Answered step by step

Verified Expert Solution

Question

1 Approved Answer

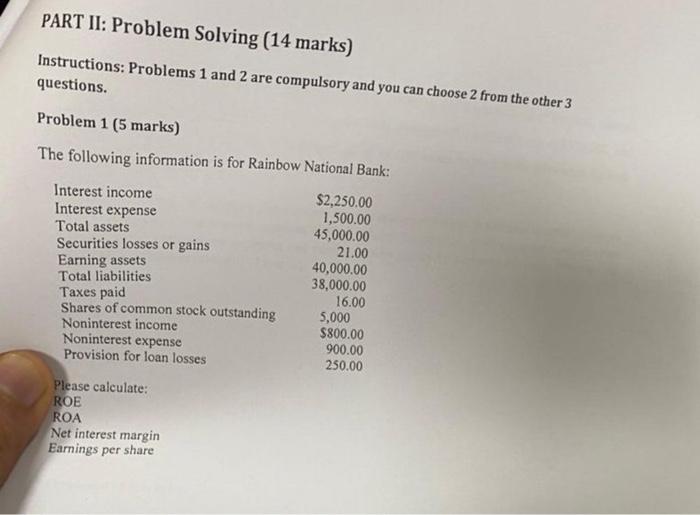

the ans ? Instructions: Problems 1 and 2 are compulsory and you can choose 2 from the other 3 questions. Problem 1 (5 marks) The

the ans ?

