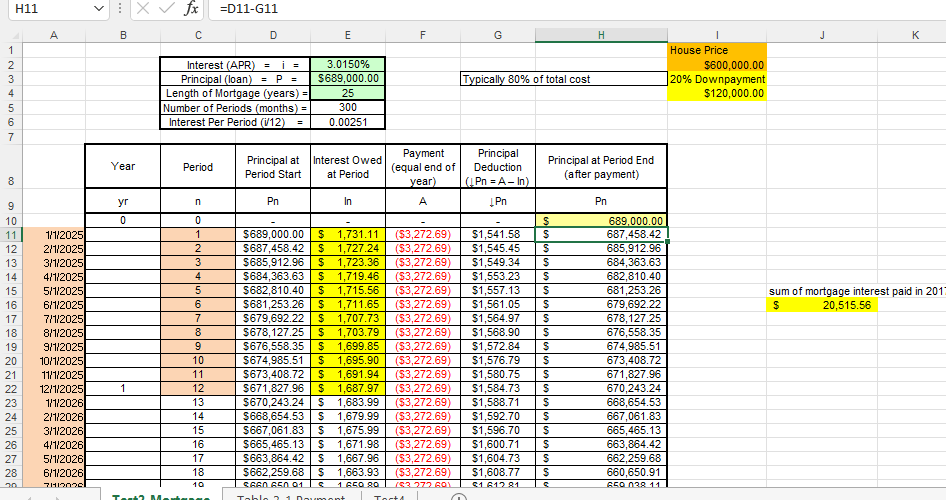

What is the A (Annuity) amount you have to pay when buying a house with 20% down payment of your own savings and then need to borrow the rest from a loan agency. Do this hypothetical case. (Continue 26) If the first A payment happens to be on January 1, 2028. How much do you still owe the loan agency after the September 1, 2030, monthly mortgage has been paid? (Continue 26) We are not going to ask you fill out the Lifetime Financial Planning data on Page 15 and assume the A amount is coming from the only income you have in purchasing the home. Broadly after estimating your spending and saving needs, you realize this A is only accounted for 35% of your monthly expenditures. Therefore you must find a job that can offer good salary to meet the minimum requirements of living as well as paying the monthly mortgage. What would be the ANNUAL SALARY you should be seeking (or bargaining for)? (Continue 26) When the mortgage payment starts in early months most of the amount goes to interest. Gradually the principal reduction increases and interest starts to come down. IN WHICH MONTHLY PAYMENT term (Month/Year) the interest portion is (about) half (50%) of the A? H11 X fx =D11-G11 A A B C D E F G . J = = 1 2 3 4 5 6 7 Typically 80% of total cost 1 House Price $600,000.00 20% Downpayment $120,000.00 Interest (APR) Principal (loan) = P Length of Mortgage (years) = Number of Periods (months) = Interest Per Period (112) 3.0150% $689,000.00 25 300 0.00251 Year Period Principal at Period Start Interest Owed at Period Payment (equal end of year) A 00 Principal at Period End (after payment) 8 Principal Deduction (Pn = A-In) Pn n Pn In Pn yr 0 $ UUUU sum of mortgage interest paid in 2017 $ 20,515.56 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 1/1/20251 2/1/2025 3/1/2025 4/1/2025 5/1/2025 6/1/2025 7/1/2025 8/1/2025 9/1/20251 10/1/2025 11/1/20251 12/1/2025 1/1/2026 2/1/2026 3/1/2026 4/1/2026 5/1/20261 6/1/20261 7H02020 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 10 $689,000.00 $ 1,731.11 $687,458.42 $ 1,727.24 $685,912.96 $ 1,723.36 $684,363.63 $ 1,719.46 $682,810.40 $ 1,715.56 $681,253.26 $ 1,711.65 $679,692.22 $ 1,707.73 $678,127.25 $ 1,703.79 $676,558.35 $ 1,699.85 $674,985.51 $ 1,695.90 $673,408.72 $ 1,691.94 $671,827.96 $ 1,687.97 $670,243.24 S 1,683.99 $668,654.53 $ 1,679.99 $667,061.83 S 1,675.99 $665,465.13 S 1,671.98 $663,864.42 $ 1,667.96 $662,259.68 $ 1,663.93 CANAL 01 1 CO 80 Tablo 1 Dumont (53,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) 152 272 60 $1,541.58 $1,545.45 $1,549.34 $1,553.23 $1,557.13 $1,561.05 $1,564.97 $1,568.90 $1,572.84 $1,576.79 $1,580.75 $1,584.73 $1,588.71 $1,592.70 $1,596.70 $1,600.71 $1,604.73 $1,608.77 C161281 S $ $ $ S $ $ $ S $ $ S $ $ $ 689.000.00 687,458.42 685,912.96 684,363.63 682,810.40 681,253.26 