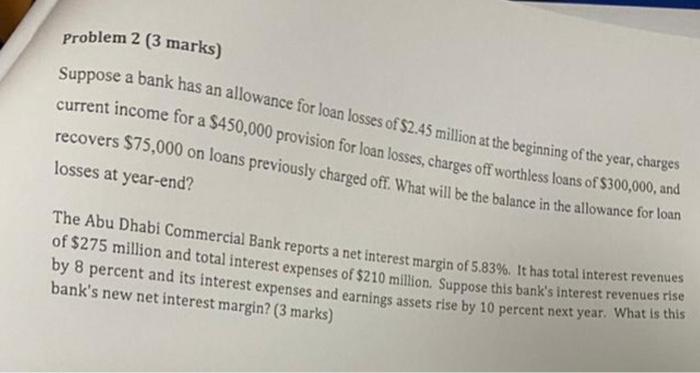

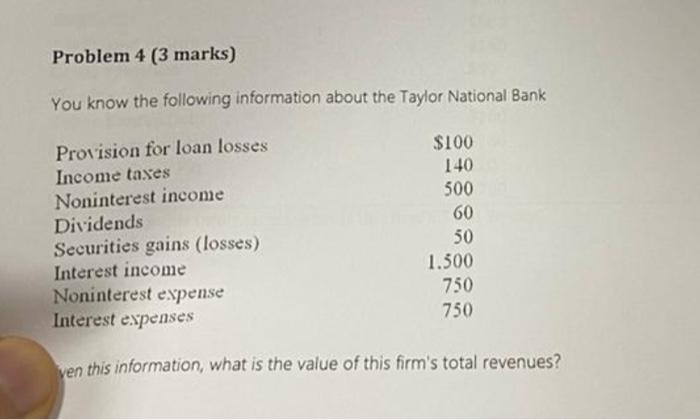

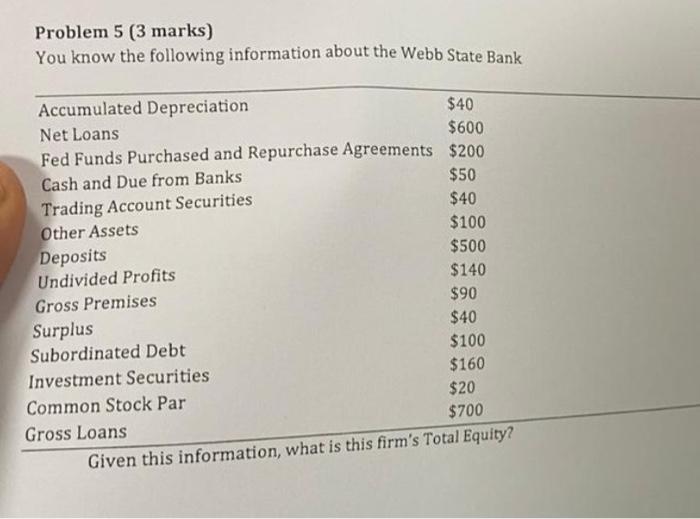

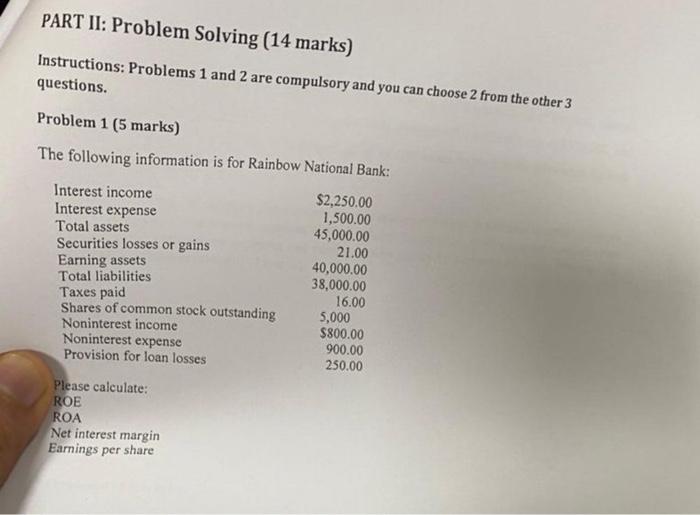

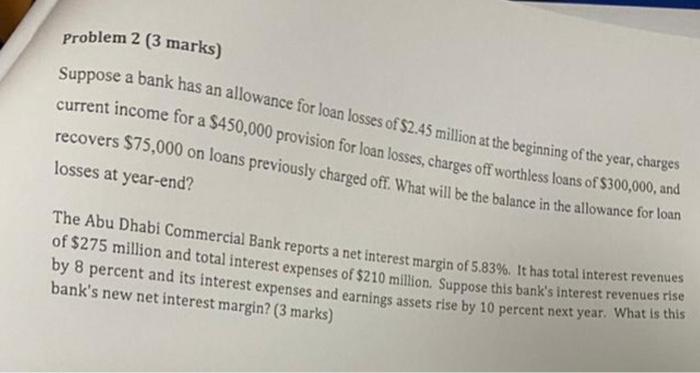

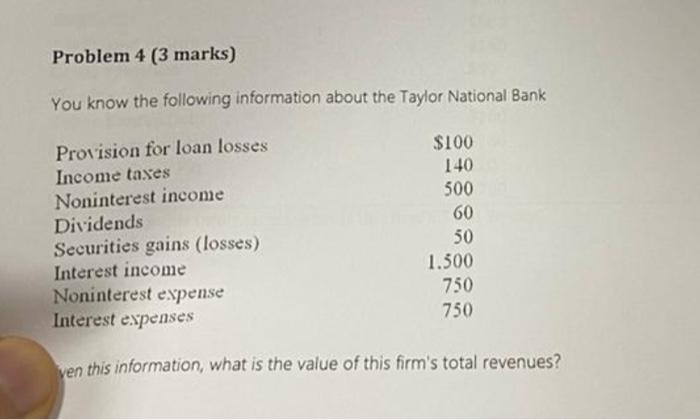

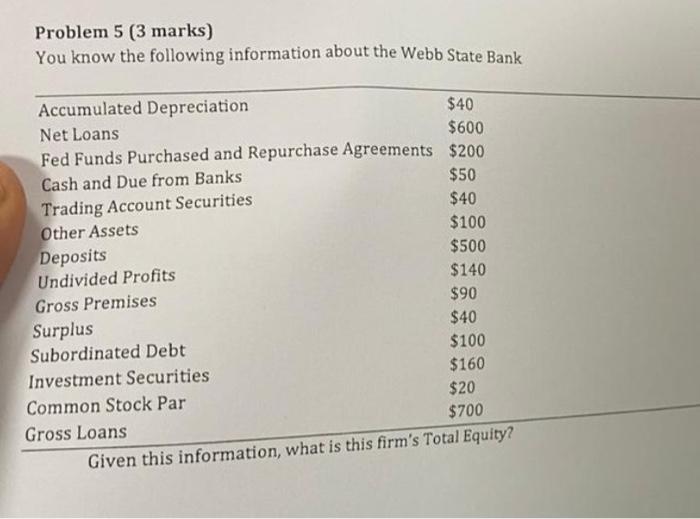

Instructions: Problems 1 and 2 are compulsory and you can choose 2 from the other 3 questions. Problem 1 (5 marks) The following information is for Rainbow National Bank: Problem 2 ( 3 marks) Suppose a bank has an allowance for loan losses of $2.45 million at the beginning of the year, charges current income for a $450,000 provision for loan losses, charges off worthless loans of $300,000, and losses at year-end? The Abu Dhabi Commercial Bank reports a net interest margin of 5.83%. It has total interest revenues of $275 million and total interest expenses of $210 million. Suppose this bank's interest revenues rise by 8 percent and its interest expenses and earnings assets rise by 10 percent next year. What is this bank's new net interest margin? ( 3 marks) Problem 4 ( 3 marks) You know the following information about the Taylor National Bank yen this information, what is the value of this firm's total revenues? Problem 5 ( 3 marks) You know the following information about the Webb State Bank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started