679,692.22 678,127.25 676,558.35 674,985.51 673,408.72 671,827.96 670,243.24 668,654.53 667,061.83 665,465.13 663,864.42 662,259.68 660,650.91 650 028 11 1 Torta H11 vix fx =D11-G11 B 1 J $ $ $ $ $ $ $ 4 $ $ $ $ 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 79 79 80 81 82 83 A 1/1/2028 2/1/2028 3/1/2028 4/1/2028 5/1/2028 6/1/2028 7/1/2028 8/1/2028 9/1/2028 10/1/2028 11/1/2028 12/1/2028 1/1/2029 2/1/2029 3/1/2029 4/1/2029 5/1/2029 6/1/2029 7/1/2029 8/1/2029 9/1/2029 10/1/2029 11/1/2029 12/1/2029 1/1/2030 2/1/2030 3/1/2030 4/1/2030 5/1/2030 6/1/2030 7/1/2030 8/1/2030 9/1/2030 10/1/2030 11/1/2030 12/1/2030 1/1/2031 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 D E $630,991.99 $ 1585.37 $629,304.66 $ 1,581.13 $ 627.613.10 $ 1,576.88 $ 625,917.28 $ 1,572.62 $ 624.217.21 $ 1,568.35 $622,512.86 $ 1,564.06 $620,804.23 $ 1,559.77 $ 619,091.30 $ 1,555.47 $ 617,374,08 $ 1,551.15 $ 615,652.54 $ 1,546.83 $ 613,926.67 $ 1,542.49 $ 612,196.47 $ 1,538.14 $ 610,461.92 $ 1,533.79 $ 608,723.01 $ 1,529.42 $606,979.73 $ 1,525.04 $605,232.07 $ 1,520.65 $603,480.02 $ 1,516.24 $ 601,723.57 $ 1,511.83 $ 599,962.71 $ 1,507.41 $ 598,197.42 $ 1502.97 $596,427.70 $ 1.498.52 $594,653.53 $ 1,494.07 $592.874.90 $ 1.489.60 $ 591,091.81 $ 1,485.12 $589,304.23 $ 1.480.63 $ 587,512.16 $ 1,476.12 $ 585,715.59 $ 1,471.61 $ 583,914,51 $ 1,467.09 $ 582,108.90 $ 1.462.55 $580,298.76 $ 1,458.00 $578,484.06 $ 1,453.44 $ 576,664.81 $ 1,448.87 $574,840.99 $ 1,444.29 $573,012.58 $ 1,439.69 $ 571,179.58 $ 1,435.09 $ 569,341.98 $ 1.430.47 $567,499.75 $ 1,425.84 F ($3,272.69) ($3,272.69 ($3,272.69) ($3,272.69 ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) ($3,272.69) G $1,687.33 $1,691.57 $1,695.82 $1,700.08 $1,704.35 $1,708.63 $1,712.92 $1,717.23 $1,721.54 $1,725.87 $1,730.20 $1,734.55 $1,738.91 $1,743.28 $1,747.66 $1,752.05 $1,756.45 $1,760.86 $1,765.29 $1,769.72 $1,774.17 $1,778.63 $1,783.10 $1,787.58 $1,792.07 $1,796.57 $1,801.08 $1,805.61 $1.810.15 $1,814.69 $1,819.25 $1.823.82 $1,828.41 $1.833,00 $1,837.61 $1,842.22 $1,846.85 $ $ H 629,304.66 627,613.10 625,917.28 624,217.21 622,512.86 620,804.23 619,091.30 617,374.08 615.652.54 613,926.67 612,196.47 610,461.92 608,723.01 606,979.73 605,232.07 603,480.02 601,723.57 599,962.71 598,197.42 596,427.70 594,653.53 592,874.90 591,091.81 589,304.23 587,512.16 585,715.59 583,914.51 582,108.90 580,298.76 578,484.06 576,664.81 574,840.99 573,012.58 571,179.58 569,341.98 567,499.75 565,652.90 51.37% 51.23% 51.09% 50.96% 50.82% 50.68% 50.54% 50.40% 50.26% 50.12% 49.98% 49.84% 49.70% 49.56% 49.41% 49.27% 49.13% 48.99% 48.84%. 48.70% 48.55% 48.41% 48.27% 48.12% 47.97% 47.83% 47.68% 47.54% 47.39% 47.24% 47.09% 46.95% 46.80% 46.65% 46.50% 46.35% 46.20% $ 5 $ $ $ $ $ 6 $ $ $ Test2_Mortgage Table 3-1 Payment Test4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started